Eureka's Week: Super, the bond bubble, property commissions

Last night | Super | Eureka's Week | The bond bubble | Property commissions | Readings & viewings

Last night

Dow Jones, down 0.67%

S&P500, down 0.92%

Nasdaq, down 1.29%

Aust. Dollar, US73.8c

Firstly, thanks for the feedback about my comments last week on the topic of our “silly tax system” and negative gearing. I think a quality debate is needed about how we fund the services we need and want, and I did appreciate the positive comments. But I am also very respectful of those who disagreed with me, and in particular the tone of your comments. It is truly a privilege to live in a democracy where we can have a civilised debate about the merits of things such as tax policy. Those who disagreed with me did so quite reasonably, arguing that negative gearing allows many Australians to create wealth which in turn means they will not need government support – from the taxpayers of the future – to fund their retirement. Thanks also to Professor Bob Lawn of South Australia who I felt made a lot of sense with this comment: “We all ultimately benefit if governments use the tax system effectively to guide sustainable economic growth as well as to provide the revenue for services. So we need more voices taking the bigger picture view and calling out distortions when they occur”.

Anyway, that said, I'll wade back into battle. Our superannuation system is one of my self-designated (no democracy here) “Eight Wonders of the Financial World”. The other seven I'll regale you with another day, but you won't be surprised to hear compound interest is at the top. Given this, you will not be expecting me to say that our super system in its entirety is part of our silly tax system. It most certainly is not. We can also have a terrific debate about the merits or otherwise of a compulsory superannuation system, but, as the chair of the Australian Government's Financial Literacy Board, I would love to say that our community wide financial skills have improved so much that we will save for the future ourselves. I am not, however, completely saturated in fairy dust. I am a supporter of our super system and also support the growth in contribution levels over the next decade.

But where super is truly silly is the bias towards high income earners. I may as well get the disclosure over and done with early. Last week I pleaded guilty to using negative gearing, a tax policy I do not agree with, to assist with my own wealth creation. This week I plead guilty to being a classic beneficiary of what I am arguing is the “silly” part of our super system. Clearly, tax policy shapes consumer behaviour. It certainly does with me and I suspect you as well. You will hardly be surprised by this. In regard to impending change, the Liberals have signalled their views in the budget. Labor adds to the debate saying that super has “unsustainably generous loopholes”, the Greens chipped in with super being a “tax haven for the wealthy”. I started to feel quite badly about the whole issue when the Telegraph described a Transition to Retirement Pension (TRIP) as a “certified money laundering system for the rich”.

Guess who has a TRIP? Oh well.

Anyway, like you I am a law abiding citizen, happy to pay the tax I legally should, but I do use tax breaks when they are appropriate for me. But this TRIP idea really is an odd beast. I turned 60 last year and have gone from an Executive Director to Non-Executive of a company I have been with for 33 years. I have also moved from Executive Chairman to Chairman here at InvestSMART. So I am genuine about a transition to retirement. Mind you, it was pretty inspiring to discover that this strategy turned my super into a pension plan, meaning no tax on investment earnings inside the fund. I am, as with any other TRIP person my age or thereabouts, required to take a four per cent pension. But I am over 60, so it comes out tax-free. Then of course I can take my taxable earnings, which at the top end of my income are taxed at nearly 50 per cent, including the Medicare levy, plus the “temporary budget repair” levy, and pop up to $35,000 into my super at only a 15 per cent tax rate. Crikey. Maybe the moon is made of green cheese.

After last week's comments and now this week's, both starting with a guilty plea, you may be thinking the silly parts of tax policy were designed with me in mind, and maybe I'd be smarter shutting up. However, it is not about me. It is about we baby boomers, who since we turned 18 have been the biggest voting bloc. Yes, tax policy has followed our wants (if not our needs). Our uni education was basically free, apart from a modest levy, which as I recall came back in the form of beer at student functions. Clearly, our very powerful voting block is behaving as any good behavioural economist would expect, with self-interest. And guess what appeals to us now? Super and health care are high on the list. Free education? Forget that, we've already had it.

