InvestSMART's Growth Portfolio: March Quarter Review 2021

- The portfolio appreciated 2.54 per cent after fees in the March quarter.

- No changes were made to the portfolio during the quarter.

- The yield on the portfolio is approximately 2.44 per cent.

- Since inception the portfolio has averaged 7.51 per cent after fees.

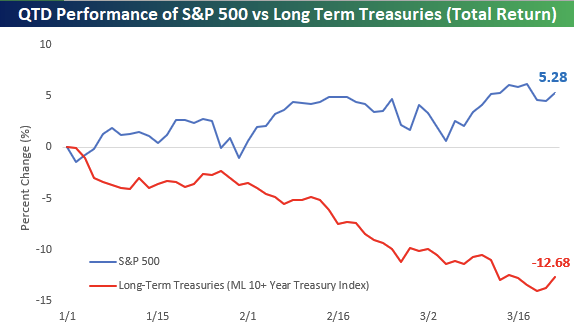

It was a slightly uneven quarter we must say and the best summary of why the Growth Portfolio lost some ground compared to its single asset peers can be seen in this chart from Bespoke Investment Group.

This chart shows just how big a divergence there was in the first quarter between US bonds and the S&P 500. The 18 per cent difference is the largest divergence in 40 years, the fall in long dated bonds (those bonds with a duration of 10 years or more) was a record first quarter decline. The key take out from the divergences across the portfolio in the first quarter was that it was abnormal and the probability of it happening again in the near future is very low.

We should also put this into the perspective of your risk profile and your investment time horizon. The Growth Portfolio is weighted more towards risk assets such as domestic and international equities and property, but that does not mean we forgo the need for defensive assets as history shows that fixed income and cash are vital for sustained, buffer-protected returns.

We stress the following point – fixed income is one of the core asset classes of any investment portfolio, even those with a high risk tolerance. It provides a strong and solid foundation; its income component provides a consistent long-term income rate, and the capital component is majority backed by sovereign governments or tier-1 corporations.

Yes, like any floating market, it can be subject to short bouts of volatility. Its normal advantage is that these bouts of volatility are mild in comparison to its riskier peers such as equities and property but that’s not always so.

