Five ways to sink a major retail brand

It seems that in starting a home improvement chain, Woolworths has inadvertently realised it has a knack for demolition. Business demolition, that is.

Woolworths' Masters business is in dire straits. Despite management’s enduring optimism for the home improvement chain, and its best efforts to turn it around, it's still bleeding money. New manager, turnaround expert Matt Tyson, has been brought in to speed things along, while the group is adamant that the hardware business is gaining sales momentum and brand recognition.

"We’ve done this [built a profitable business from scratch] a number of times before and we’ll do it again," Woolworths chief executive Grant O’Brien said at a briefing on Masters earlier this week.

But the punters are still sceptical. Masters has made a number of really silly mistakes that has pretty much destroyed all confidence in its management and cast doubt on whether a turnaround is even possible.

Here are five of the retailer’s fatal mistakes that have had a disastrous impact:

1. Set the budget before you understand the business. And then confess it to your shareholders.

"We didn't know a lot about the business when we set the budgets for FY13.”

Yes, that is a genuine quote from former Master’s chief Melinda Smith. A lack of foresight with its budgeting left Masters with a $157 million loss in FY13. The retailer lost an additional $176m this year, and has now abandoned its plan to break even by 2016.

2. Engineer a situation where the store loses money regardless of sales

After its 2013 results, The Australian’s John Durie calculated that Masters was losing 37c on every $1 in sales. Calculating the loss per sale in FY14 is a bit more difficult. Masters didn’t disclose its lease costs in the most recent update, obscuring its true overhead costs.

But if we assume that Masters had a similar lease cost per store as last year, and factor in that it expanded to run 49 stores by the end of FY14 , the group lost slightly more per sale this year: 41c per every $1.

Masters attributed this to its product mix. The merchandise was selling alright, but low margins on its most popular products meant that it wasn’t making enough profit to covers its costs.

3. Overstaff your stores

Woolworths entered into Masters as part of a joint venture with US retailer Lowe's, and it seems it let Lowe's get the better of it in terms of management and staffing arrangements.

Maybe it had something to do with the stark differences between the US and Australia when it comes to employees. It’s a lot easier to fire employees in the US, and the minimum wage is much lower ($US7 compared to $A16.87). US retailers often employ more customer service staff than their Australian counterparts, and it seems Masters was keen to stock its stores chock full of employees. If Masters wanted to differentiate itself from the Bunnings model, this certainly wasn't the smartest way to go about it. Masters did eventually realise its mistake.

As Smith explained last year:

"We've actually changed our labour model quite significantly because you'd be aware that the cost of wages in America are quite different to Australia."

4. Shrug off the ‘seasonal curve’

You don’t have to be an executive to know that when its winter in Australia, it’s summer in the US. And you don’t have to be a retail expert to know that events like Father’s Day would drive hardware sales. Yet both of these points eluded Master’s management.

Smith: "We've got a great joint venture partner in America but when it's Christmas time over there it's also winter. Our Christmas time lines up with spring and Father's Day so it's quite a different seasonal curve and there's no doubt there's a heap of opportunities to better capitalise on that.

"You know we didn't have the right stock in some instances and we left quite a lot of opportunities on the table."

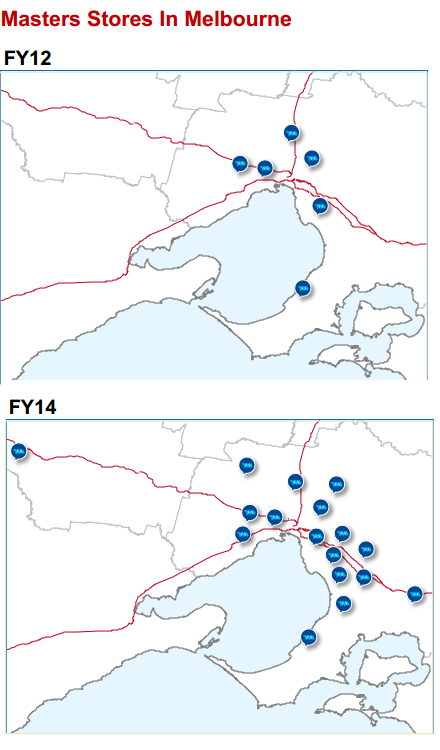

5. Open stores in random locations

An attempt to quickly roll out the Masters brand led to a situation where stores were placed in a rather random, sporadic manner. To make matters worse, Masters store placement led to a situation where they actually started to cannibalise each other’s sales. Just take a look at this map of Melbourne below.