Ethical funds' surprise wins

Summary: Despite a recent claim that ethical investors are missing out on good returns, responsible funds are outperforming the market. Fund managers are doing deeper research and becoming specialists in some areas. Investors are also focusing on the longer term, in the knowledge that “non-financial” issues such as environmental or community impacts are increasingly affecting companies' financial performance. |

Key take-out: Responsible equities funds have outperformed the market over one year three years, five years, seven years and ten years, according to two studies. |

Key beneficiaries: General investors. Category: Economics and investment strategy. |

Responsible investing has been in the spotlight, after the Australian National University's decision to divest from seven resources stocks that did not meet its ethical criteria. The university blacklisted oil and gas producers Santos and Oil Search, gold miners Newcrest and Independence Group, mineral sands miner Iluka Resources (see Iluka exploits ANU's 'ethical' assault), nickel junior Sirius Resources and copper producer Sandfire Resources. The subsequent commentary surrounding the decision has even included feedback from Prime Minister Tony Abbott. “Any entity which says that they're simply not going to invest in energy companies is frankly depriving its members of the benefit of some very good investments,” Mr Abbott said.

But are investors who “deprive” themselves of fossil fuel investments really suffering?

Performing better, on average

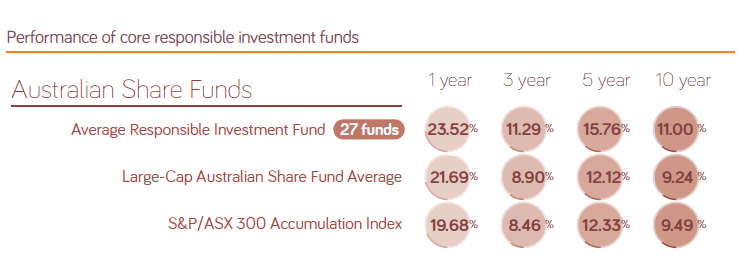

The average responsible Australian equities fund has performed better than the S&P/ASX300 Accumulation Index over time frames of one year, three years, five years and ten years, according to figures from the Responsible Investment Association of Australasia (RIAA) published in July. The average covers data from 27 funds that engage in “core” responsible investing – that is, the funds screen out negative investments, actively include positive investments, invest in sustainability (for example, clean energy and green technology) and engage in corporate advocacy. At the end of 2013, core responsible investment portfolios totalled $25 billion, found the RIAA report. A further $153 billion is invested in “broad” responsible investment – where fund managers may not screen out companies but integrate environmental, social and governance factors into their investment strategies.

Source: Responsible Investment Association of Australasia

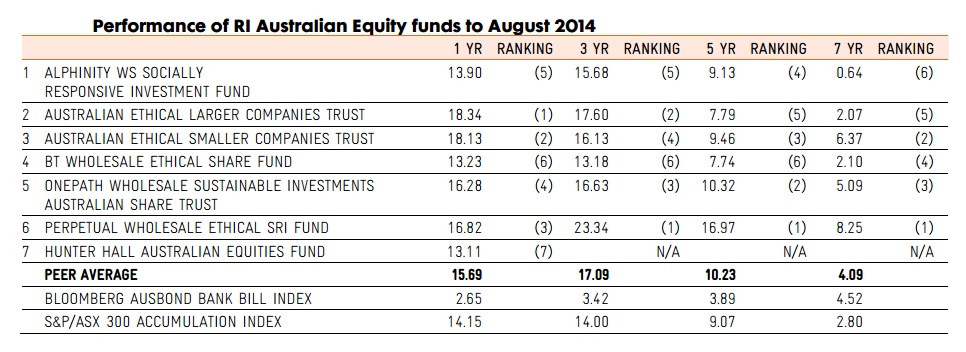

A cynic might suggest the responsible funds have benefited from the slump in commodity prices, or from focusing on higher “quality” companies, which have been in favour since the GFC (see: Six ways to identify quality companies). However, Lonsec research released this week covering seven responsible Australian equity funds generally confirms the RIAA's findings. On average, the responsible funds beat the S&P/ASX300 Accumulation Index over one year, three years, five years and seven years to August 2014, the research found. Lonsec notes that these seven funds approach responsible investing with varied intensity, catering for both “light ethical clients” comfortable holding some resource stocks and “substantial ethical investors” with zero resources tolerance.

Source: Lonsec

At this year's Australian Fund Manager Awards, Australian Ethical Investments won the international equities award, beating funds from Platinum Asset Management and Perennial Investment Partners.

