Kohler's Week: Amazing US jobs, Advance Australia? A graph odyssey, RBA, Disruptions, Long/short, Anteo Diagnostics, Starpharma, John Abernethy, Dick Smith

Last Night

Dow Jones, up ~0.08%

S&P 500, down ~0.23%

Nasdaq, up ~0.2%

Aust Dollar, US70c

Amazing US jobs

Well, that's just about confirmed it: a December rate hike in the US is now close to certain. The only thing that will stop the Fed from starting to move the cash rate off zero next month would be for some unexpected crisis to emerge.

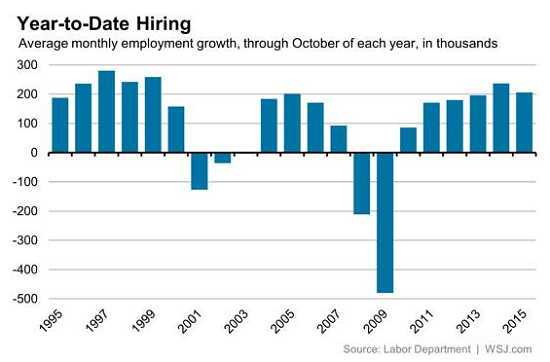

The October payrolls report this morning produced the astonishing news that 271,000 new jobs were created, of which 267,000 were in the private sector. That was about 100,000 more than the market had expected. Taking a longer view, it means the US economy has added 2.8 million jobs over the past year and the monthly employment increase in 2015 so far is now 206,000, the second highest level since 1999.

Here are a few quotes from economists:

“…labor markets have fully rebounded after slowing in August and September”.

“Barring a disaster in November, rates are going to rise in December.”

“…hourly earnings are now showing acceleration”.

“The risks of waiting for the first rate hike are much smaller than the risks of moving too soon.”

“The Fed's hawks will now argue that they have hard evidence in the most widely watched (but least reliable, not that it matters right now) data that the tightness of the labor market is pushing wage gains higher.”

“We expect the fed-funds rate to be close to 2 per cent by end-2016.”

And from John Authers in the Financial Times:

“This report followed September's survey that was equally shocking in the opposite direction, suggesting that growth was far weaker than had been thought. That report has now been revised, and the dramatic market gyrations of the past two months look as though they owed much to bad data. It is galling to think of the amount of money that has changed hands, and the amount of analysis that has been produced, on essentially false premises.”

Yes, well, perhaps it's a bit like Chinese data, for different reasons. America and China are vast countries and it rather looks like their statisticians are prone to making wild guesses about what's going on to get the data out quickly, too quickly – the Chinese try to please their political masters and the Americans to please the markets – the “Masters of the Universe”, which they then revise several times as they find out the truth. Good grief. (The Chinese don't even revise, by the way, since that would involve losing face).

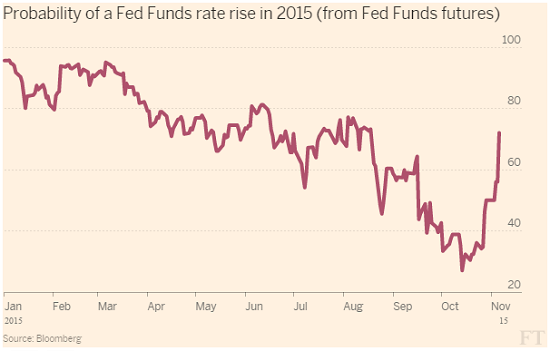

Anyway, in each case that's all we have to go on, and this morning's October employment number is big. Here's a chart of the market probability of a rate hike, from the FT. It's now up to 70 per cent:

It means we can probably now start thinking what the first Fed rate hike in seven years will mean for us. And the answer is: probably not much anymore.

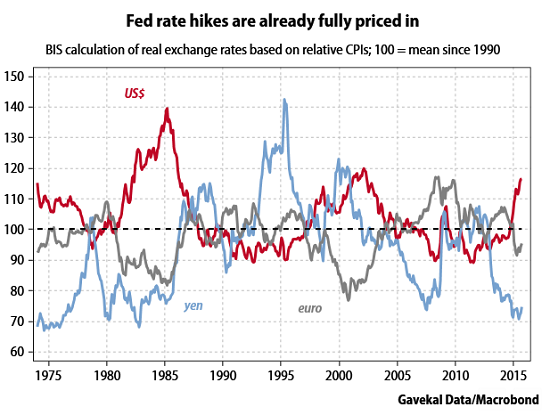

Here's a chart of the Bank for International Settlements' calculation of real US, European and Japanese exchange rates over 40 years, which suggest that a rate hike is already fully priced into the US dollar exchange rate.

You might think that's contradicted by this morning's forex market action, with the US dollar index jumping from 98.2 to 99.2 on the news. But it's actually a pretty small move, and there may also be just a small one when the rate hike is finally announced – it's more likely to be a case of “buy the rumour, sell the fact”.

Therefore, if you're a currency trader, it might not be a good idea to aggressively short the Aussie ahead of the December Fed meeting. It's at US70.4c as I write this morning, down from US71.4c immediately before the payrolls report came out, and I'd say there's a fair chance of sub-70 over the next few weeks, but much of the decline in response to a December Fed hike would be baked in now.

Where possible, markets anticipate rather than react. That's not always possible, but the Fed has been talking about December for quite a while now, including Yellen's statement the other day that it's a “live possibility”, which presumably is the same as saying it's a “definite maybe”. Now maybe it's a “live probability”.

In fact the only thing that would force the Fed to stand down again in December might be the extent of anticipation over the next month – if the dollar really rallies from here and causes more problems in emerging markets. A new currency crisis in Asia and Latin America caused by a surging US dollar looks like the only thing that would stop a December rate hike now.

Advance Australia? – A graph odyssey

I don't think Australia is heading into recession, but nor do I think we can expect our investments and our businesses – that is our wealth and our income – to simply ride a return to the higher growth rates of the past.

It used to be that whenever there was a downturn, and there were plenty of them, you could be sure GDP growth would return to 4 per cent and that that process would provide a kind of whiplash effect. Most of us could leverage that into double digit wealth and income growth: it was just a matter of waiting.