So anyway, I promise, next week I'll get off my soapbox and stop banging on about our tax system. We should have a chat about investment and wealth creation. But let me close by saying that I am respectful of those who those feel we need to spend less by cutting back on non-critical government services and also deliver what we need more efficiently. This takes us to the politicians' favourite budget rebalancer, the “efficiency dividend'. Has anyone actually seen that deliver, anywhere in the world? I also get those who argue for smaller government and feel that government will tend to waste revenue generated by more tax, and that higher tax in itself is a negative driver for the economy. All fair.

But it seems to me we want an awful lot of government services and support. Once given, it is hard to take back without a riot from impacted voters. I'll get little argument that over time we should spend on services and benefits what we raise, mainly in the form of taxes of one kind or another. Right now it is bleedingly obvious that in pretty good economic times, which these are, as a nation we are spending a heap more than we are earning. Given the terrific state of our nation's balance sheet, this is just fine, for a while.

We independent thinking citizens need to stand up and give our pollies a hand here. Because as a community we have the poor buggers too terrified to give us any bad news. To raise tax revenue, cut services, reduce or restrict benefits to the truly needy is a community call. But who is going to stand up and support that call?

- Paul Clitheroe

Eureka's Week

The bond bubble

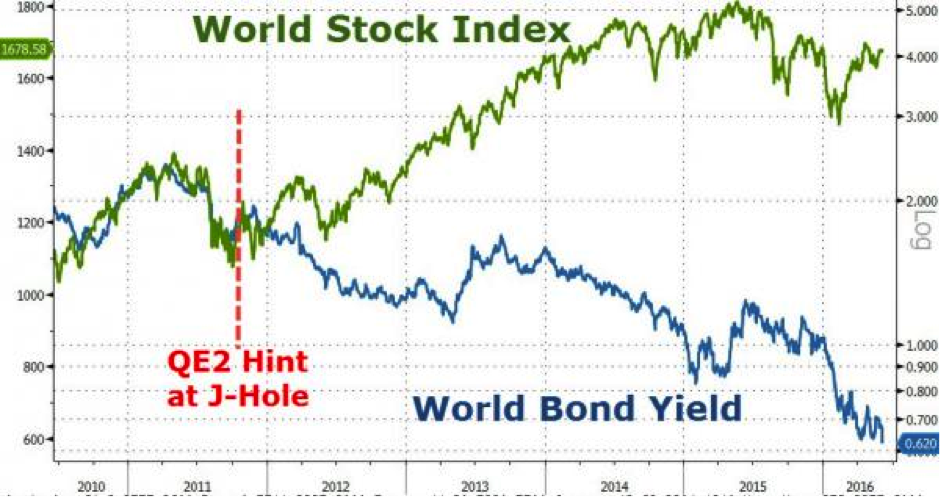

Bond guru Bill Gross tweeted on Thursday: “Global yields lowest in 500 years of recorded history. $10 trillion of neg. rate bonds. This is a supernova that will explode one day.”

Markets have ignored him. Last night global bond yields fell to new lows: German 10-year bunds now yield 0.015 per cent, the Japanese bond yield fell to minus 0.1572, and the US 10-year bond yield fell to 1.64 per cent – a new record low.

The Australian 10-year bond finished trading yesterday at 2.1019 per cent – also a record low and the 5-year yield stands at 1.7244.

It's also connected to the next item on the property frenzy: that is, it's part of the reason house prices are still booming.

What are you going to do – put your money in a term deposit at 2.7 per cent? At least with an investment property yielding that much you can persuade yourself that you might get some capital gain.

So investors are accepting lower and lower rental yields, especially with negative gearing helping out when the tax return comes due, and as a result, property and bonds are interconnected bubbles.

The apparently inexorable rise in Australian bond prices (which is the reason yields are falling) is part of a global phenomenon – bond yields everywhere are the lowest in history.

