Floats enter choppy waters

The return of initial public offerings to the Australian market has snared the attention of mum and dad investors and fund managers alike. But those considering whether to invest have mixed views on some of the offerings that will come to the market before the year end.

The much talked about offering Dick Smith begins trading at noon today and chief executive Nick Abboud is hoping for excess demand for his company’s stock. Ideally, that would push the electronics retailer into the green before the close of trade, but it looks like a tough feat with the broader market moving lower in early trade.

It is shaping up to be a very different story for Nine Entertainment, with reports indicating interest in the bookbuild is coming in at the lower end of the $2.05 - $2.35 price range. Roadshows and talking to investors help to put the offer at the top of investment agendas and in this case it appears investors are voting with their wallets.

Varying attitudes towards Dick Smith and Nine can be explained by industry differences and underlying business models. The increased interest in IPOs in general can be in part explained by a buoyant equity market, which has reignited investor interest in the stock market once again, and falling volatility, sparking investor appetite for initial public offerings.

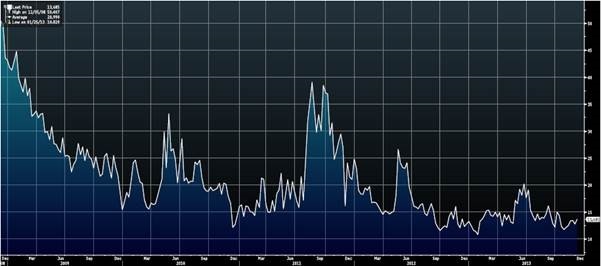

The graph below highlights the volatility of the Australian index has fallen dramatically over the last five years as the market has become more stable.

Source: Bloomberg

Without doubt, new investment opportunities add excitement to an otherwise passive market.

Value-wise, the past six months has produced IPOs totalling around $2.6 billion and there is a further $4 billion or so on the horizon.

Interest rates are low and individuals along with fund managers find themselves with increasing cash balances, so IPOs provide another entry point into a market which is trading at multiples in excess of five and 10-year averages.

November was a tough month for the Australian market relative to global markets. The performance domestically was accentuated by a falling Australian dollar and mixed commentary from a string of annual general meetings.

With the market having dealt with another attempt of the RBA to jawbone the Aussie dollar lower and overcoming a confession-session, the decks are cleared and provide an opportunity to list and trade for a couple of months before the next reporting season swings around.