Flicker of hope amid oil gloom

Summary: The current oil glut has come about because nearly every oilfield is producing at close to capacity, and this situation has been exacerbated by declining investment in exploration and development. But despite this Norwegian consultants Rystad Energy have broken from the pack arguing that conditions are emerging for a reversal of oil's decline. |

Key take-out: The oil-flooding tactics of Saudi Arabia are starting to work, with high-cost oil being forced out of the market by low prices. |

Key beneficiaries: General investors. Category: Commodities. |

Oil and mining stocks had a rough start to the week but behind the low oil price there are signs emerging of the potential for a big change over the next six months which could see heavily discounted stocks regain some of their recently lost ground.

According to one study of the oil market the conditions are emerging for an “oil-price shock”, perhaps as soon as February.

Rystad Energy, an independent Norwegian consultancy, believes the current oil glut is a result of virtually every oilfield in the world producing at close to capacity, leaving little room to cope with a sudden disruption.

Compounding the problem is the declining rate of investment in oil exploration and project development which is essential for an industry which sees all new oilfields start to decline within weeks of starting production.

The warning from Norway, one of the world's biggest oil producers, which has just switched on a new field in Arctic waters off its northern coast, is a reminder that conditions can change quickly in the oil and gas business.

This story is not a suggestion that investors should rush back into oil stocks - that's something to ask your licenced investment adviser - but it is a pointer to the latest developments in a market which has been heavily sold off.

Local producers at year lows

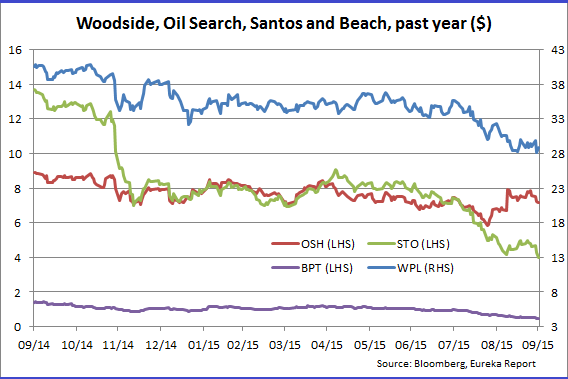

Most local oil and gas producers, including Woodside Petroleum, Oil Search, Santos and Beach, have slumped to 12-month lows over the past month as investors fret about the potential for the oil price to continue falling.

Woodside touched its low of $27.43 two weeks ago during the first phase of a proposed merger with Oil Search (a stock which was at a 12-month low of $5.62 just four weeks ago). Santos and Beach reached their respective 12-month lows earlier today at $3.96 and 46c.

It will take much higher prices for oil and gas to lift those stocks back to where they were 12 months ago, but the only way for that to happen is for the oil flood unleashed by over-production in the US and Saudi Arabia to abate.

Norwegian consultants tip oil price rise

Rystad suspects that the conditions are emerging for a reversal of the downward trend in oil - a view not shared by some of the world's biggest investment banks which see lower prices for longer.

What makes the Norwegian view interesting is that a recovery in the oil price is inevitable, with timing the unknown factor, thanks to the collapse in development plans which has seen the mothballing of an estimated $US1.5 trillion worth of oil and gas projects.

All that Rystad has done is move early with its prediction of a price spike, a view based largely on an assessment of conditions in Saudi Arabia, but supported by the latest evidence of pressure rising in the US oil industry.

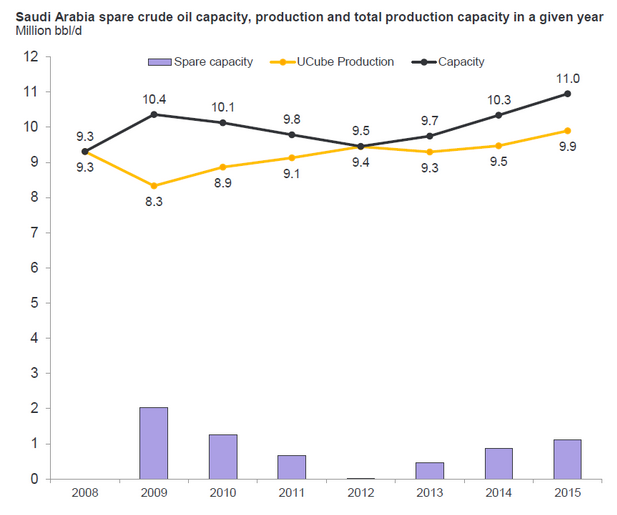

“The world's safety cushion to compensate for sudden disruption of global (oil) production is historically low,” the consultancy said. “Saudi Arabia's spare crude production capacity stands at only 1.1 million barrels a day.”

Source: Rystad Energy

Back in 2009, the last time there was a significant imbalance in the oil market Saudi Arabia's spare capacity stood at 2.1 million barrels a day.

“Rystad Energy forecasts that when the oil market rebalances next year, it will be with limited capacity to increase production meaningfully in the event of a sudden disruption, leaving the market vulnerable to price shocks.”

At the same time the Norwegian consultants were taking a close look at global oil production capacity fresh developments in the US pointed to that country's reborn domestic oil industry entering a crisis caused by excess debt and declining activity.

Growing list of debt casualties in oil and gas sector

The failure of Samson Resources, an oil producer valued at $US7 billion just four years ago, is the latest in a growing list of oilfield collapses caused by excess debt taken aboard during the oil-price boom.

According to a report in London's Financial Times, an alarming 41 per cent of all loans made to oil and gas companies are currently classified as distressed, with 70 oil production and oilfield supply companies defaulting on their debts this year.

The damage caused to the US industry by the Saudi-engineered oil flood has also bitten deeper into exploration activity with another four drilling rigs removed from active duty last week.

Baker Hughes, a US oilfield specialist, reported that there were 640 active rigs last week with the latest four to be removed making it four weeks in succession that the rig count has declined with the number of active rigs a proxy for future production.

Rystad's review of the global oil industry noted that Saudi Arabia and Russia remain the equal two biggest oil producers at 9.9 million barrels a day with the US third.

US alone among the biggest oil producers to have spare capacity

In the event of a supply disruption Russia is unlikely to be able to quickly lift output because it is already producing at full capacity to help boost the country's embargo-hit economy, and Saudi Arabia is close to capacity.

“The US is the remaining (big) producer which can meaningfully increase output in the near term,” Rystad said, while also noting that the US does not export oil thanks to an historic ban introduced during the oil shocks of the 1970s to protect local supplies.

The US response to a potential oil shock next year would be erratic, according to Rystad, with some mothballed wells brought back within weeks, but adding only about 100,000 barrels a day to output. Over the following month other wells already drilled but not completed could add another 500,000 barrels a day, but a full-scale response to add 1 million barrels a day would take a year.

“While the US supply response to a supply shock could be significant, the resulting market volatility could be far greater than expected,” Rystad said.

“The US is not a crude oil exporting country, and hundreds of companies make individual decisions.”

High cost producers vacating the field

Rystad's view of the oil sector is an early sign that the oil-flooding tactics of Saudi Arabia are starting to work with high-cost oil being forced out of the market by low prices.

The rebalancing that the Norwegian consultants see is in line with what Saudi Arabia is seeking to achieve, restoring its dominant position in setting the oil price which it hopes will rise to at least $US70 a barrel, sufficient to encourage some new investment, but not a rush.

However, managing a market as diverse as oil is a tricky business. The volatility that Rystad sees is reflected in prices over-shooting on the way down, but also having the same effect on the way up. If nothing else, this makes oil an exciting business for investors with a high tolerance for risk.