As I pointed on the ABC on Thursday, Japanese 30-year bonds are currently yielding 0.3 per cent and as Bill Gross pointed out, more than $US10 trillion worth of bonds worldwide are trading on negative yields.

The average global bond yield is now 0.67 per cent – a new record low, forever.

If yields rose just one per cent, the capital losses on bonds would be more than $US1 trillion – more than the total lost on US mortgage backed securities in 2008.

This is not only mind-bending, it's unprecedented and scary. In a sense, if the market yield on any asset goes negative, whatever the hell that means, then you can safely call it a bubble and head for the hills. That clearly applies to the current bond market.

I think the only reason there hasn't been a flight of money out of sovereign bonds already, and global yields have actually taken another big step down in 2016 (that is, prices have taken a big step up) after rising yields through 2015, is the perception of safety.

The fact is that there are few absolutely safe investment assets around at the moment (or ever). A lot of investors like gold, so the spot gold price has surged 20 per cent this year, but that feeling about the yellow metal is not universal. A lot of people worry about gold, and the fact that its price is determined by range of factors other than investment related ones – such as central bank selling, Chinese and Indian buying and jewellery demand.

Sovereign bonds, on the other hand, are largely a matter of mathematics. The safety is usually assured because a government has the power to pass laws and impose taxation. It's true that occasionally a country gets into a mess where it can't tax anymore and its bonds lose value – for example, Greece – but on the whole AA and AAA sovereign bonds are as close to perfectly safe as it's possible to get.

The mathematics have to do with inflation: what's a dollar going to be worth when the bond matures and you get your money back?

If, for example, there would be 10 per cent inflation every year over the next decade, then $100 today would be worth $35 then. Your starting point as an investor who knew that was going to happen would be that you need to be compensated for that loss in value. That means you need at least 10 per cent interest per year, plus some more for your trouble and risk.

So for example, Australia's 10-year government is currently trading at a yield of 2.1 per cent while the US 10-year bond, rated riskier by the ratings agencies, is trading at 1.68 per cent. The difference is in the inflation expectations and market perception of risk, as opposed to the formal ratings.

What does a 2.1 per cent 10-year bond rate tell you? That the people lending (investing) the money think that a dollar today is pretty much going to be worth a dollar in 10 years – that is, very low inflation. Most of that two per cent is the reward for locking your money up for 10 years, or alternatively for buying a tradable security subject to market volatility.

People lending to a government for less than zero per cent interest think there will be deflation – that is, that there will be a recession and/or deflation in the next few years so their money will be worth more when the bond matures and they can afford to give up some of that increase in value.

Well, that is what they'd be thinking if they were being rational. I suspect a lot of the current bond frenzy is irrational – a desperate flight to safety, which is scary.

Then again, maybe it's rational, which is even scarier.

Property commissions

Commissions to financial advisers for selling investment products were banned two years ago, but if you're an adviser pining for a commission, never fear! Anyone, and I do mean anyone, can still get juicy percentages from property developers.

In fact what's going on is a sign that the apartment bubble is reaching its final blow out and may be about to burst.

I was shown a brochure this week offering “off the plan” apartments for sale under the heading: “Incredible developer incentives”. It's a frighteningly accurate headline.

For a block of flats in Racecourse Rd Flemington, the upfront sales commission is eight per cent, plus a $10,000 “Channel bonus”, plus developer to pay stamp duty, plus developer to pay $5,000 FIRB application fee.

So for a $500,000 apartment, that's $40,000 cash, upfront, plus the bonus, plus stamp duty, plus $5,000. And although all this is ostensibly being paid by the developer, of course the buyer is actually paying it, because the commission is built into the price.

Last time I sold a house, which was a long time ago now, I negotiated the agent down to one per cent commission, and grumbled about that! But eight per cent? It's a total disaster.

There's another one in Docklands offering upfront commissions, plus “48,000 per apartment to be used to either discount the purchase price and or upgrades on all remaining apartments.” This one “has FIRB approval and can be sold to FIRB”.

