Global investor: Jim Rogers eyes AMP China

Summary: Legendary international investor Jim Rogers is not optimistic after a six-year bull market in American stocks. He owns a number of funds that invest in China, including the AMP Capital China Growth Fund, while he is shorting US tech stocks and US junk bonds. He thinks agriculture has better future potential than other commodities. |

Key take-out: In terms of commodities, Jim Rogers says he would buy agriculture with both feet, energy with a toe and watch the others. |

Key beneficiaries: General investors. Category: International investing. |

At age 73, Jim Rogers, the international investor who once motorcycled around the world to find opportunities, says he's slowing down his investment activity a bit.

But for Rogers, who fights Father Time with daily two-hour exercise sessions at his Singapore home, this step back is no concession to age. It's more about the limited opportunities he sees right now in the many markets he studies, due to his concern that mounting worldwide debt and too much easy money will lead to a global bear market.

“The next time around, we are going to have a very serious problem, I'm afraid,” said Rogers, speaking by phone from a hotel room in Beijing last week. “So basically what I'm saying is that I'm not racing around looking for markets.”

“I don't think anybody should ever be interested in anything that they don't know about. If you can't find Kazakhstan on the map, don't invest there.“ —Jim Rogers

Photo: CJ Sameer Wadhwa/GettyImages for Barron's

Rogers, an Alabama native, first gained fame in the 1970s as he and hedge fund partner George Soros racked up a 4,200 per cent gain in 10 years. Now, managing his own account, Rogers is nibbling at investments before his projected big shakeout comes. He concedes that global stock indexes could get another boost as central banks keep short-term rates low. But it will end badly, he concludes.

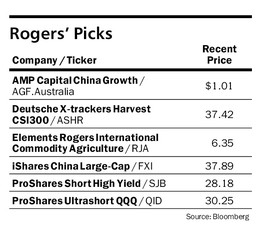

In an interview, Rogers offered some ideas for US investors, including two China exchange-traded funds that he holds, and a few short ideas. He also shared his take on commodities, including gold.

Barron's: You're regarded in the US financial media as a go-to source for investing in emerging markets, principally China, and commodities. I want you to help me put these investment sectors in perspective. Let's say you're a 50-year-old Barron's reader with a few million dollars in net worth. How much of your assets should be in these areas?

Rogers: Well, it depends on the time [in the market cycle], and it depends on the person. I don't think anybody should ever be interested in anything that they don't know about. If you can't find Kazakhstan on the map, don't invest there.

What if the time frame is now and the investors are folks who are comfortable with the risks of emerging markets and commodities?

Right now as I look at the world, I'm not terribly optimistic. The American stock market has been in a bull market now 6½ years. In America, we've had economic setbacks every four to seven years since the beginning of the republic, and chances are we're getting closer to being due for some kind of correction, bear market even. And the next bear market is going to be worse than most of us have experienced because the debt is so much higher.

You know, we had a problem in 2008 because of high debt, but since then, debt worldwide has gone through the roof. I mean nobody has reduced their debt, almost no nation has reduced its debt since 2008—the debt has gotten higher and higher. So the next time around, we are going to have a very serious problem.

What I'm saying is that I'm not racing around looking for markets. I'm afraid that the big picture is such that we are going to have more problems in the next year or two, and being long most stocks or most investments is not going to be great.

So where do you think the big global problems are going to start?

Big problems are going to come from the US, essentially because it has been the American central bank that has been the most at fault. We're the ones who started all this money-printing, and everybody else of course copied us. But it is the first time in recorded history that you've had all the major central banks printing staggering amounts of money: Japan, the US, Europe, Britain, we're all doing it.

Having said that, when you look back at previous bear markets, they usually start with a small, marginal country that has trouble that snowballs, and the next thing you know, we're all in trouble.

There is going to be another leg up in stocks as central banks continue to panic [and keep rates low]. I suspect it will be the last one.

In an interview in Barron's in 2013, you said that you wouldn't buy China's stock market “unless it collapses.” This summer, did it collapse enough to get you interested, and are you still a buyer?

In July 2015, I started buying on the collapse. There were a couple of days where it was down very big on a day. Well, I was one of the buyers on those days. I haven't been terribly active since.

And you are using ETFs to invest in China?

I own FXI [iShares China Large-Cap] and ASHR [Deutsche X-trackers Harvest CSI300], as well as some based in Singapore. But the best investment might be AMP Capital China Growth [ticker: AGF.Australia] units listed in Australia, which is a closed-end fund trading at a big discount. [Editor's note: Hong Kong-based activist investor LIM Advisors has been vocal in its concerns about the discount of around 20 per cent, demanding AMP devise a plan to close the gap to NTA. London-based hedge fund Metage Capital has also called for the fund to buy back shares, calling the discount “unacceptable”.]

Do you have any short positions right now that you'd care to share?

I have been shorting US junk bonds by going long the ProShares Short High Yield [SJB], and I'm shorting US technology stocks through the ProShares Ultrashort QQQ [QID].

But if you think US stocks have one last leg up, why are you shorting these risk-on assets that should be helped by a rising market?

Well, one has to be hedged in case one is wrong.

What would you say to an investor now who has little to no exposure in commodities and who sees that most assets have been beaten down? What types of commodities do you think have the best potential going forward?

I would say agriculture, through the Elements Rogers International Commodity Agriculture exchange-traded note [RJA]. It is amazing how low some of these agricultural prices are. The average age of US farmers is 58 now. The average age in Japan is 66.

There are more people in the US who study public relations than study agriculture. It has been a nightmare industry for a long time, and that's got to change. I would certainly buy agriculture. [Rogers designed the index that the RJA fund tracks.]

What about other commodities?

I would probably start to buy oil in a small way, energy in a small way. I think it may be at the bottom, but since I don't have much confidence in my convictions right now, I want to see more. There is a lot of bad news that keeps coming out about energy, and yet the prices don't go down.

Historically, I have noticed that if something is going up, and good news comes out, and it doesn't keep going up, it usually means the top is being set. Likewise, if something is going down, and bad news comes out, and it doesn't continue to go down, it usually means we are making a bottom, so I suspect that energy is making a bottom.

What about investment opportunities for base metals including copper, given the slowdown we've been seeing from China?

Well, base metals have been crushed, but I don't see the same [bottoming] in base metals that I see in energy. So I think I would wait on base metals. I would keep watching.

What about gold?

I own gold, but I wouldn't buy gold at the moment. I still expect a great opportunity to buy gold in the next year or two or three. I guess I would buy agriculture with both feet, energy with a toe, and watch the others.

What percentage of one's investment assets should be in commodities now?

I would certainly put a fair amount of money in agriculture. It could be 10 per cent of a portfolio.

This piece has been reproduced with permission from Barron's.