InvestSMART's International Equities Portfolio: March Quarter Review

We should also point out that the International Equities Portfolio has returned 11.49 per cent per annum since inception. That performance not only takes into account the shocks of COVID-19 but also the China hard landing crisis in 2015-2016, the Brexit vote, the US presidential elections of 2016 and 2020 and finally, the US-China trade wars. This should highlight that time in the market will still outperform all others even when short-term risk events take hold.

The performance over the past year is clearly premised on the world’s response to COVID. Mass stimulus, government support programs and light speed changes to our habits of consumption and investment have fuelled the global movement in equities. What we must also note from the first quarter of 2021 is how many of these support mechanisms are likely to stay in place even with the surging bounce back in local economies.

For example, the US Federal Reserve believes it will hold its current programs in place until 2023, the newly elected Biden administration has just injected over US$1.9 trillion into its economy and are hinting this won’t be the last injection either. Both the Bank of England and the European Central Bank are in the same vein as their cross-Atlantic peer. While in places like Japan, relatively new Prime Minster Yoshihide Suga has suggested it will ramp its programs up even further over the coming period to support Japan’s COVID recovery. In short, the stimulus programs will continue to support international equities.

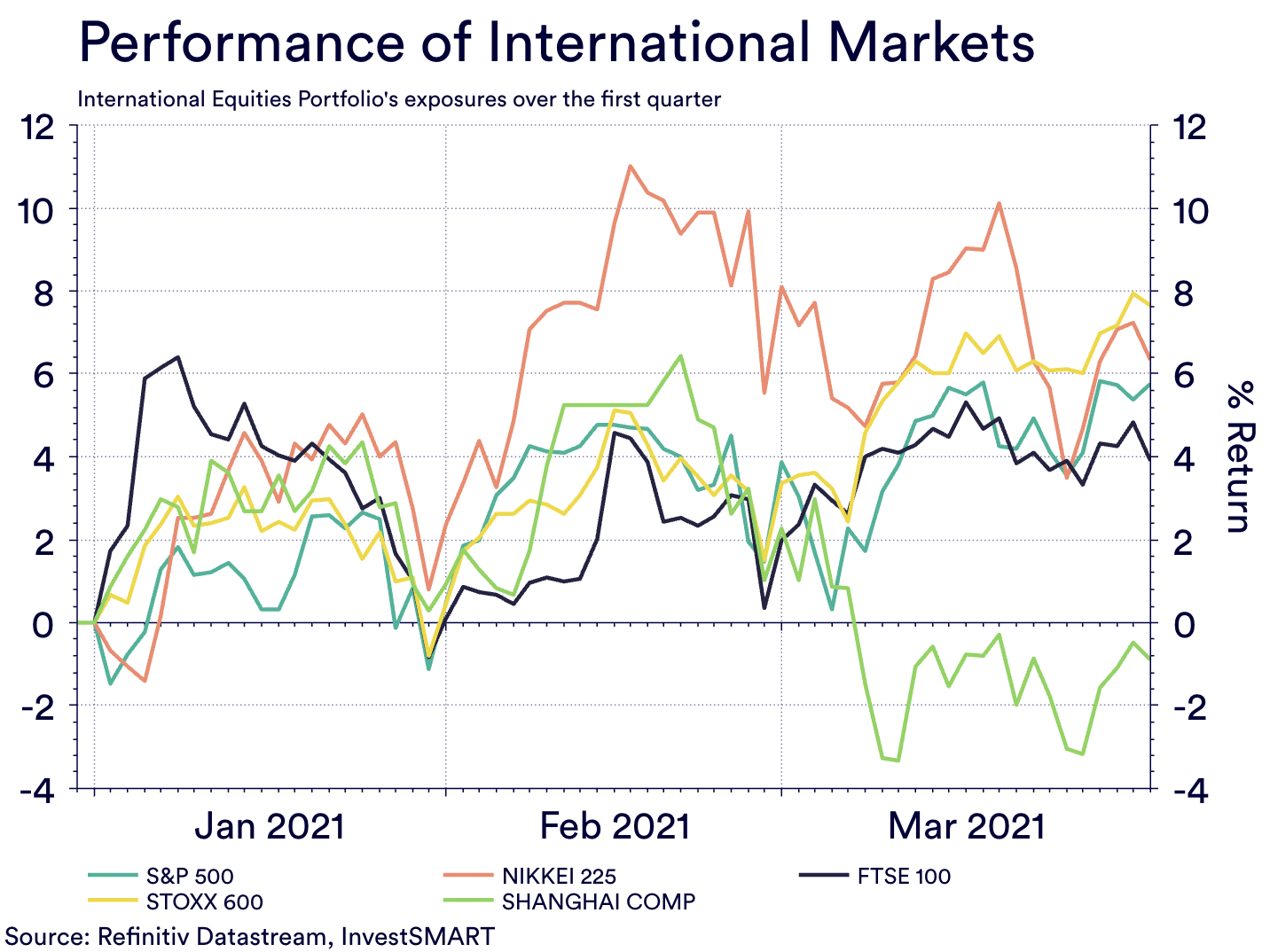

However, we did notice some interesting differences between continents and nations’ equity performance over the past quarter that is not what one would expect. For example, Europe, despite its poor handling of the COVID crisis and having entered a third lockdown during the quarter, was actually the best performing market in the portfolio. Compare this to China’s Shanghai Composite which was the worst performer despite China now growing faster than it was in the year before COVID and its overall performance with handling the COVID crisis.

What also caught our attention over the quarter was the performance of the NASDAQ. Although we don’t hold the NASDAQ in the portfolio, it caught our attention as it underperformed global peers by some way. This is the first time since the pandemic started that it has fallen behind. This suggests investors are changing into value over ‘out-and-out’ growth. It also shows that some of the ‘hot money’ that has flown into markets during the past 9 months in particular, is starting to ease and some revaluation of portfolios is occurring.

But looking forward and as stated before with central banks and central governments holding the line on their respective COVID stimulus programs for at least the next 18 months, international equities are likely to continue their outperformance – something the International Equities Portfolio is well positioned to take advantage of.

Frequently Asked Questions about this Article…

The International Equities Portfolio has returned 11.49% per annum since its inception, demonstrating resilience through events like COVID-19, the China hard landing crisis, Brexit, and the US-China trade wars.

Global stimulus programs, including those from the US Federal Reserve and European Central Bank, have significantly supported international equities by injecting liquidity and fostering economic recovery, which is expected to continue for at least the next 18 months.

Despite entering a third lockdown and handling COVID-19 poorly, Europe was the best performing market in the portfolio, showcasing unexpected resilience and investor confidence in its recovery potential.

The NASDAQ underperformed for the first time since the pandemic began, indicating a shift in investor preference from growth stocks to value stocks and a revaluation of portfolios as 'hot money' inflows ease.

With ongoing support from central banks and governments, international equities are expected to continue their strong performance, and the International Equities Portfolio is well-positioned to benefit from this trend.

The Biden administration's injection of over US$1.9 trillion into the economy, along with hints of further support, has bolstered market confidence and contributed to the positive performance of international equities.

Investors are shifting towards value stocks over growth stocks, driven by a revaluation of portfolios and the easing of 'hot money' inflows that characterized the past nine months.

Despite China's rapid economic growth post-COVID, its Shanghai Composite was the worst performer in the portfolio, highlighting a disconnect between economic performance and market returns.