Those mentions of FIRB are a clue about the target market for these things. As I understand it, the brochures are mostly being distributed in China, to financial advisers, property agents and anyone else who might be interested in selling an Australian apartment to someone they know – apparently they've even been distributed in universities, to try to get students to sell apartments to their friends.

But the commissions are also available to local advisers and accountants looking for a quick buck to replace some of their lost product commissions after FoFA, and some are taking it up.

For local advisers it's not all that attractive because it's a one-off chunk of cash, and they lose FUA (funds under advice). That's the way financial advisers make money now – instead of getting trailing commissions from investment product “manufacturers”, they skim a percentage off their FUA (usually 1-1.5 per cent).

It's the same percentages as commissions used to be and allows the advisers to call themselves “fee for service”.

Over time an adviser can pick up much more money from clients by hanging onto their clients' money than by taking a one-off commission from an apartment development.

But the fat commissions from developers are certainly getting some attention in China, and agents and advisers there are doing anything to make a sale – which is the intention of the eight per cent commissions.

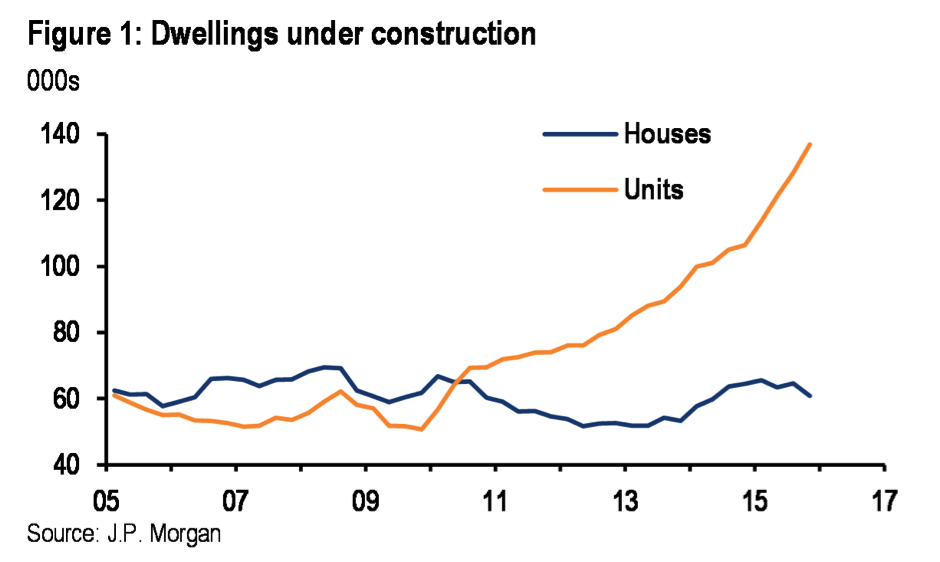

And that goes a long towards explaining this chart that I showed on the ABC News on Monday:

The report by JP Morgan from which that graph was taken estimated the current glut of apartments – that is, the excess of supply over potential demand – to be 70,000.

On Wednesday we learnt that approvals for investment mortgages had collapsed 21 per cent in the latest 12 months, but obviously that doesn't have much impact on Chinese buyers: they are borrowing their money there, not here.

In fact last week, ABS data showed that approvals for new apartments had accelerated in April – up 8.1 per cent, month on month, versus a 2.4 per cent rise in March.

What's more, house prices in Sydney and Melbourne also accelerated in May, rising 4.3 and 4.6 per cent respectively (seasonally adjusted).

Clearly the Australian apartment market is being held aloft by eight per cent upfront commissions and the lying and cheating that they encourage. It is going to crash.

What we don't know is when, since these sort of parties can go on for longer than you expect, especially with the desire of Chinese savers to get their money out of China.