That process seems to be over, at least for a while. I'm not pronouncing the death of the business cycle or something, but we are probably in a long period of what Gerard Minack and others call “secular stagnation”. Today I want to explain, mainly with charts, why I think that's the case and then what should be done about it.

Actually perhaps I should cut to that conclusion: stagnation, by which I mean extended 2 per cent GDP growth, means we have to work for our wins. It's a stock pickers' market and has been all year, and in business the winners are the disruptors – those who makes things happen, not those who sit back and collect rents.

I'm indebted to George Tharenou of UBS for a lot of today's charts.

First, a look at what's happened:

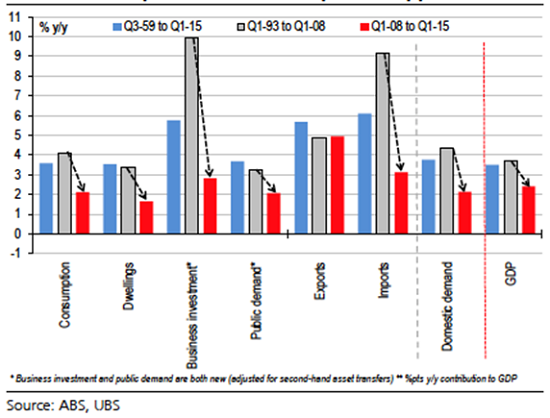

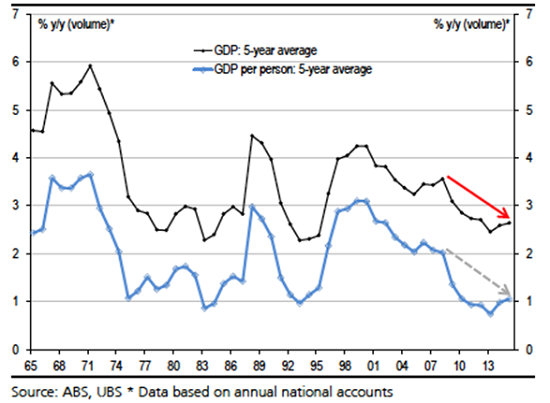

Long term GDP growth is 3.5 per cent (1959-now). In the boom years between 1993 and 2008 it kicked up to 3.75 per cent. Since the GFC it has fallen to 2.2 per cent, which is where it's likely to stay.

The post-GFC decline has been broad-based. Business investment has collapsed and consumption has halved, contributing to a fall in overall domestic growth from 4.2 to 2 per cent.

Here's another view of it, including per capita GDP, which has fallen much more because of strong post-GFC population growth.

There are five reasons to believe Australia's growth rate will remain low – around 2 per cent: debt, demographics, fiscal repair, China and El Nino.

As I mentioned, I don't think the economy will go into recession, partly because interest rates can be cut quite a lot still (Australia's policy is not at zero like the US, Europe and Japan) (not that monetary policy works any more, mind you), but clearly it's very vulnerable and recession is a real risk.

- Debt

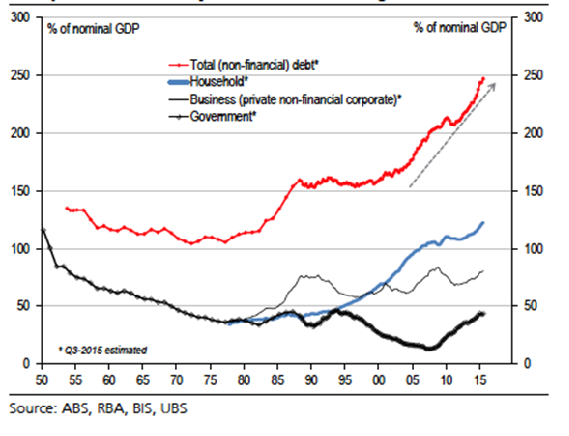

I've been banging on about this for a while, and no need to repeat myself. Debt weighs on demand, production and prices. Australia's overall debt to GDP ratio is very, very high historically, and among the highest in the world …

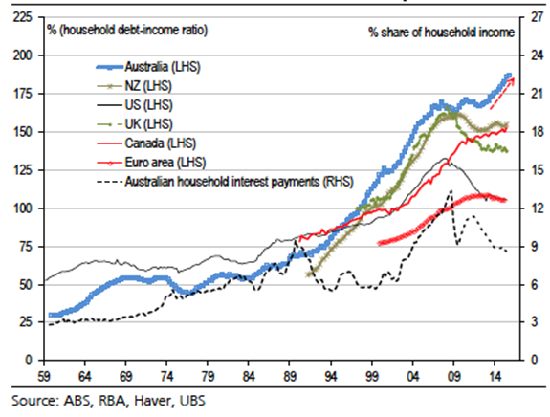

And the household debt to GDP ratio is easily the highest in the world:

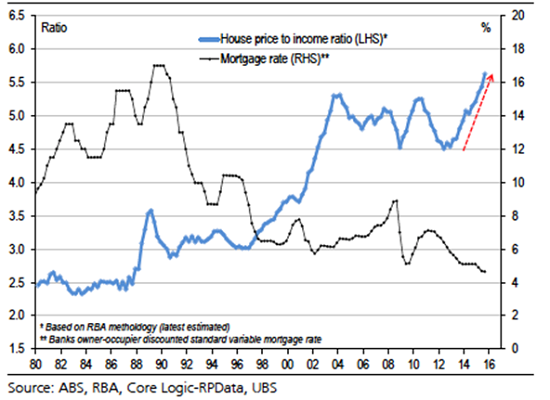

… A lot of which has to do with the surge in house prices and the fall in the mortgage rate.

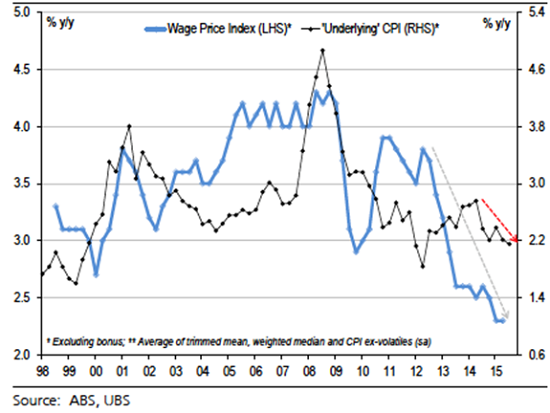

Meanwhile household income growth has crashed because tax cuts have ended and wage growth has fallen from 4 per cent to 2.25 per cent.

