Factoring the Crypto into Card Payments

Well before a forgotten wallet at a New York restaurant in 1950 led to the creation of the Diners Club charge card, people had been working on ways to pay securely and conveniently.

Most consumer payments at point-of-sale and online are still performed by cards and mobile wallets but crypto is emerging as a revolutionary new way to pay. The role of cryptocurrencies in payment systems is coming back into play as crypto markets hibernate during the crypto “winter”.

Cards have been around for decades while mobile wallet payments have emerged in the last decade and grown rapidly to the point where they’ll likely eclipse card payments in the Asia-Pacific region next year and comprise 40 per cent of global consumer payments at the point-of-sale in 2025.

It’s a huge market so developers are continuing to create disruptive products and services that might challenge the centralised payment scheme hegemony.

A Brief Historical Primer

The first modern precursor to today’s credit and debit cards emerged in New York in the 1930s. The “Charga-Plate” was a small metal plate embossed with a customer’s details that was used in an imprinter with an inked ribbon to produce a charge slip, not unlike the embossed plastic cards which emerged later.

In 1950, a Frank McNamara forgot his wallet when dining out at a New York restaurant which prompted the idea for a charge-card for diners and gave birth to the Diners Club, which grew to 42,000 members within a year and then took off internationally.

Bank of America launched its first credit card in 1958, and American Express the first plastic card in 1959. Magnetic stripes appeared on cards in the 1960s and “smart chips” in the 1970s and 80s. The international EMV standard (Europay, MasterCard and Visa) emerged in the early 2000s which enabled smart chip global interoperability, leading to contactless EMV in the mid-2000s.

The 2010s saw the emergence of mobile wallets from the likes of Google and Apple which allowed credit and debit cards to be loaded virtually onto a mobile phone for contactless payments at the point-of-sale. In parallel, AliPay and WeChat waved the flag for Chinese innovation with their AliPay and WeChat Pay mobile QR-code technology so widely used across Asia especially.

Payment cards and mobile wallets are now ubiquitous and enable consumers to pay easily, and securely, in-store and online. Most of us use these solutions without much (or any) consideration of the risks and costs because they’re convenient and accepted almost everywhere.

How They Work

Modern card and mobile wallet solutions enable a transaction between two parties, being the consumer of a good or service and the provider of that good or service, aka the merchant. The card or mobile wallet scheme operator acts as both a network and a settlement intermediary between the consumer and the merchant.

The scheme operator is intrinsic to the way a payment to a merchant is authorised by the consumer because the transaction physically flows across the scheme network. If there was no network, then the transaction would have no means of traveling digitally from the merchant to the consumer.

Visa and MasterCard as scheme operators settle funds between financial institutions (“FIs”) that act on behalf of the consumer or the merchant. FIs that issue cards to consumers are called issuers, and FIs that provide payment acceptance services to merchants are called acquirers.

When an issuer approves the transaction, then the scheme operator acts as a trusted party to settle funds between the issuer and acquirer. The scheme operator will debit funds from the issuer and credit funds to acquirer. Issuers debit the consumer for the funds and acquirers credit merchants with the funds. If participants trust the scheme operator, then the transaction can be authorised, cleared, and settled safely and securely.

Network Effects

Card and mobile wallet solutions work because they benefit from “network effects”. Robert Metcalfe, who created Ethernet (the network protocol that connects computers on a local area network), popularised “Metcalfe’s law” which says that the “value of a telecommunications network is proportional to the square of the number of connected users of the system”.

In practice, payment networks offer value to a participant only when there are other participants to transact with. This might seem blindingly obvious, but the network value grows exponentially with growth in the number of participants, and it is this non-linear growth that directly benefits the network or scheme operator.

Roads, airports, railways, telephone networks, the Internet and FAANGs are all beneficiaries of Metcalfe’s law.

A Licence to Print Money

The tremendous growth in transaction volumes over decades has resulted in the likes of Visa, MasterCard and more recently China UnionPay becoming the industry titans for payment cards, and AliPay and WeChat for QR-code wallet payments.

|

2021 |

Visa |

MasterCard |

|

Payment volume |

US$10.4T |

US$7.7T |

|

# transactions |

164.7B |

112.1B |

Source: Visa and MasterCard reported figures.

(Reliable data for AliPay and WeChat Pay is elusive, but each is estimated to have ~1 billion users each and payment volume greater than Visa’s).

These payment schemes earn fees for their network and settlement services by charging merchants and consumers directly, or indirectly via issuers and acquirers. As electronic payment volumes have risen over decades, but explosively in the last two decades with the rise of eCommerce and mobile payments, the leading payment schemes have created significant economic moats to ward off competition.

The schemes set the operating rules and fees, and issuers and acquirers have little choice but to abide and accept the costs as the alternative is exclusion from the network. Visa and MasterCard have even fallen foul of anti-competition laws in some jurisdictions (including Australia) due to their exercise of market power, resulting in subsequent regulatory action by authorities.

