Inflating expectations of a Fed rate rise

A surprising pick-up in consumer prices in the US has brought forward expectations of a cash rate rise. But with considerable spare capacity across the country, the Federal Reserve won’t pull the trigger just yet.

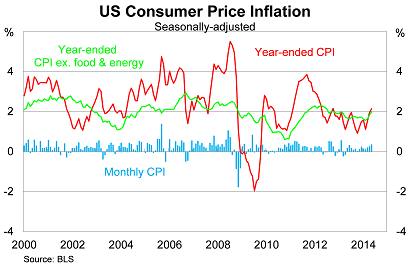

Inflation in the US rose by 0.4 per cent in May, beating market expectations, to be 2.1 per cent higher over the year. It marks the strongest monthly surge in prices since February last year and year-ended growth is now at its highest level since October 2012.

The big question is whether this is a temporary spike in inflation or a sign of things to come. In February 2013, prices rose by 0.6 per cent but then fell in the following two months. That episode was largely driven by a sharp rise in gasoline prices, which can be notoriously volatile.

By comparison, the recent uptick has been fairly broad-based and that can be seen by how closely core inflation is tracking the headline rate. I expect inflation to track a little higher than 2 per cent (a touch above the Federal Reserve’s inflation target) for the remainder of this year.

Core inflation (which excludes volatile items such as food and energy) rose by 0.3 per cent in May, to be 2 per cent higher over the year. Energy prices rose by 0.9 per cent in the month, following some recent softness, while food and beverage prices climbed by 0.5 per cent.

But despite this recent surge, the Fed is unlikely to get ahead of itself. Its preferred measure of inflation, the core personal consumption expenditure deflator, continues to track below other measures.

The core PCE deflator rose by just 1.4 per cent over the year to April. I expect this to tick up further and eventually converge with the consumer price index, but for now there remains plenty of room before the core PCE deflator approaches the Fed’s upper target of 2 per cent annual inflation.

Another question worth pondering is whether inflation could become an immediate problem. Could it get away from the Fed?

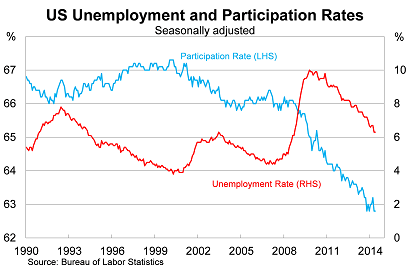

It’s important to note that wage pressures have eased in recent months, to the extent that real average hourly wages actually declined over the year to May. That may prove temporary, since wages are often a lagging indicator of the economy, but for now wage pressures remain fairly benign and unlikely to catch the Fed by surprise.

Certainly the biggest concern for declining real wages is for household spending, though that has been offset by fairly solid employment growth. Non-farm payrolls rose by 217,000 in May, following strong gains since February (A strong jobs report won’t alter the Fed’s course, June 9). In fact, over the past eight years, there have only been three four-month periods with higher job creation.

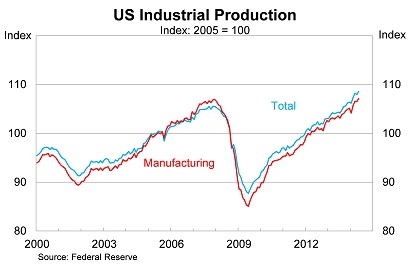

Consistent with stronger employment, measures of industrial production and capacity utilisation have improved in recent months. Industrial production rose by 0.3 per cent in May, to be 4.3 per cent higher over the year. Capacity utilisation remains below its pre-crisis level but has increased by 1.3 percentage points over the past year.

Recent data from the US shows that its economy has lost none of its underlying strength, despite a weather-affected decline in the first quarter. The economy appears to be developing largely as the Fed expects, particularly if we discount this inflation result in favour of its preferred measure the core PCE deflator.

The Federal Reserve is meeting overnight and it is all but certain to continue to wind down its asset purchases by an additional $US10 billion. But it is likely to wait until next year before pulling the trigger on interest rates.

Certainly, if inflation picks up further over the next few months -- and that is a distinct possibility -- then it might bring that date forward. But with plenty of spare capacity remaining in the labour market, and relatively benign wage growth, I don’t see a pressing need for it to jump the gun just yet.