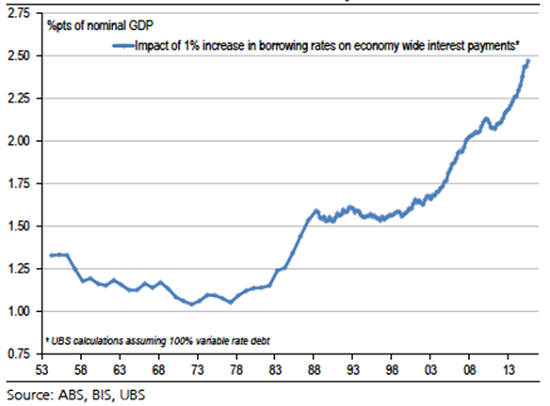

Of course there is no sign of an increase in interest rates yet, but the level of debt has made the economy very sensitive to interest rates:

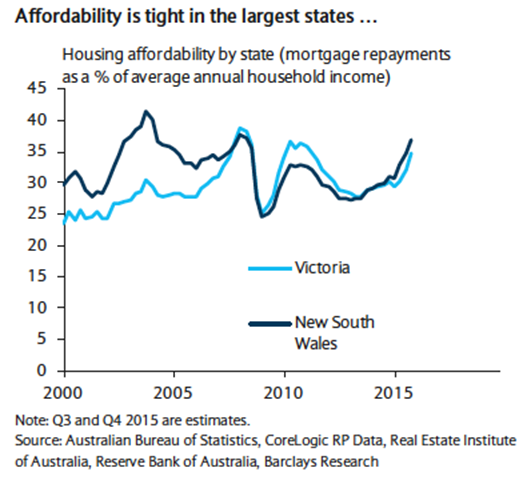

Meanwhile housing affordability is now very low in Melbourne and Sydney, implying that prices are about to fall – as they usually do when affordability gets to this level.

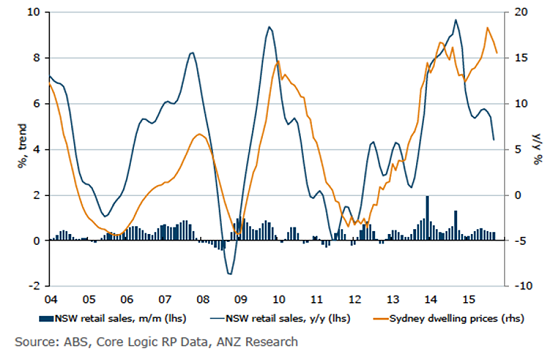

The data clearly show that house prices have a direct impact on retail sales:

Even without any changes in either interest rates or the housing market, Australia's high level of household debt will keep growth low. Any fall in house prices or increase in interest rates will have an outsized impact.

2. Demographics

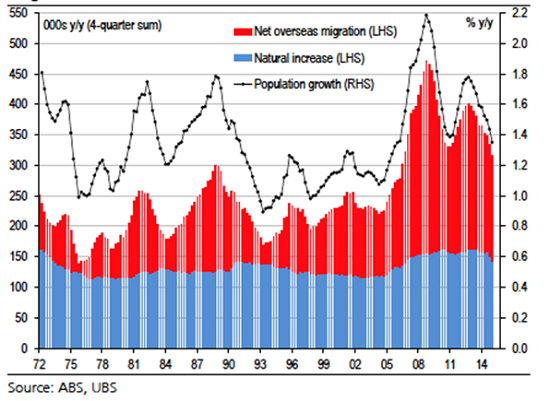

In some ways this is the biggest and most intractable problem. Population growth has slowed sharply, with both net migration and natural increase in decline:

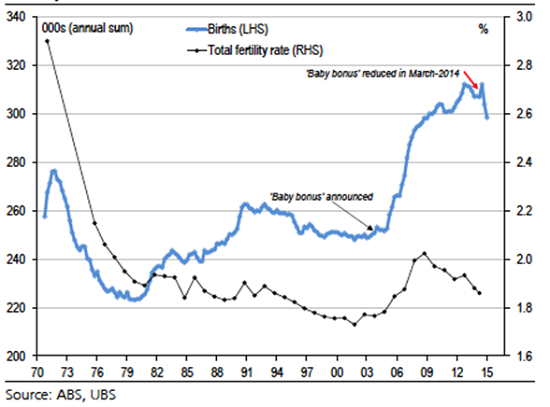

The fertility rate is falling and the decade-long surge in births has peaked:

Population growth, especially migration, has been the main source of GDP growth for a decade, but that seems to be over.

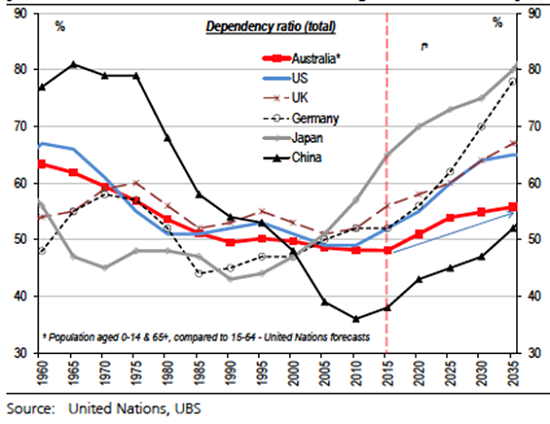

And as a result of that, and the retirement of the baby boomers, the dependency ratio is now rising – everywhere, including Australia – reversing a 50-year economic tailwind:

This will put increasing pressure on Government budgets and household incomes, since more and more incomes will have to be funded by fewer and fewer workers.