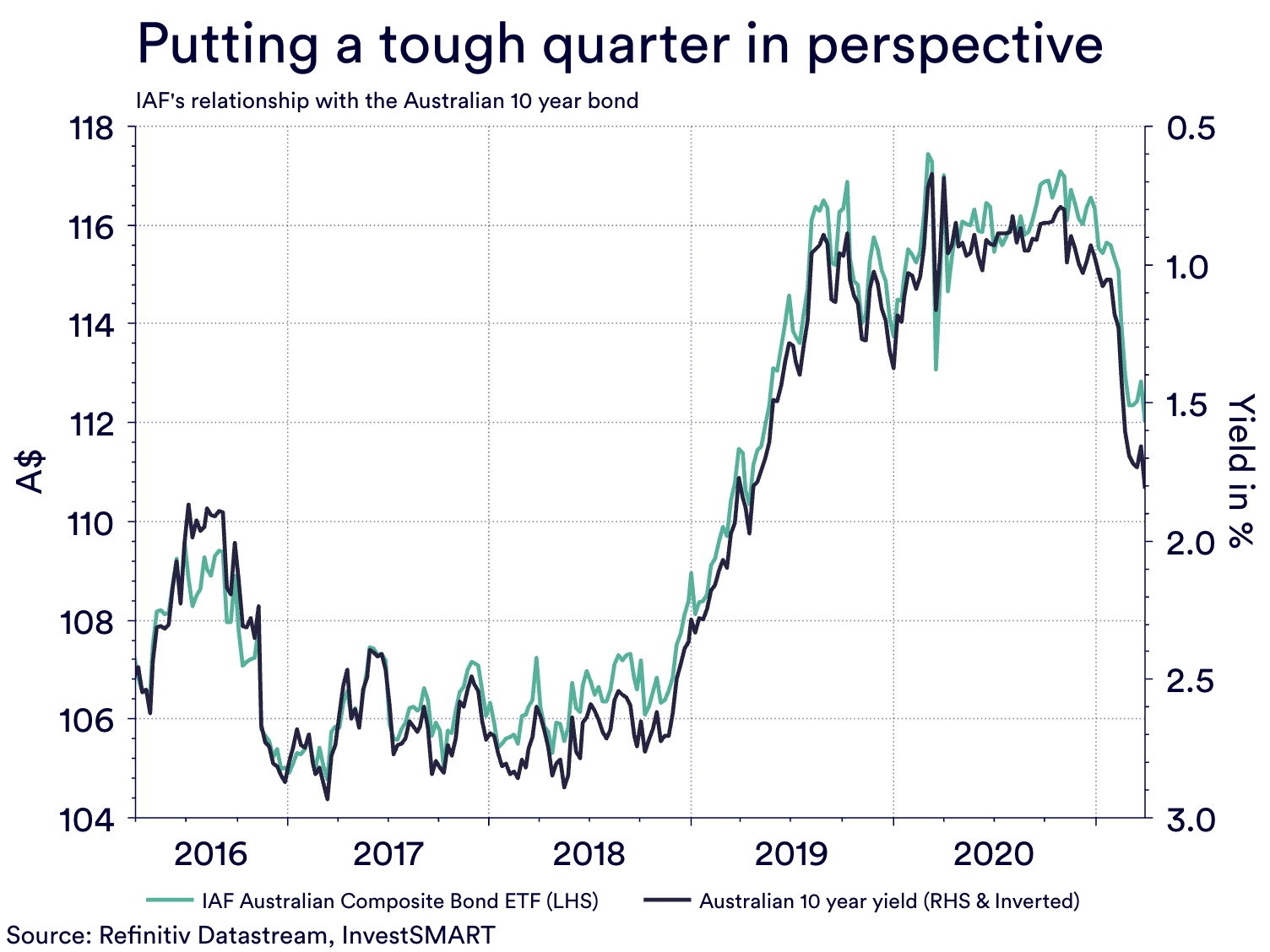

In the Growth Portfolio we hold the iShares Australian Fixed Income ETF (IAF) for your Australian treasuries’ exposure. Its biggest holding is the Australian government 10-year bond and as this chart shows very clearly, the Australian 10-year bond was sold off in the quarter causing its yield to rise which saw IAF’s sell off mirroring that of the 10-year.

This fall has led to a debate over the merit of fixed income, with some even suggesting it’s facing an ‘existential crisis’ and that it no longer has a place for investors. This is disingenuous, as the same chart above shows the incredible positive movement throughout 2019. We even warned investors back then that that kind of appreciation was abnormal in the fixed income sphere and not to expect this kind of move on a long-term basis.

We are here to remind you of the same point but in reverse – fixed income will return. If we look at the Australian 10-year bond, its price is currently below its ‘face value’ (for more on the inner workings of fixed income, click here to view our fixed income series)

Furthermore, the performance of the Growth Portfolio during this period needs to be looked at in the context of risk and your tolerance of risk. It also needs to be looked at in terms of your investment time horizon.

As a growth investor you should be looking to invest for over 5 years or more. Therefore, if we compare the ASX 200 to the Australian Growth Index over time, the last quarter’s slightly lower performance to single assets like equities is put into perfect perspective as this chart shows.

The chart also highlights the buffers other asset classes add to overall performance. It has not only weathered the COVID-crisis better, but also the selloff in global markets in October 2018 and the declines seen in 2015. The portfolio is designed to take full advantage of what growth markets can bring to your total returns, but it has been the defensive assets buffering it from the falls risk markets are exposed to that have helped it outperform single asset classes.

Investors should continue to apply their personal risk tolerance to their investment goals and should remember that overall long-term performance is core to reaching these goals.

Frequently Asked Questions about this Article…

The Growth Portfolio appreciated by 2.54% after fees during the March quarter of 2021.

The yield on the Growth Portfolio is approximately 2.44%.

The Growth Portfolio lost some ground due to an abnormal divergence between US bonds and the S&P 500, which was the largest in 40 years. This divergence is unlikely to happen again soon.

Fixed income assets provide a strong foundation for the portfolio, offering consistent long-term income and capital backed by sovereign governments or tier-1 corporations. They act as a buffer against volatility in riskier assets like equities and property.

Yes, despite recent volatility, fixed income remains a core asset class. It provides stability and income, and its recent performance should be viewed in the context of long-term investment goals.

Growth investors should aim for an investment time horizon of over 5 years to fully benefit from the potential returns of growth markets.

The Growth Portfolio has weathered market downturns better than single asset classes due to its diversified approach, which includes defensive assets that buffer against market falls.

Investors should consider their personal risk tolerance and investment goals, focusing on long-term performance rather than short-term fluctuations.