Is the data real, or just another snow job?

If we can believe the data -- and that’s a big if -- Australia’s labour market deteriorated in September, following a sharp downward revision to employment estimates for August.

The result follows a couple of rogue estimates, which left many analysts questioning the credibility of the Australian Bureau of Statistics (ABS).

Yesterday the ABS announced that last month’s extraordinary result never actually happened. It was a statistical quirk; the result, in its opinion, of a random shift in the seasonality present in the July and August employment data.

In light of this problem the ABS took the unprecedented step of removing the seasonal factors that it typically applies to July, August and September data to obtain a more accurate view of Australia’s labour market. For these three months, the seasonally-adjusted estimates are identical to the non-seasonally-adjusted estimates.

But it remains unclear why the seasonality disappeared and whether there is a more important underlying cause behind these rogue results. There must also be some concern about what will happen in October and for the remainder of this year.

As it stands, I urge readers to take the seasonally-adjusted estimates with a grain of salt. Certainly the new estimates seem more reasonable than the nonsense reported last month, but the trend estimates are where readers should address their attention.

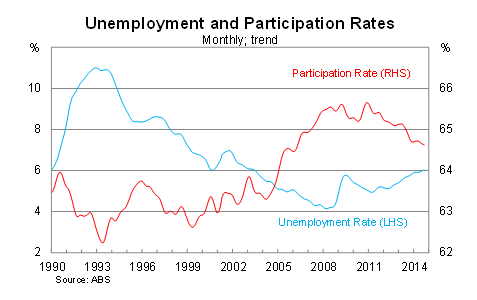

For the record though -- and because markets continue to prioritise seasonally-adjusted estimates -- employment fell by 29,700 in September, led by a sharp decline in the number of part-time jobs. As a result the unemployment rate ticked up to 6.1 per cent -- its highest level since June 2003 -- and the participation rate declined further to be at its lowest rate in eight years.

Had the ABS not made its adjustment yesterday, it would have reported a decline in employment of around 170,000. It’s easy to see why it didn’t want the media reporting that.

On a trend basis, total employment rose by 5,600 in September and monthly growth has slowed considerably since its peak in March this year. The economy has produced 133,500 additional jobs over the past year; well below the federal government’s pledge of 200,000 jobs per year and the more pessimistic estimates from the Department of Employment (There’s no substance to the Coalition’s attack on welfare; May 23).

I should note at this point that trend estimates were also revised down significantly since they are based on the ABS’ seasonally-adjusted estimates. Last month for example, the ABS reported that employment rose 18,700 in August on a trend basis (compared with 7,400 after their revisions).

The difference between those estimates is the difference between an economy that is travelling beautifully compared with one that is struggling. The trend is always the more reliable indicator but it is still only as good as its underlying data. I explored this issue a little further in last month’s analysis (Making sense of a surprising jobs spike; September 11).

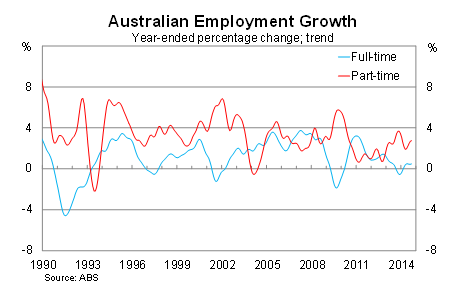

Employment growth continues to be concentrated in part-time jobs and the number of full-time jobs has declined for the past four months. Consequently, employment among women continues to rise while male employment has stagnated.

The unemployment rate continues to trend up modestly but remains at 6.0 per cent for now. At this stage it appears as though the unemployment rate will continue on its upward trajectory, although the recent uplift in residential and non-residential construction may help somewhat. Countering this, a number of mining jobs will be lost as iron ore producers either shut up shop or strip their operations down to the bare minimum.

As always a correct assessment of the labour market requires consideration of the participation rate. The participation rate was broadly unchanged in September but is now at its lowest level since April 2006. The participation rate is expected to decline further as an increasing share of ‘baby boomers’ retire, and that will place some downward pressure on the unemployment rate and growth for the foreseeable future.

Estimates of hours worked – the only seasonally-adjusted result from last month that the ABS was confident in – continued to fall in September and indicates that the labour market remains fairly weak and to some extent confirms the net loss of jobs over the past few months.

In the light of this mess it’s probably a good thing that the Reserve Bank of Australia (RBA) has not been fine tuning policy. Steps taken by the ABS appear to have reduced the recent volatility which has plagued the survey but it remains difficult to interpret the data and it may remain that way for a number of months.

But taken at face value this is a particularly weak jobs report that indicates that the economy is struggling to create new jobs – particularly of the full-time variety. The labour market will have to improve significantly for the RBA to raise rates next year as most market analysts predict.