3. Fiscal drag

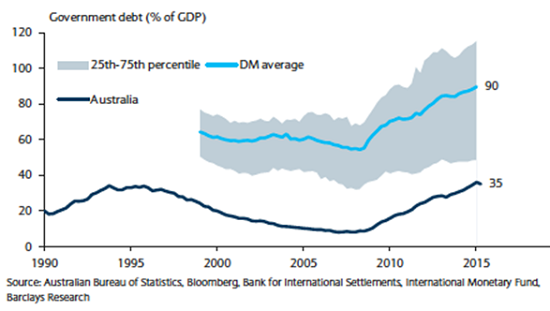

Australia's Government debt is very low by world standards:

… Although the increase as a percentage of GDP since 2007, at 18 per cent, is among the highest.

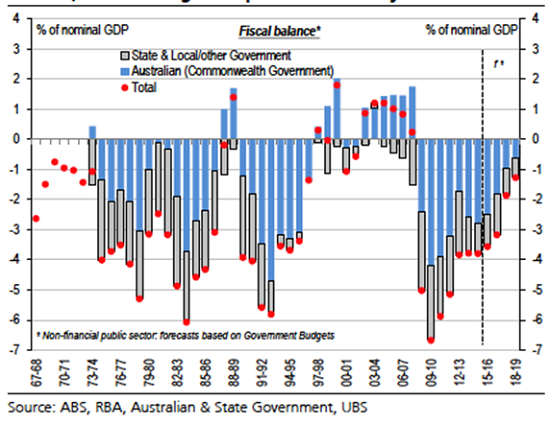

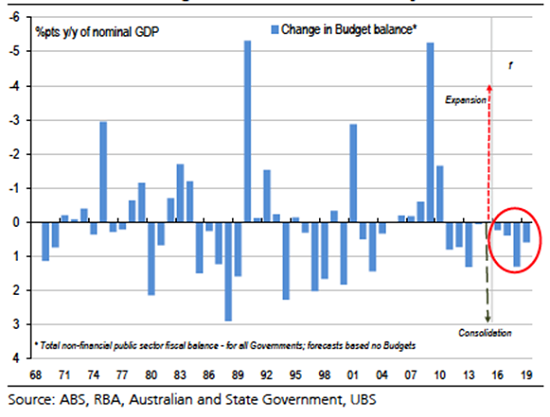

And of course it's still increasing rapidly because of large deficits at the both the commonwealth and state level:

Doing something about this is expected to reduce GDP growth by 0.5 to 1.25 per cent a year over the next four years.

So whatever else happens, repairing the national government budgets will be a drag on economic growth for years.

4. China

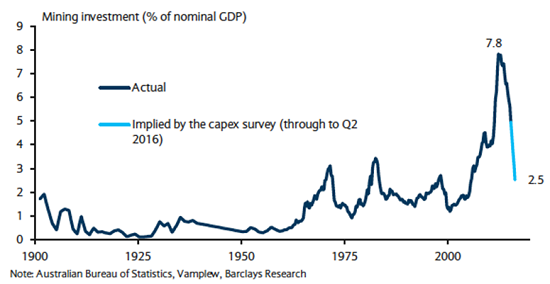

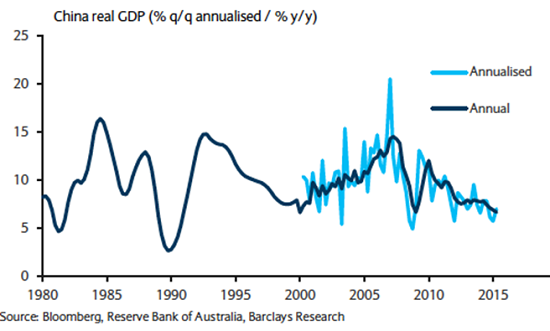

It turns out the China-induced mining boom was a bubble, which has now burst:

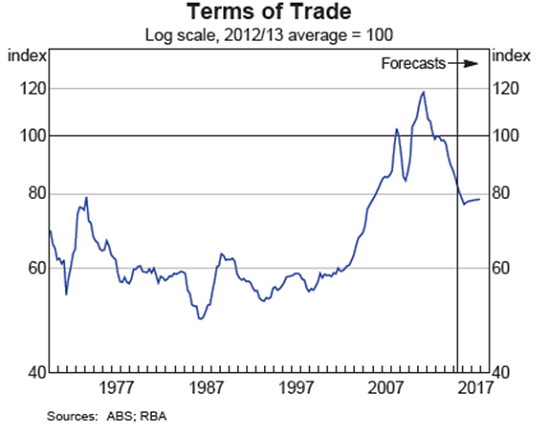

It was brought about by a terms of trade boom:

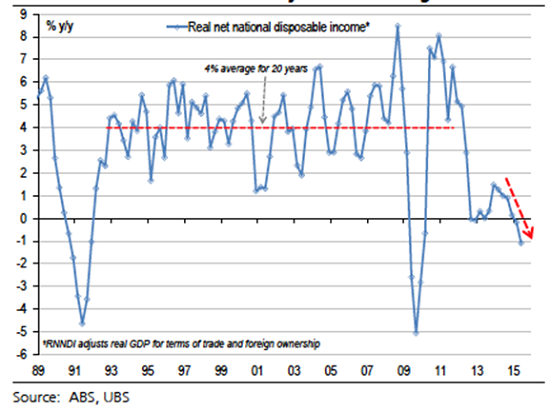

The main effect of the decline in the terms of trade, caused by the China slowdown reducing commodity prices, has been to cut real national income. After 20 years of 4 per cent p.a. growth, it has now slumped to negative:

The question is whether Chinese growth stabilises at this level (just below 7 per cent) or keeps going down to the sort of “hard landing” that happened in 1989-90.

Even without any further decline in the domestic Chinese economy, trade volumes have been stalled for more than two years.

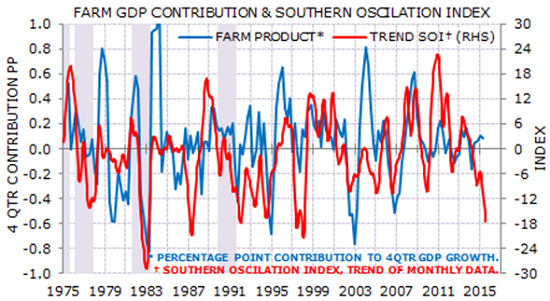

5. El Niño

It's hard to know whether this will be a short or long term thing, but so far it is one of the strongest El Niños on record. The Southern Oscillation Index, which measures it, averages –14.3 in the nine strongest El Niño episodes since 1990; between June and August it averaged -15.5. A serious drought, which is what we are in, can cut up to 1 per cent from GDP.

