Inflation will stretch RBA expectations

Headline CPI rose by more than expected in the September quarter but with considerable fiscal and monetary uncertainty in the US, a tentative recovery in Europe and the rebalancing of the Australian economy, the risks to the economy remain firmly to the downside. Expect the Reserve Bank to wait and see before making another decision.

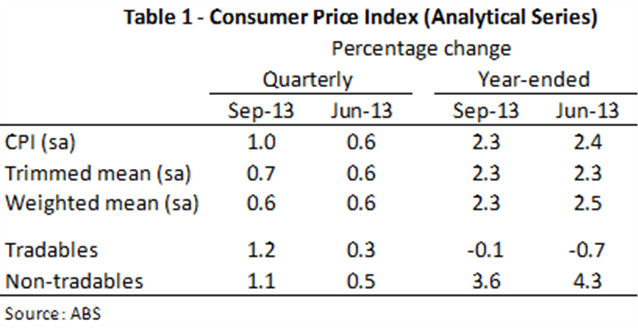

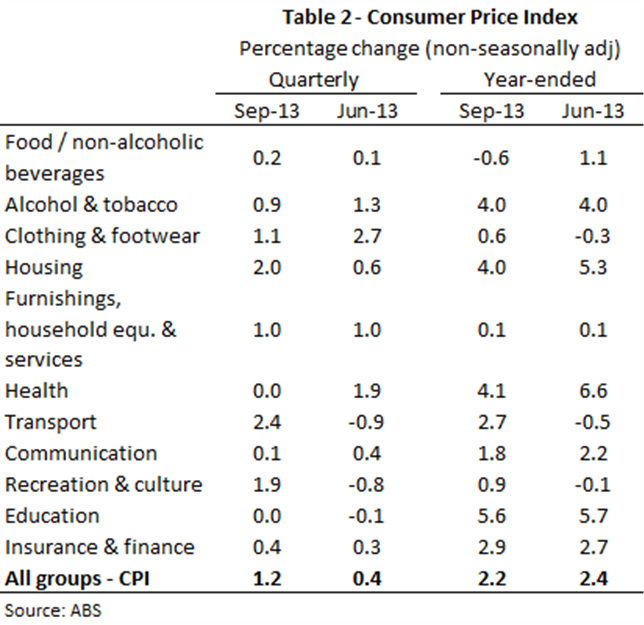

Headline CPI rose by 1.0 per cent in the September quarter on a seasonally-adjusted basis, to be 2.3 per cent higher over the year (table 1). The rise was driven by housing and transport (including a 7.6 per cent rise in the price of petrol; see table 2). On a non-seasonally adjusted basis headline CPI was up by 1.2 per cent in the quarter.

The trimmed and weighted mean CPI series – which remove volatile items – increased by around 0.6 per cent to 0.7 per cent, to be 2.3 per cent higher over the year. The result fits squarely into the Reserve Bank’s target band for inflation of between 2-3 per cent.

The overall result was stronger than market expectations, which had factored in a headline CPI of 0.8 per cent and trimmed and weighted mean of 0.6 per cent. The market will interpret this result as reducing the likelihood of further rate cuts but downside risks to Australia’s economic forecasts remain considerable.

On a year-ended basis, headline inflation is likely to trend upward in the December quarter as the effects of the carbon tax disappear. This should see headline CPI return towards 2.5 per cent growth on a year-ended basis. Both trimmed and weighted means should be rising at a similar annual level.

Although year-ended growth remains relatively contained for now, inflation over the past six months gives the Reserve something to consider. On a six-month-annualised rate, headline inflation rose to 3.2 per cent in the September quarter (up from 1.6 per cent in the June quarter), while the trimmed mean increased to 2.6 per cent (up from 2.0 per cent) and the weighted mean climbed to 2.3 per cent (up from 2.2 per cent).

While this inflation report will not give the central bank reason to panic, it does highlight the complexity of the policy environment that the Reserve has to navigate. The economy is faced with the potential for rising inflation and a high Australian dollar, combined with below-trend growth and a faltering exports sector (if the high exchange rate persists).

The relationship between the exchange rate and inflation is far from exact, and movements in exchange rates often flow through to inflation with considerable lag. But the rising Australian dollar – a source of concern in recent weeks – may prove beneficial to inflation in 2014, providing some downward pressure on the prices of tradables.

The removal of the carbon tax in mid-2014 will also reduce the rate of inflation, although much like the implementation of the tax, the Reserve Bank will look through the volatility when making decisions by focusing instead on the trimmed and weighted mean measures.

As the economic environment becomes clearer, it is becoming increasingly evident that the Reserve faces a number of economic challenges in the months ahead. Of primary concern is the prospect of choosing between rising inflation on one hand and below trend growth on the other.

At present the threat to inflation is not as important as the threat of below-trend growth; if faced with a choice between the two the bank should focus on rebalancing the economy away from the mining sector. The Reserve should not overreact to a higher-than-expected inflation reading.

An effective rebalancing will set up the economy through the medium-term. By comparison, a messy rebalancing will prove disruptive to economic growth, raising the likelihood of a prolonged period of below-trend growth or an economic downturn. The downside risks to that scenario are more ominous than the risks of inflation heading towards 3 per cent annual growth (which may not even come to pass).

This inflation report, combined with a broader economic environment characterised by fiscal and monetary uncertainty in the United States, a tentative recovery in the eurozone area and the rebalancing on the Australian economy, will likely result in the Reserve Bank waiting for the dust to clear and more data to arrive. Although the market will interpret this inflation report as a sign that the easing period is over, that seems overly optimistic in light of the considerable downside risks to the economic forecasts.