Anyway, I'm passing all this onto you, not because I think you'd be silly enough to buy an apartment off the plan from a shonky salesmen on eight per cent commission, but because we all need to be aware of the what's happening at the racy end of the property market these days.

When interest rates start rising again, or even if they don't, there are going to be problems: as in all market crunches, liquidity is likely to disappear and lenders will be caught short. Extreme care needs to be taken.

Readings & viewings

Matt Damon's commencement speech at MIT a few days ago, including this, On the banking system and the Great Recession: “It was theft, and you knew it. It was fraud, and you knew it. And you know what else? We know that you knew it. So yeah, you sort of got away with it. You got that house in the Hamptons that other people paid for as their own mortgages went underwater. And you might have their money, but you don't have our respect. And just so you know, when we pass you on the street and look you in the eye, that's what we're thinking.”

The reality is neither Labor nor the Liberals have policies that are hostile to economic growth, but even the OECD now recognises there's more ways to grow the pie than just cutting company taxes.

A review of six new books about the digital age, and how it's changing what it means to be human.

This story isn't financial and has nothing to do with investment. It's about an unknown body on the English moors. I just like the way it's presented - it looks like the future of reading online.

Zero interest rates encourage companies to sacrifice their future.

Donald Trump will never be able to reinvent himself as a moderate.

More and more, this US election feels like a referendum on one man.

Why Trump was inevitable.

Hitler's rise was not inevitable, and he didn't will himself to power. He was put into office by supercilious idiots.

The creator of Dilbert, Scott Adams, is doing a realty good blog, mainly about Donald Trump. Here's a piece he did on Trump's battle with the so-called Mexican judge.

Republicans who once expressed shock at Trump are now standing behind him.

The rise of manufacturing marks the fall of globalisation.

The homes on Sydney's northern beaches that were damaged by the big seas last week might not be insured against it.

Voting “leave” won't necessarily means Britain actually does leave the EU.

Solar has beaten coal for a whole month in the UK, for the first time.

Goldman says China's debt load is much higher than previously thought.

Our two brain hemispheres mean we are really each two people. If the two sides of the brain split, there would be two of us.

The outsized life of Muhammad Ali.

China's had one of the biggest credit booms in modern history. Historically, credit booms of that size, which happen that quickly, they all result in financial crises.

Happy Birthday Richard Strauss, 152 today. Here's Renee Fleming doing Beim Schlafengehen, the third and arguably the most beautiful of the Four Last Songs. Heartbreaking.

Last week

Shane Oliver, AMP

Investment markets and key developments over the past week

Shares were mixed over the last week. While US shares pushed higher to within 1% of an all-time high on Fed rate hike delays and Australian shares rose slightly, Eurozone, Japanese and Chinese fell slightly. The oil price rose above $US50/barrel but metal prices fell slightly as did bond yields with Australian yields making it to a record low. The $US was little changed after its payroll driven fall a week ago, but the $A pushed above $US0.74 as the RBA failed to signal an easing bias.

Despite the short term noise one of the big dynamics helping markets since February has been the lack of upwards pressure on the $US which is partly due to a more cautious Fed. This has taken pressure off US profits, allowed commodity prices to stabilise or improve, reduced the threat of default by energy producers, helped reduce worries about a collapse in the Renminbi and capital outflows from China and reduced fears of a funding crisis in the emerging world. All of which has been positive for shares generally, commodity prices and corporate debt (with credit spreads falling back).

Will the decision by benchmark provider MSCI on June 14 on whether to include Chinese mainland (or A) shares in its emerging market and world equity benchmarks really have much impact on Chinese shares. Yes it could cause a near term flurry of interest but given that any inclusion will be phased in over time, the short term impact may prove to be brief and marginal. Just like the Shanghai-HK share connect that generated much enthusiasm initially. Including Chinese A shares in global equity benchmarks over the very long term will boost foreign interest in Chinese shares which is good but other drivers are far more significant in the short term.