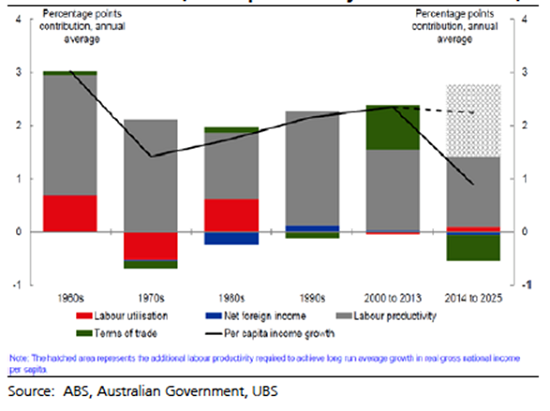

Finally, in a speech this week entitled “The Path to Prosperity”, RBA Governor Glenn Stevens said: “with the terms of trade-driven improvements now behind us – and at least partly reversing – productivity is the main game.”

This chart puts that proposition graphically:

In case you can't read it, the bit in blue at the bottom says the hatched grey area on top of the far right bar shows the improvement in productivity required to simply achieve long run growth in income, given what's happened to the other factors. It's not going to happen.

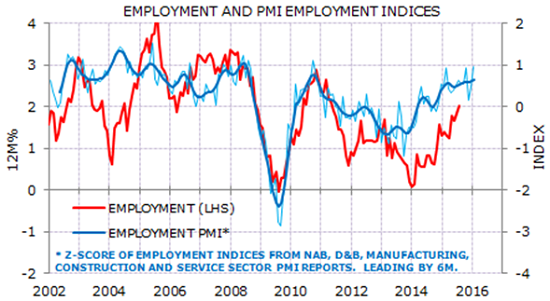

The key now is what happens to employment. So far at least, employment has remained strong, perhaps because of weak wages growth.

If that keeps going, Australia will avoid a recession and might even improve on 2 per cent growth.

RBA statement

Notwithstanding all of the above, the RBA's Statement on Monetary Policy, from which a few of the graphs were taken, did not change its GDP forecast and only reduced the inflation forecast – basically because of the fall in the exchange rate.

That is the main counter argument to my first item. The lower Australian dollar is supporting growth. It also means, and yesterday's statement implies, that the cash rate will not be cut further – unless the US dollar falls and pushes our exchange rate higher.

Disruptions

As discussed above, a lot of investment and business activity is dominated by disruptions. Two worth focusing on in a little detail are cars and banks – this week cars, next week a detailed look at banking disruption.

1. Cars

I think the motor industry, in all its forms, is going to be entirely disrupted. In the long term it will be electric vehicles and driverless cars disrupting, the fossil fuel, crash repair and insurance businesses, but for the moment it's taxis and car rentals.

Uber has taken the world by storm. In Australia the company has just passed 15,000 drivers and 1 million riders, and I caught up with their management this week to see what's going on.

First, it's not illegal. Some court cases were launched but all have been withdrawn. The taxi industry has given up trying to stop Uber and is instead asking for compensation for the reduction in value of taxi plates.

The ACT became the first government to regulate Uber, basically demanding the things that Uber already does, and Tasmania declared last week that it will be the first state. All of the other states have inquiries and reviews at various stages, but there's not much doubt that these will all result in regulations that confirm and fully legitimise the existence of Uber.

Soon Uber will launch Uber Eats (meal delivery), Uber Pool (carpooling), Uber Rush (couriers) and Uber Commute (a public transport alternative using carpooling).

Action: you can't buy Uber shares yet, but you can, at least, sell Cabcharge if you still own it.

Also, this week I interviewed a bloke named Chris Noone who runs a small ($5.7 million cap) ASX listed company called Collaborate Corporation, the main business of which is a peer to peer car rental business called DriveMyCar. You can check out the interview here.

The proposition is that people with a car they're not using can rent it through Collaborate Corp's platform, but the reason I like this business is that Chris is now talking to large fleet owners to get stock, including car dealers. At the moment they've got 500 cars, mainly from private owners, but that could increase several times over from corporate fleets. First deal is with MacMillan Shakespeare, for 40 cars, but they could end up thousands of cars from dealers and large fleets.

If and when that happens DriveMyCar will seriously disrupt the car rental industry, which has to own and garage all their cars. Chris says they are up to 62 per cent cheaper than traditional car rental firms, and an average of about 20 per cent cheaper.

Noone has added to that, a caravan rental business plus rental of all sorts of stuff that people have hanging around in storage sheds – called Rentoid (rentoid.com.au) – plus a peer to peer lender that focuses on lending against invoices (it used to be called factoring).

All of these things work off the same platform and anyone who signs up for one sort of rental, say a car, can also rent a caravan or a fridge. The key to the platform is that it monetises underutilised assets in a very scalable way. I like the look of this business.

Long/short

In line with my policy of telling you about interesting alternative investment ideas, I had a coffee this week with Richard Fish, who runs a fund called the Bennelong Long Short Equity Fund, which, as the name implies, is part of Jeff Chapman's Bennelong Group. Richard is about to launch a listed investment company (LIC) to be named Absolute Equity Performance and he's looking to raise $100m.

The investment strategy is entirely “non-directional” – that is, its performance is totally independent of what happens to the market – either up or down – and is also independent of sector performances. There is zero correlation between the market and the fund, which makes it an ideal diversification tool.

Richard and his small team look for “pairs”, that is companies that they believe are going in opposite directions, and they buy one and short the other. For example they were long Wesfarmers and short Woolworths for two years because they believed Coles would outdo Woolies. It was a wonderful trade. They have also been short ANZ/long Challenger for three years, which has also been a lucrative trade.

This is not a hedge that relies on algorithms or quant – it's all about fundamental analysis of stocks, with the specific aim of finding “pairs”.