Meanwhile, a September report from the University of Oxford's Smith School of Enterprise and the Environment, titled ‘From the stockholder to the stakeholder: How sustainability can drive financial outperformance', presented the business case for sustainability. Some 80% of the academic studies on the relationship between sustainability and stock prices show that companies' share price performance is positively influenced by good sustainability practices, the report found. Similarly, 88% of the research on the link between sustainability and performance shows solid environmental, social and governance practices result in better company operational performance, while 90% of studies on the cost of capital found that sound sustainability standards lower companies' cost of capital, according to the report.

Doing extra research

Even industry insiders are not 100% sure of the reasons for this outperformance, but it clearly has something to do with the heightened attention to governance and old-fashioned conservative investing. The responsible investment industry has to undertake a broad range of research to make decisions, says RIAA chief executive Simon O'Connor. “They believe there's more that drives investment returns than just what's in the financial reports,” O'Connor says. Analysts consider issues that are termed “non-financial”, such as community, labour force and corporate governance issues. “All of them are doing more investment research for each decision. All of them are looking at more sources of information to inform decisions. This is my best guess about why the results are playing out favourably.”

Australian Ethical chief investment officer David Macri says his funds focus on areas that mainstream fund managers might not. Because they are looking at areas that aren't as heavily researched, there's more scope to outperform, he says. He uses biotech stocks as an example, saying many fund managers deem the sector to be risky and avoid it. “All it requires is just paying some attention to it. Invest some time in learning the space, understanding the technology and the stories – treat it like any other sector and there's massive scope to make money. Because we become the experts, the companies get to know us, we get opportunities beyond a mainstream manager.”

Macri says a focus on smaller cap non-mining stocks has also added value, as the group's ethical charter directs managers to screen out investments that are harmful to the environment and society, as well as to actively invest in companies that create a positive influence. “It does filter the universe quite significantly,” he says, noting the opportunity to become experts in particular fields through recognising issues such as climate change. Australian Ethical started an international equities fund specialising in energy efficiency and renewable energy. “Absolutely we do not sacrifice on returns because we invest ethically,” Macri says.

Focusing on the long term

RIAA's Simon O'Connor says issues that were traditionally seen as “non-financial”, such as companies' environmental or community impact, are increasingly influencing the success of listed companies. These issues are becoming material to company success, for example, in cases where environmental issues can delay resources projects. On the question of climate change, “the economics and the ethics are converging very closely,” O'Connor says. “We see strong ethical arguments about not supporting companies' contributions to climate change. We're also seeing investment arguments showing the economic arguments for supporting thermal coal are getting less compelling.”

A new superannuation fund, Future Super, is attuned to community concerns about coal. Led by former GetUp! director Simon Sheikh, the fund bills itself as Australia's first fossil fuel free super fund. Future Super director James Thier points out that if global warming is to be limited to two degrees Celsius, a substantial amount of existing coal, gas and oil will not be able to be burnt. Thier is a director of CAER, the consultancy currently in focus for providing research to ANU about the ethical standards of companies that the university decided to divest from. “There are assets in the ground that might not be able to be utilised,” Thier says. If these assets can't be dug up and sold, they are worth less than their valuation on the balance sheet, he says. Conversely, he cites renewable energy as a growth area, with wind and solar decreasing in cost and take-up rising. Renewables have been a challenging area for investors here and overseas, and whether Thier and Sheikh can overcome this remains to be seen. The super fund is two months old and does not have any returns to report yet, but Thier says there has been strong interest and growth. “The issue of climate change is a touchstone for a lot of people.”

At Colonial First State Global Asset Management, 86% of the firm's more than 150 funds have performed better than their relevant benchmark over three years, while 90% have outperformed over five years. “A core part of our investment belief is that not managing ESG well will result in inferior performance,” says Pablo Berrutti, head of responsible investment, Asia Pacific at CFSGAM. Poor management of environmental impacts results in a higher cost of capital, while companies with damaged reputations can find it harder to operate in some communities, he says. On the positive side, companies with highly engaged employees tend to perform better, while energy efficiency is a good thing from both environmental and financial perspectives.

Investing for the future

To help financial consumers navigate the many available options, RIAA also offers a certification program covering fund managers, super funds and financial advisers. Simon O'Connor stops short of encouraging investors to divest from all companies with questionable practices. He suggests investors use their votes at company AGMs in favour of stronger ESG performance, or tilt their portfolios to their beliefs by weighting some stocks lower than the index does. But he points out that other responsible investors will prefer funds that exclude resources stocks. “It's important that funds are clear on who they're holding.”

O'Connor also emphasises that responsible investing is “not a fringe thing anymore. It's a benchmark of good investment practice.”

Disclosure: Elizabeth Redman is a superannuation member of Australian Ethical.