Glimpsing the 'goddess of war' on the ASX

A high frequency trading racket has been exposed in New York on the NASDAQ. Australia needs to watch that the same market manipulation is not taking place here.

It's unfair to use one day's trading, but what happened in Australian markets yesterday would indicate the possibility that our markets are being manipulated in the same way as New York.

In New York, the big institutions have high-bandwidth 'pipes' into the market so that they can gain an advantage over smaller investors. They generate big revenues for the stock exchange as they dominate the market trading. Their public relations machine is very sophisticated and regular press articles praise the advantages of the high frequency traders' market manipulation. In Australia, high frequency traders also have pipes into the market but are subject to much greater regulation to curb New York-style market rigging. But the pipes still exist.

An article in the Big Picture newsletter is the source of my New York material.

This month the SEC took its first ever action against a high frequency trading firm for market manipulation: Athena Capital Research.

Athena systematically and algorithmically manipulated the NASDAQ auction closing price in thousands of securities throughout 2009.

They had HFT programs called ‘meat' and ‘gravy' specifically designed to manipulate the closing prices. Their algorithms read the NADSAQ imbalance information blasts, and reacted in intentionally nefarious ways.

Athena referred to its accumulation as ‘meat' and to its last-second trading strategies as ‘gravy'.

Athena referred to this in internal emails as “dominating the auction” and “owning the game".

In New York, as in Australia, the closing price is not just any price. Of all the thousands of price points throughout the trading day, it is the most important one because it is used to price mutual funds, ETFs and many other securities.

Athena manipulated thousands of stocks every day. The Athena managers, officers, and employees wrote code to accomplish this and did so brazenly. They wrote about it in emails. They were deliberately manipulative even to the point where they debated internally whether they would get caught, and asked themselves if they risked “killing the golden goose”.

The fact that prosecution has taken five years is a damning indictment on New York regulators. And the fact that the fine was only $1 million shows that this is just a slap on the wrist. But it showed to all that what we believed was happening in New York is really happening.

And so we come to Australia.

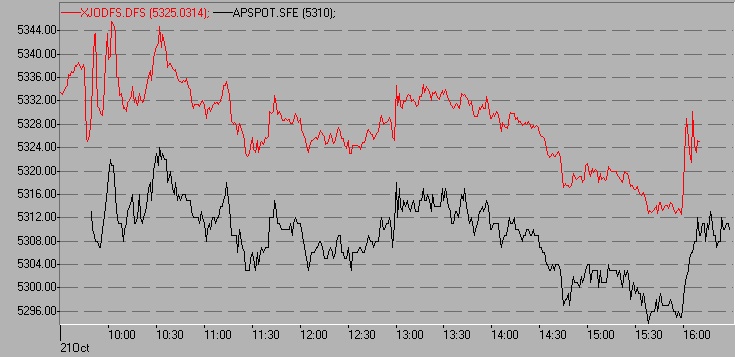

While the situation may not be as bad as New York, the closing price is equally powerful. Yesterday Richard Morrow of Baillieu Holst sent me the intraday chart of the physically delivered and cash-settled futures.

Do we have an Athena in Australia? You would need to look at a lot more closing price actions, but that sharp increase would indicate that, at least yesterday, an Athena-type action could have taken place in Australia.

Athena, the goddess of war, is an alert to the ASX. Yesterday's chart was a warning. The ASX wants Australia to be an Asian financial centre, but to achieve that status we must be able to promote ourselves as a clean market free of Athenas.