Performance since BLEF was established 14 years ago has been an average of 18 per cent per annum. There have been some down years, and other years of 30 per cent returns, but the key is that the average is 18 per cent and the returns have no correlation to the market.

The fees are pretty spicy – 1.5 per cent base plus 20 per cent of all performance … above zero! Not even above a benchmark! But the performance numbers quoted above are after fees, so it doesn't matter (although some institutions have bailed out because of the fees).

Anteo Diagnostics

The technology is called nanoglue and the product is Mix&Go and that's about as far as my puny brain will go in understanding what this company does.

In summary, the stuff helps diagnosis tests by pathologists to be more effective and cheaper, and also improves the performance of electrodes in batteries.

Interesting, mind-bending. But there were some subscribers watching the interview live who clearly were full bottle on Anteo and were asking very intelligent questions, making my job quite a lot easier. Definitely worth watching, or reading, the interview with CEO Geoff Cumming, here.

Starpharma

Jackie Fairley, the CEO of Starpharma, is one of the stars of the Australian biotech scene. She's been at the company 10 years and became CEO six years ago. Starpharma's product, covered by patents, is called a “dendrimer” which is a molecule that can be used as a drug itself or a drug delivery agent.

Once again, I quickly got out of my depth on the technology, but the news is the company has just signed a deal with AstraZeneca that Jackie says will deliver revenue of $450m (the company's market cap is $230m). She has changed the company's strategy from using the dendrimers as drugs, to drug delivery licence deals with firms like AstraZeneca.

You can watch and read the interview here.

A letter from my friend John Abernethy about last week's main item

“Read your weekly on stock selection and the variations in price movements.

“The loved and the unloved.

“To my eye the price movements are exaggerated by hedge funds and shorting which is almost at out of control proportions.

“It is worth looking at two stocks that we at Clime held that have been rerated from in value (June) to excessively priced now. Both The Reject Shop (TRS) and SMS Management and Technology (SMX) have had big moves up in price with precious little news. Both were being shorted in the June quarter.

“TRS has nearly doubled in three months and it is now valued at $100m more than Dick Smith (that is 33 per cent more) with half the current year earnings. Yes half the earnings! That is a great example of loved and unloved. Reverse of the position just six months ago.

“My point is that hedge funds are creating price leverage in the market. Shorts position fund longs (creating leverage) and therefore price movements are magnified excessively. I notice this is more so at end of quarters and months.

“As for the stocks that you noted which have rocketed in last four months they are collectively capped at less than $30 billion combined or less than 2 per cent of the total market capitalisation.

“DMP, BKL, TRS, QAN or Sydney Airport have a market value of $30bn with combined earnings forecast at $1.48bn in FY 2017. A cool $1bn of this profit is Qantas alone!

“Their PERs are very high and it is unlikely that in ten years' time they could even collectively pay a 5 per cent dividend or $1.5bn in dividends. For instance DMP is capitalised at nearly $4bn and may earn $100m in 2017. A 5 per cent dividend would require a dividend that is twice the 2017 profit. How long will that take?

“So we battle on in a ridiculous market, with negligible real interest rates and crashing foreign income.

“In many respects the loved stocks are benefitting from being scarce. They are growing earnings but they are priced as if there is no chance of a mistake.”

The American crisis

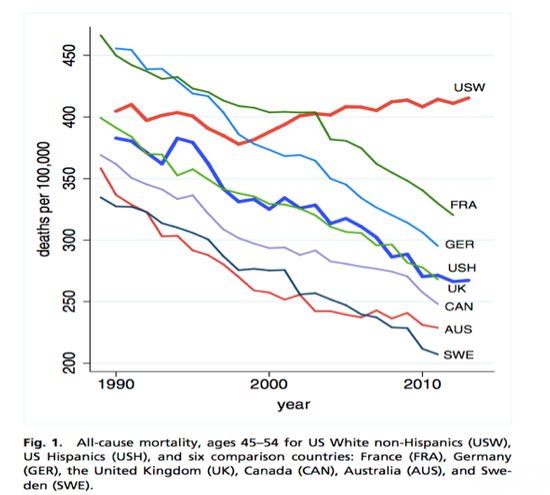

This chart is truly horrifying – mortality for white males 45-54:

It's from a new paper published by the National Academy of Sciences of the United States, which you can access here.

As Paul Krugman wrote in his blog: "Something terrible is happening to white American society. And it's a uniquely American phenomenon; you don't see anything like it in Europe, which means that it's not about a demoralizing welfare state or any of the other myths so popular in our political discourse."

A visit to Grandma's

Dick Smith

A subscriber sent me this link during the week, to an article about Dick Smith headed: “Dick Smith is the greatest private equity heist of all time”.

Given some of the private equity heists that have taken place, this is quite a big claim. The article is very detailed, and pretty devastating, so I asked our analyst, James Samson, to look at it and get the company's response as well.

This is what he wrote:

"Essentially when asked what the points DSH would like to convey about this Forager piece, DSH suggested two main points:

“Firstly, the acquisition by Anchorage was three years ago, and the write downs that ensued are not able to materially impact trading three years later. Stock has turned over many times since then so any inventory impacts are lost in the wash.

“Secondly, the acquisition was made, and a gain on acquisition of $145m was made. If they (Anchorage) were trying to low ball the asset base to pump profitability, then they could have written things down significantly. This was not done, suggesting the absence of the intention to low ball any figures, and lift accounting profits.

“My view is that this is a fair counter argument. The end of the day, this was a few years ago. The current issues in my mind are more about competition and poor retailing (bad advertising strategy and stock mix). The market should be more concerned with this, than a scare campaign on the well-known function of PE firms dumping things on the market.

“So, they are both right, but it doesn't matter – that is not what went wrong at DSH... it is an operating issue, not an accounting issue, and it will take a strong cash flow result and profits hitting the guidance range for the market to start to trust DSH again.”

Readings & Viewings

At the rugby world cup, the Kiwis' haka was a truly ferocious affair. It was rather different in 1973 …

The full text of the TPP has been released by President Obama. Here it is.

And on video – the TPP explained in 75 seconds.

