Is this market fall the big one?

Summary: The current market correction can be traced back to comments from the US Fed, the failure of the ECB to roll out an extensive bond-buying program and global geopolitical tension. But a major fall would require an escalation in the situations in Europe and/or the Middle East. A warning from the RBA about the possibility of a looming crash can't be ignored, with a spiral likely before US interest rates rise. |

Key take-out: If you are an aggressive investor, the Debelle crash is probably not at hand, so you will likely keep investing, but remember the market could fall when you least expect it. For more risk-averse investors, be careful about increasing equity exposure and be watchful of long-dated fixed interest earning securities. |

Key beneficiaries: General investors. Category: Economics and investment strategy. |

Right in the middle of a global share market correction the Reserve Bank's assistant governor for financial markets, Guy Debelle, issued a stark warning about a looming crash in the interest rate securities market.

Equity markets would almost certainly become part of that crash. I do not believe what we are seeing now in markets is the start of the event Debelle is warning about, but there are no certainties. So first I want to talk about the current equity weakness and then the “Debelle crash”.

Let's start with the old Arabian Ali Baba story. Legend has it that Ali Baba was a poor woodcutter who discovered the secret riches in a thieves' den which you entered with the password “open sesame”.

In the modern version of the story Ali Baba (in the form of the Chinese ecommerce company Alibaba) entered the “thieves' den” (Wall Street) on September 19, 2014 and during that crazy day the S&P 500 hit an intra-day record of almost 2020 points.

A large number of the “thieves” on Wall Street reckoned that was the signal that the market had gone too high. In fact, of course, there were many other forces pushing the market down, almost all of which we have canvassed in recent months in Eureka Report without being sure when they would come together (see Don't dismiss market risks, The road ahead and The three biggest threats for 2014-15).

But suddenly in the “den of thieves” the forces came together and created a global equity market correction. There usually needs to be a trigger to bring the forces together and I suspect on this occasion it was the combination of the Ebola crisis and the failure of European Central Bank chief Mario Draghi to roll out an extensive program to buy eurozone bonds to boost the eurozone economy.

You can argue that the seeds of the correction were actually sown in mid-July when the chair of the US Federal Reserve Janet Yellen gave the market a shake when she said areas of the market were getting “frothy”. In the official report she noted there were high price valuations amongst some “momentum stocks” and this was a potential cause for concern.

And then two days later the Russian separatists shot down Malaysia Airlines flight MH17. That crash was an awful human tragedy but it also sparked a standoff between the US/Europe and Russia. Europe imposed economic sanctions on Russia, which hurt the Russian economy, but the European economy was also hit because Germany has Russia as its major trading partner and the consequential fall in trade hurt the Germany economy.

Russian President Vladimir Putin was not passive about the embargoes and responded by putting a ban on imports of dairy products into Russia from Europe, the US and Australia. He knew that would “shirtfront” the Europeans.

Europe, which in 2014 has achieved a big increase in dairy production, began storing dairy products (funded by government subsidy) and that rekindled memories of a decade ago when Europe had a mountain of dairy product. The global price of dairy products has fallen about 40%.

And then of course around the same time Israel launched a ground invasion of Gaza and later the realisation of the impact of the Islamic State emerged.

We also had an Argentine debt default, which was a reminder to all that there are a lot of weak spots in the global economy, among emerging economies. The market was awash with liquidity as a result of the massive US money printing and so these events just simply washed through the markets and the American indices continued to rise until Ali Baba entered the thieves' den.

I am sure it was mainly a coincidence but as Alibaba soared to $US99.70 (it's now around $US84.95) it seemed like a warning. Suddenly the adverse events started to come together.

Of particular significance, as I've mentioned, is the deteriorating situation in Europe. The failure of Europe to embrace a version of quantitative easing played an important role because it is hard to see a way out.

Similarly in the Middle East it looks like we are now entangled in a long extended conflict between the various arms of the Muslim religion.

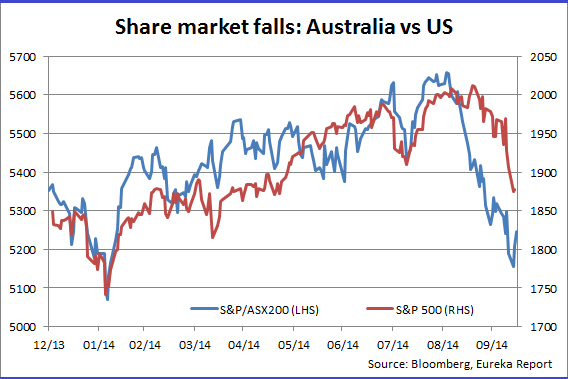

When the market starts to fall the enormous power of computer trading means that as soon as a share or the market falls to a certain level, the selling is automatically multiplied. In addition the US market is the subject of margin borrowing and as the market begins to fall that also triggers sell-outs. The ASX has fallen about 8% since the beginning of this rout – Wall Street has fallen around 5%.

But if we are going to have a major fall in the market we will need to see Europe and/or the Middle Eastern war become far more serious. Of course here in Australia we would include weakness in China among the potential nasty events. There is no doubt that the Chinese banking system is overextended. Our market actually went down further than Wall Street because we had two separate blows.

The first blow was the fact that demand for commodities fell and the second centred on our banks – which copped more than their share. The good news for Australia is that China finds itself in a position where it cannot afford for its economy to deteriorate too much because of the social ramifications of higher unemployment. And so when Chinese authorities saw deterioration, China loosened its credit for the dwelling building industry and put a tariff on imported coal. Exports have also increased.

As I understand it dwelling building activity in China is now picking up sharply and that is why the iron ore price is starting to rise again.

As for bank stocks. it's worth noting that the yields on most banks – excluding CBA – rose over the last few weeks and so that also attracted support. So I suspect we are probably going to have a much calmer period in our markets, subject to New York.

But the Debelle warning can't be ignored. In essence he is saying that world markets have been feasting on low interest rates for a long time. Sometime in the future US rates will rise and that will trigger higher global rates. When that happens it will also suck money into the US but it will cause huge losses among many institutions and others investing in interest-bearing securities. The derivative markets will be savaged.

Those that have borrowed on the basis of low rates may find it hard to get money if their investments fall in value. And while the markets appear liquid at the moment in a crash they will not be liquid so this will accelerate the spiral downwards. Last week I pointed out that vast amounts of the US liquidity has found its way into suspect borrowings (see Urgent! We need earnings growth).

Actually Federal Reserve chair Janet Yellen made similar remarks to Debelle last July. When will this happen? My guess is that it will occur when markets become convinced that there is going to be a sizable rise in US interest rates – in other words before the actual rises. It will probably happen in 2015 but it could be 2016.

I was yarning with ASX CEO Elmer Funke Kupper today (October 15) and he describes the addiction to low interest rates as like a drug. In time you don't know you are taking it. He agrees with Debelle that withdrawal will be painful particularly in global interest-bearing security markets. But in my view equity markets cannot escape.

Strategies in this situation depend on your aims. If you are an aggressive investor wanting to maximise gains I don't think the Debelle moment is at hand so you will keep investing. But like this latest correction, the Debelle moment will come when you least expect it. And once the market starts falling it's hard to get out.

The more risk-averse investors who invest longer term are usually carrying large taxable equity profits, which will limit selling, but be careful about increasing your equity exposure and more importantly be watchful of long-dated fixed interest earning securities.

And go back to my commentary last week (see Urgent! We need earnings growth) about taking risks on interest-earning securities.