Fed delaying again and for good reason. After a brief flurry of heightened expectations for another rate hike soon Fed Chair Janet Yellen while upbeat and cautious at the same time described low payroll growth in May as “disappointing” and “concerning” and dropped any reference to raising interest rates "in the coming months". So the prospect of a Fed rate hike in the week ahead looks very low (although maybe not quite the market's assigned probability of zero), the late July meeting looks too soon as there will only be one more monthly payroll report by then so September looks more likely for the next move, but as we have seen for a long time now the Fed has been consistently too hawkish on rates relative to market expectations.

In Australia, the RBA left interest rates on hold at 1.75% as expected, but its failure to reintroduce a comment something like "the low inflation outlook provides scope to ease rates further if necessary" into its post meeting statement coming on the back of diminishing expectations for any imminent Fed rate hike saw the $A briefly push back to $0.75. This undid nearly half of its recent plunge from $US0.78 to a post rate cut low of $US0.7145. Talk of an easing bias is cheap and yet the RBA has made this mistake repeatedly over the last four years which has only served to delay the adjustment in the $A. Is the RBA done? Maybe, but I doubt it given the ongoing downside risks to inflation.

Along with the RBA, the Reserve Banks of New Zealand and India also left interest rates on hold in the past week, but the Korean central bank surprised with a rate cut to 1.25% and maintained an easing bias, indicating that global monetary conditions are still easing.

Which brings me to bond yields. How low can they go? Australian 10 year bond yields this week have hit a new record low of 2.09%. There are two key influences. First, the earlier fall to record low bond yields globally with ongoing delays in Fed tightening impacting more recently.

Locally the plunge in the cash rate is also impacting. Since the ten year bond yield reflects investor expectations of the average cash rate over the next ten years (along with compensation for locking your money away over time) and since such expectations tend to extrapolate current conditions off into the future the longer the cash rate stays low or falls further the greater the risk the bond yield will push into new record low territory catching down to sub 2% bond yields in the US and much lower yields in Germany and Japan. The chart below shows the Australian 10 year bond yield against a 24 month trailing moving average of the cash rate which assumes that the cash rate remains at 1.75% for the next year. This would imply a sub 2% yield for Australian ten year bonds soon.

Of course if global growth improves and deflation risks recede then other factors will impact. So by year end we see bond yields being a bit higher, but the risks are on the downside.

Major global economic events and implications

May US payrolls were disappointing but a new high in job vacancies and very low jobless claims tell us that labour demand remains strong and layoffs remain low.

Eurozone March quarter GDP growth was revised up to 0.6% qoq telling us growth is continuing at a reasonable pace.

Japanese March quarter GDP growth was also revised up slightly to 0.5% qoq from 0.4%, which is good but growth in Japan has been bouncing between negative and positive quarters suggesting it may not be sustained. April machinery orders and May economic sentiment were both weak.

Chinese exports fell 4% year on year in May, which was in line with expectations, but the fall in imports moderated to just -0.4% yoy which is indicative of higher commodity prices and possibly improved domestic demand. Meanwhile, consumer price inflation fell to 2% yoy but producer price deflation continued to abate which is a good sign.

Australian economic events and implications

Australian housing finance commitments fell in April led by a fall in investor finance, suggesting APRA measures continue to bite. Of course this was before the May rate cut. Meanwhile, the MI Inflation Gauge fell in May, indicating disinflationary pressures may be intensifying in the June quarter.

Next week

Craig James, CommSec

Key speech and jobs data to dominate attention

The Australian economic calendar has plenty packed into the four days of the coming week (holidays in most centres on Monday). Of note, the Reserve Bank Deputy Governor delivers a speech on Thursday with employment data out the same day.

The week kicks off on Tuesday with the release of the latest data on credit and debit card lending from the Reserve Bank.

Latest figures show active use of debit cards by consumers in preference to cash-based transactions while credit card debt continues to be pared back.

Also on Tuesday the NAB business survey is released with the weekly consumer confidence data from ANZ and Roy Morgan. In trend terms business conditions are at 8-year highs. And consumer confidence is at the highest levels in 29 months, no doubt underpinned by data showing the strongest economic growth in 3½ years.