It's not just Australia that's seeing declining household incomes – the real median household income in the US has declined 11 per cent over 15 years.

A National Carrier Pigeon Network (NCPN) has been launched to compete with the NBN. “It'll be there on Friday… maybe Monday. I dunno.”

How Britain turned the ruins of its empire into a mighty entertainment imperium.

Playing music benefits your brain more than any other activity. I agree!

The purpose of Putin's wars is war itself, because only at war can Russia feel at peace.

China has rolled out its first big passenger jet – a rival for Boeing and Airbus.

Robert Reich: the rigging of the American market.

What's really stopping bank reform.

Does China's economic growth rate really matter to the global steel industry?

What we know about computer formulas making decisions about your life.

Of cats and cliffs – ethical dilemmas of driverless cars.

Why Stanley Druckenmiller loves Amazon: “Because they're investing in their future. Bezos is a serial monopolist,” he said, referring to the company's founder.

Why tax breaks are not the answer to encourage Australian startups.

Not since 1977 – when Sir John Kerr got plastered – has a governor-general performed so poorly at the Melbourne Cup.

Oprah Winfrey's investment in Weight Watchers was smart because the programme doesn't work. Huh?

The strange, lucrative world of YouTube stardom.

Robots will transform the global economy over the next 20 years, but increase inequality.

Paul Johnson's review of Charles Moore's book about Margaret Thatcher. "Mrs Thatcher is the point at which all snobberies meet.”

The Dismissal. How John Kerr saved Malcolm Fraser forty years ago.

This is amazing – a Filipino in jail etched a 20-year diary into ostrich eggs.

Volkswagen's latest emissions scandal could be worse than the first one.

How Singapore's PM made history by bringing together China and Taiwan's leaders.

The latest in the collapse of global trade – China's container freight is at record low.

Happy birthday my beloved Joni Mitchell, the 20th century's greatest singer/songwriter, and a constant in my life. Here's one of her greatest songs: A Case of You.

Last Week

By Shane Oliver, AMP

Global shares mostly saw solid gains over the last week helped by good economic data, albeit with talk of ongoing Fed warnings of a possible December rate hike and nervousness ahead of the October payroll report in the US constraining the gains. Chinese shares are now up 20 per cent from their August low. Australian shares remain under pressure though, dragged down by banks and mining stocks. The $US also broke higher, putting pressure on commodity prices but despite this the $A managed a small gain as expectations for a near term RBA rate cut were reduced.

A “good” versus a “bad” Fed hike. The past week saw Fed Chair Yellen reiterate the message from the Fed's last post meeting statement that a December rate hike is a “live possibility” if economic data supports its relatively upbeat expectations regarding the economy and inflation. The key for investors is to recognise that there is a difference between a “good Fed hike” (where rates are raised against a backdrop of solid economic news and receding worries about the US/global growth and inflation outlook) and a “bad Fed hike” (where rates are raised against a backdrop of global and US growth worries probably made worse by a rising $US adversely affecting commodities and emerging market currencies). Either way a December rate hike would likely see market wobbles but they would be short lived with a “good hike” and longer lived with a “bad hike” as the latter would be seen as a policy error. The key is that by making a hike dependent on receiving information consistent with its upbeat economic view the Fed should be unlikely to embark on a “bad hike”.

RBA still content on interest rates, but adopts an easing bias. While the RBA has signalled that it remains content with current interest rate settings, it has adopted an easing bias with RBA Governor Stevens noting that were there to be a change in monetary policy “in the near term, it would almost certainly be an easing, not a tightening”. The RBA's easing bias is reinforced by the downwards revision to the RBA's inflation forecasts in its Statement on Monetary Policy. Although the RBA is sounding a bit more upbeat on the economy, it's noteworthy that yet again it's revised down its GDP growth forecast for this year to 2.25 per cent from 2.5 per cent in August which in turn was down from a mid-point of 2.75 per cent in February. Its 2017 growth forecasts were also shaved.

While the RBA is clearly in no rush to move on rates, so a December cut may be premature, we expect the RBA to act on its easing bias sometime in the months ahead as: bank mortgage rate hikes which have now spread to the smaller banks are likely to weigh on retail sales in the run-up to Christmas; the non-mining investment outlook remains poor; peaking building approvals point to a peak in the contribution to growth from home construction next year; El Nino related drought risks are posing an additional threat to growth; the terms of trade are still sliding; the $A risks a rebound if the Fed doesn't hike next month and if other global central banks continue to ramp up monetary easing; and inflation is likely to remain below target.

It's worth noting that I am not in the bearish camp on the Australian economy. It has been rebalancing nicely, but I do see it needing more help to continue doing so as the mining investment downturn continues. It is noteworthy that since the RBA started cutting interest rates four years ago we have seen several occasions where the RBA has expressed reluctance to ease again, only to ultimately resume easing.

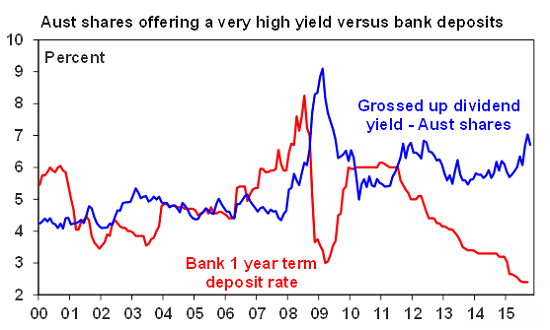

Regardless of whether the RBA holds or cuts, interest rates look like remaining at very low levels for a long while to come as we are only about half way through the mining investment downturn. As a result higher yield assets like Australian shares and commercial property are likely to remain attractive for investors looking for decent income flows. The gap between the dividend yield on Australian shares grossed up for franking credits and 12 month term deposit rates remains about as wide as it has been since the GFC. As we have seen in recent years “search for yield” investor demand is likely to remain a source of support for the Australian share market – in between the periodic scares about growth, bank capital raisings, etc.

Source: RBA, AMP Capital.

Major global economic events and implications

In terms of global growth worries it's notable that there has been some good news over the last week with October manufacturing and services conditions PMIs (as published by Markit) mostly seeing decent gains in the US, Europe, Japan and China. While monthly data can be volatile, it could be a sign that the September quarter soft patch in global business surveys that helped drive growth worries through the quarter may have come to an end.