A Problem That Crypto Might Solve?

Payment scheme operators are the conduit through which payment messages are transported and funds settled. As trusted intermediaries, merchants and consumers can transact securely, safe in the knowledge that the payment scheme operator protects the integrity of their transaction.

But let’s consider the scenario where the payment scheme operator did not act in the best interests of the merchant, consumer, or the channel intermediaries. Or if the payment scheme network was hacked or otherwise compromised. Or the payment scheme operations failed to meet service levels for funds settlement or suffered a loss of funds.

Such an event could be catastrophic for confidence and potentially put merchant and/or consumer funds at risk.

The possibility for catastrophe (where a functioning payment system relies upon a payment scheme operator to “do the right thing”), is one of the factors that led Satoshi Nakamoto to develop the concept of a fully decentralised transaction ledger for payment transactions with built-in reward incentives that automatically self-adjust to supply and demand factors … otherwise known as Bitcoin.

Others then took Satoshi Nakamoto’s idea and have tried to improve, adapt, or build upon it with varying degrees of success or failure. But the core principle of decentralisation is precisely to mitigate the negative consequences and costs of the centralised payment schemes which currently dominate.

Bitcoin’s Lightning Network is one attempt at a disruptive technology that aims to challenge the centralised payment scheme hegemony.

The Lightning Network is a "2nd layer" solution that sits on top of the base Bitcoin layer to facilitate "millions to billions" of transactions per second. It uses smart contracts to perform transactions "off-chain", significantly reducing cost-per-transaction to the point where micro-payments are economically viable.

If scale is achieved, Lightning Network would process transactions at a throughput orders of magnitude greater than all of the existing payment schemes combined (estimates vary, but there is some consensus that Visa and MasterCard could handle thousands of transactions per second).

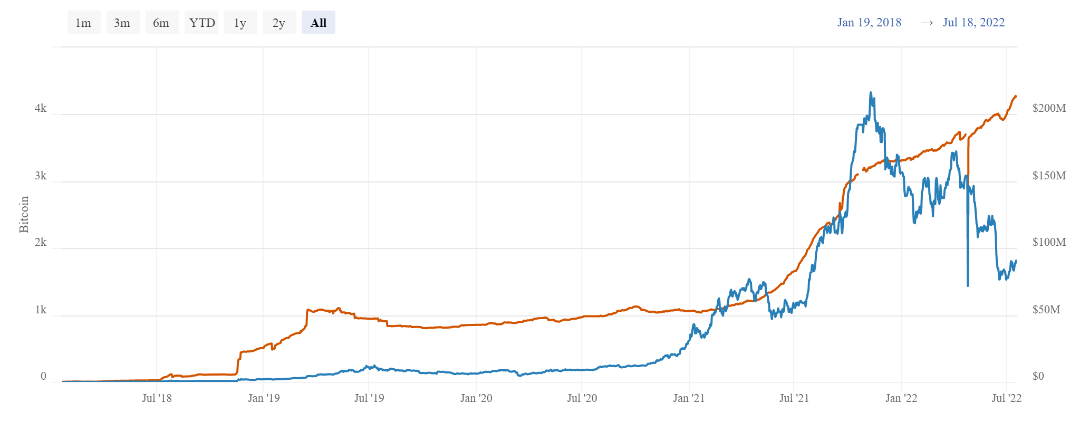

Lightning is a new technology that has emerged only in recent years, but its throughput measured in BTC and USD has grown tremendously, including barely a pause through the current market downturn.

With digital payments an integral part of our modern economy, the emerging battle between centralised and decentralised alternatives may have far-reaching impacts for us as investors, businesses and consumers.

Frequently Asked Questions about this Article…

Cryptocurrencies are emerging as a revolutionary new way to pay, especially as crypto markets hibernate during the crypto 'winter'. They offer a decentralized alternative to traditional payment systems, potentially mitigating risks associated with centralized payment scheme operators.

Mobile wallets have rapidly grown over the last decade, allowing users to load credit and debit cards onto their phones for contactless payments. They are expected to eclipse card payments in the Asia-Pacific region soon and comprise a significant portion of global consumer payments by 2025.

The Lightning Network is a '2nd layer' solution on top of Bitcoin that facilitates high-speed transactions using smart contracts. It aims to challenge centralized payment schemes by enabling millions of transactions per second at a lower cost, making micro-payments economically viable.

Visa and MasterCard have become industry titans due to their tremendous growth in transaction volumes over decades. They benefit from network effects, creating significant economic moats that ward off competition and allow them to set operating rules and fees.

Centralized payment schemes rely on operators to act in the best interests of merchants and consumers. If compromised, these systems could fail to meet service levels or suffer a loss of funds, posing risks to merchant and consumer confidence and funds.