And in a packed day on Tuesday, Reserve Bank Assistant Governor (Financial Markets) Guy Debelle delivers remarks to a Hong Kong conference.

On Wednesday, Westpac and the Melbourne Institute release the monthly consumer confidence survey. The actual confidence results are of lesser importance given that the Roy Morgan survey is produced weekly. But additional questions such as “What is the wisest place for new savings?” are of interest. In the last survey, respondents said “pay debt” was the second best place for new savings.

On Thursday, the two highlights of the week are scheduled on the same day. Reserve Bank Deputy Governor – and Governor designate – Philip Lowe, delivers a speech at the Economic Society of Australia Business Lunch in Brisbane. And the May employment data is released.

The May employment data will be closely analysed – and not just job creation and the jobless rate but figures showing the number of hours worked and the participation rate are also super-important.

In April, jobs rose by 10,800 and the jobless rate held steady at a 2½-year low of 5.7 per cent. But hours worked fell by 1.1 per cent in April to be down by 0.5 per cent over the year – the first annual decline in hours worked in almost three years. We expect that jobs grew by around 15,000 in May with the jobless rate little-changed.

Also on Thursday the Bureau of Statistics (ABS) issues the May data on new vehicle registrations. The Federal Chamber of Automotive Industries has already released sales data and this showed that there were 96,672 new cars sold in May. Over the year to May a record 1,172,402 new cars were sold. Annual growth of 4.3 per cent is the strongest in 31 months.

Chinese monthly data and US interest rates in focus

There are some ‘top shelf' indicators to watch in China in the coming week. And in the US, the Federal Reserve hands down its interest rate decision.

The week kicks on Sunday in China with the release of key monthly data – retail sales, production & investment. Australasia will be the first region to respond to the data on Monday morning.

On Tuesday in US the Federal Reserve begins a two-day meeting (decision 4am in Sydney on Thursday morning). The weak jobs data for May suggests that the Fed will do nothing on rates this month. Updated economic forecasts may provide some guidance on the timing of future rate changes.

Also on Tuesday retail sales data is released together with figures on import/export prices, the National Federation of Independent Business business optimism survey and the usual weekly data on chain store sales.

Retail sales may have lifted 0.3 per cent in May, and sales may have been up 0.4 per cent if autos are included.

On Wednesday, industrial production data is released with producer prices, the New York Federal Reserve survey and capital flows data for April. Production may have risen just 0.1 per cent in May after a solid 0.7 per cent gain in April. Producer prices may have risen 0.4 per cent in May but a more benign 0.1 per cent if food and energy are excluded (core measure).

On Thursday, the consumer price index is released with the Philadelphia Federal Reserve survey. Core consumer prices may have lifted 0.2 per cent in May to be up 2.1 per cent on the year. The usual weekly data on new claims for unemployment insurance (jobless claims) is also released.

And on Friday data on housing permits and starts are released. After solid gains in April, relatively flat results are expected in May. Permits may have done best, up around one per cent.

Share market, interest rates, currencies & commodities

In terms of currencies, only 30 of 120 currencies have lifted against the US dollar with around 11 currencies unchanged and 79 currencies lower over the period. Strongest has been the Japanese yen (up 12 per cent) from the Ghana cedi (up 10 per cent) and Iceland krone (up 7 per cent). The Aussie dollar has fallen around 5 per cent against the greenback, putting it in 83rd spot.

In terms of global share markets, it's been a tough 12 months. Only 20 of the 73 global sharemarkets monitored by CommSec have increased so far in 2015/16. Best has been Latvia (up 47 per cent) from Slovakia (up 27 per cent) and Hungary (up 23 per cent).

Australia's All Ordinaries has been flat over 2015/16, ranking it in 21st spot of 73 markets. Ukraine, China, Zimbabwe and Saudi Arabia have been the worst performers.