Meanwhile in the US, jobs reports were mixed but still solid, the trade deficit improved and construction spending is continuing to rise. Productivity also rose solidly in the September quarter for the second quarter in a row but is up just 0.4 per cent year on year.

US September quarter earnings have come in better than expected but still down slightly. 86 per cent of S&P 500 companies have now reported with 73 per cent beating on earnings and consensus earnings expectations for the year to the September quarter have improved from -6.3 per cent three weeks ago to -2.8 per cent. Revenue has been disappointing though with only 44 per cent of companies beating on sales as the strong $US and falling oil price have weighed. These drags will recede though if the $US and oil price stabilise.

German factory orders fell for the third month in a row in September, despite okay readings for the German manufacturing PMI suggesting a bounce back soon.

It looks like there is a good chance that the IMF will include the Renminbi in its basket of Special Drawing Right currencies (currently the $US, Euro, British Pound and Yen) as early as late this month. While inclusion in the rather archaic SDR supplementary foreign exchange reserve assets is unlikely to have a major impact on global financial markets or Chinese economic prospects it will symbolically help boost the Renminbi's global status as a reserve currency and China's importance in global financial markets.

Australian economic events and implications

Australian economic data releases were a mixed bag. On the one hand retail sales are continuing to motor along with okay growth, albeit this is being helped by weak pricing, and continued growth in retail sales volumes and a strong contribution from trade look like underpinning September quarter GDP growth at a reasonable rate. On the other hand though (..starting to sound like an economist here!) the AIG's manufacturing and services conditions PMIs fell in October to around 50 or below pointing to a renewed weakening in business conditions, building approvals look increasingly like they have peaked pointing to a peak in the contribution to growth from home construction in the first half next year, CoreLogic RP Data for October shows further evidence of a cooling in the housing market and the October TD Securities Inflation Gauge shows that inflation continues to remain below target.

Next Week

By Craig James, CommSec

Lending data and jobs in focus

Another busy week lies ahead with around eight key economic indicators to be released in Australia.

The week kicks off in Australia on Monday with the October data on job advertisements from ANZ while on the same day the Australian Bureau of Statistics (ABS) releases figures on tourism arrivals and departures.

In September Australian businesses posted more than 150,000 employment opportunities, up 3.9 per cent on the month and the biggest monthly increase in 15 months.

On Tuesday, data on new home loans (housing finance) is released by the ABS while National Australia Bank issues its October business survey.

The number of loans taken out by people wanting to live in homes – as opposed to buying as an investment – may have eased by 1 per cent in September.

Also on Tuesday the weekly ANZ/Roy Morgan consumer confidence survey is released.

Another check on consumer sentiment will occur on Wednesday with the monthly survey from Westpac and the Melbourne Institute.

On Thursday the October employment report is issued – probably the highlight in a busy week. In September just over 5,000 jobs were lost but we expect that employment rebounded in October, lifting by 20,000. The jobless rate was probably steady at 6.2 per cent.

Also on Thursday the Reserve Bank will release the monthly data on credit and debit card lending.

And on Friday the broader lending figures are released by the ABS. This data covers personal, housing, business and lease loans.

Chinese data in focus

The ‘top shelf' US economic indicators don't occur until Friday. So the early part of the week will be spent analysing the Chinese ‘top shelf' indicators.

The week kicks off on Sunday (November 8) in China when data on exports and imports is released. Imports are down 20.4 per cent over the year but this reflects lower commodity prices as well as some softness in demand. Exports in August were down 3.7 per cent over the year.

In the US, the week kicks off on Monday with the employment trends report. But on Tuesday a number of ‘second tier' indicators are slated for release. These include the NFIB business optimism survey (survey of small business), export and import prices, wholesale sales and inventories and the weekly data on chain store sales.

In China on Tuesday, the October inflation data is issued – producer (business) prices and consumer prices. With consumer prices up just 1.6 per cent over the year, there is scope for China to further cut interest rates.

On Wednesday in China, there is the monthly ‘download' of activity data – figures on retail sales, production and investment. Real retail spending is growing at a double-digit annual rate.

On Wednesday in the US, the usual weekly report on mortgage transactions – purchases and refinancing – is scheduled. While on Thursday the monthly budget figures are released with the JOLTS job openings series and the usual weekly data on claims for unemployment insurance.

And on Friday, finally there is some ‘top shelf' data to monitor in the US. October readings on producer prices (business inflation) are released with retail sales. There are also the preliminary consumer sentiment figures to watch.

Economists expect that core producer prices (excludes food and energy) probably rose just 0.1 per cent in October with the annual rate near 0.8 per cent. Meanwhile retail sales (excluding cars and gasoline) may have lifted by a healthy 0.4 per cent in October.

Sharemarkets, interest rates, commodities and currencies

Longer term interest rates have lifted, pushing up to around the highest levels in six weeks. There are two reasons for this. There are increasing expectations that the Federal Reserve will start the “normalisation” process – lift interest rates – in mid-December. And the second factor is that investors and analysts alike are giving up on an interest rate cut in Australia any time soon.

According to Thomson Reuters I/B/E/S, US companies have posted stronger-than-expected quarterly results in general so far this earnings season. So far around 379 of the S&P 500 companies have reported results, 70 percent beat profit estimates, compared with 63 percent in a typical quarter.

At the start of the earnings or profit-reporting season, analysts had tipped a 4.9 per cent annual fall in earnings from S&P 500 companies. So far, Reuters report that earnings have fallen by only 1.5 per cent.

There is just over 1½ months to go until the end of the year. So it is a good time to track how global share markets have fared so far in 2015. Of 73 global share markets or bourses assessed, 36 are up over the year – or a touch under half.

The biggest gains have been recorded in Venezuela (up 195 per cent) followed by Argentina (up 49 per cent) and Latvia (up 46 per cent). Weakest markets are Ukraine (down 29 per cent), Peru (down 28 per cent) and Kenya (down 25 per cent).

The Australian share market is in 41st place, down around 2 per cent over the year. In US dollar terms, Australian shares are down closer to 18 per cent.