Generators to cash in at expense of renewables and consumers

Hugh Bannister from one of Australia’s handful of electricity market modellers, Intelligent Energy Systems, has released analysis looking at who would win and lose out of a move to axe the large scale component of the Renewable Energy Target (the LRET).

The headline answer is that the winner won’t be energy consumers, in fact they’ll lose to the tune of a half a billion dollars over the next decade on a net present value basis. Indeed what is likely to cause quite a deal of shock is that the average NSW household would end up paying more on their electricity bill per year from abolishing the LRET then the entire extra cost associated with the carbon tax.

Instead the one clear winner from abolishing the scheme will be incumbent fossil fuel generators, who will receive a $12.8 billion windfall in net present value over the next ten years.

This echoes findings from pretty much all the other Australian electricity market modellers such as ROAM Consulting, SKM MMA and Schneider Electric.

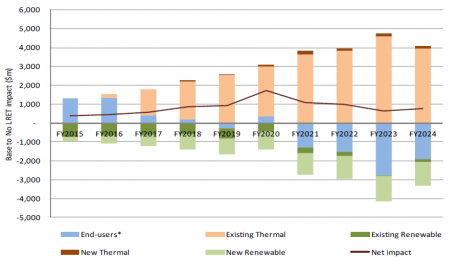

The estimates of the distribution of gains and losses each year are part of our charts of the week and shown below. As you would intuitively expect consumers initially gain from no longer having to pay a subsidy to support new renewable energy projects. But this rapidly erodes and they then become net losers from around 2021. The reason for this result is to do with how the extra additional supply from low operating cost renewable energy power plants acts to create extra competition for the existing generators.

Distribution of financial gains and losses from abolishing the LRET

Note: analysis does not include a price on carbon and is based on the Australian Energy Market Operator’s 2013 forecast of electricity demand.

Source: Hugh Bannister of Intelligent Energy Systems (2014) Who wins and who loses from change the LRET?

As we’ve explained in a number of columns in Climate Spectator over the years, (check out here, here and also the video clip down the bottom of this column) while you need to pay extra to get a renewable energy power project built this only pushes up that proportion of your bill supplied from this renewable energy, which is about 20 per cent. Once built these projects have very low operating costs (no fuel cost) and so bid into the overall electricity market at low prices which then tends to push out the highest cost generators in the market, which then lowers energy purchase costs for the remaining 80 per cent of your energy supply that doesn’t come from new renewables.

Initially the abolition of the RET would make little difference to electricity prices. But over time the amount of extra supply from renewables which we’d have missed out on becomes quite significant. This lack of new low operating cost supply means the electricity price becomes increasingly set by higher cost fossil-fuel generators, particularly gas, and may ultimately rise to a level required to make construction of new power stations attractive. The chart below illustrates Bannister’s estimates of how much higher wholesale prices would be with the LRET abolished (light red) versus if it remained as is (dark red). The difference steadily rises over time to become as big as $20 per megawatt-hour. To give you a feel for how significant that is, consider that current Victorian baseload power contracts are trading at $32 per MWh.

NEM wholesale electricity prices with no LRET (light red) and with existing LRET (dark red)

Note: analysis does not include a price on carbon and is based on the Australian Energy Market Operator’s 2013 forecast of electricity demand.

Source: Hugh Bannister of Intelligent Energy Systems (2014) Who wins and who loses from change the LRET?

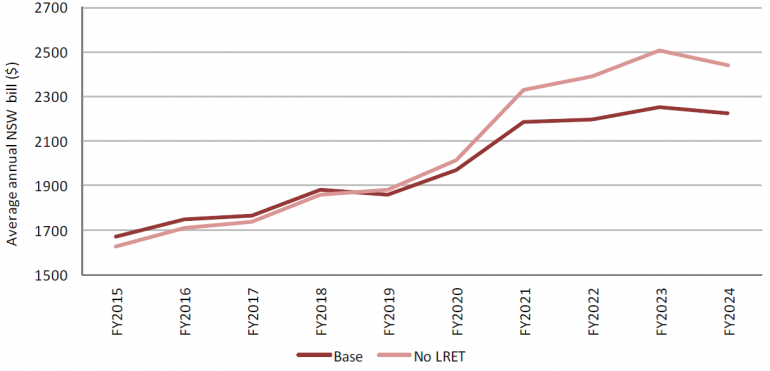

What is likely to give federal Coalition politicians some serious pause for thought is that Bannister estimates that the average NSW householder would end up paying about $200 more per annum on their electricity bill (results illustrated below).

That is more than the cost imposed by the carbon price.

Average NSW household annual electricity bill – light red is with LRET abolished and dark red is with it remaining as is.

I’ll repeat and explain that in case you hadn’t absorbed it. The fixed carbon price next year would be roughly $25 and the average NSW household’s annual electricity supply would involve about 6.5 tonnes of CO2, which works out to $162.50 per annum. By abolishing the RET the Coalition would be unwinding all the benefit consumers would have seen on their electricity bill from abolishing the carbon tax.

Now you might have noticed in the very first chart that when you sum up the financial gains and losses you end up with a net impact of a positive gain (illustrated by dark red line). This is likely to be the number which the government’s RET Review team will want people to focus on.

But given the current hostility of the electorate towards electricity companies, due to recent hikes in electricity prices, they probably won’t be too sold on the value of this net gain if it’s entirely the product of a $12.8 billion windfall to power companies, rather than a reduced power bill. And likely marketing campaigns to resist changes to the RET, such as the one just launched by Greenpeace, could fuel a dangerous political and consumer backlash (see: Big 3 energy retailers face shame campaign on renewables).

Video clip explaining how the RET can lower wholesale electricity prices.