ETF Detective: iShares Composite Bond ETF

What is the iShares Composite Bond ETF and what is it invested in?

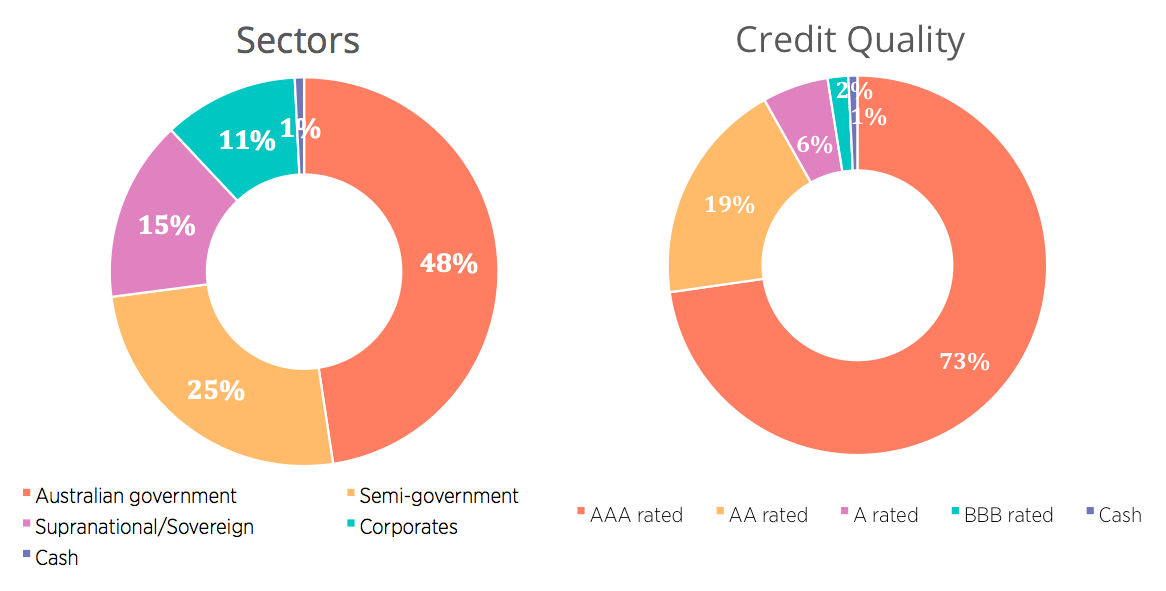

The iShares Composite Bond ETF (ASX Code: IAF) is an exchange traded fund that provides exposure to the Australian bond market. It invests in Australian government bond, semi-government bonds (mostly bonds issued by state governments), supranational and sovereign entities that issue Australian dollar denominated bonds and corporate bonds. The iShares Composite Bond ETF aims to track the Bloomberg AusBond Composite 0 Yr Index.

There are other bond ETFs that provide a similar exposure such as the Vanguard Australian Fixed Interest Index (ASX Code: VAF) and the SPDR S&P/ASX Australian Bond Fund (ASX Code: BOND) (although this one tracks a different benchmark).

The InvestSMART portolios use the iShares Composite Bond ETF as it is one of the more liquid exposures and has competitive fees. Our next choice would be the Vanguard Australian Fixed Interest Index ETF.

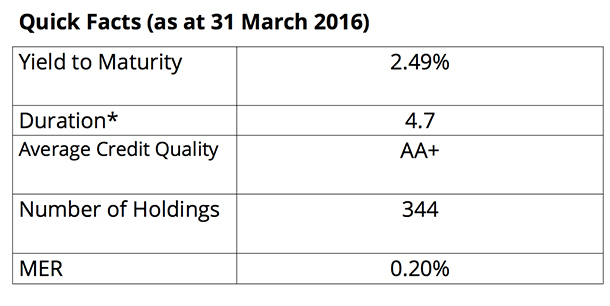

* Duration is a measure of the sensitivity of bond prices to a change in interest rates. Rising interest rates mean falling bond prices and falling interest rates mean rising bond prices. Duration is expressed in years, so a duration of 4.7 years means that if interest rates fell 1% the bond portfolio would rise by about 4.7% and vice versa, if interest rates rose 1% then the bond portfolio would fall by around 4.7%.

Why are the InvestSMART Diversified Portfolios invested in the iShares Composite Bond ETF?

An investor would typically hold an exposure to bonds as part of a broader diversified portfolio for two main reasons:

as a source of income and

to provide diversification against the equity portion of their portfolio

Historically an investor in bonds has been able to have both the benefit of an income producing asset as well as the diversification benefit that goes with holding bonds in a portfolio. However, these days, given that central banks have pushed interest rates down to historical lows, an investor has to choose between holding bonds for diversification purposes or finding higher yields in more risky asset classes.

Is it a good time to buy the iShares Composite Bond ETF?

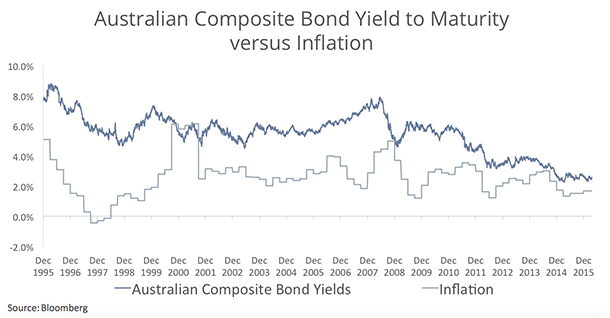

If you take a look at the chart below, for the period from 1995 to 2008 yields from Australian bonds were in the range of 4.5% - 8.5% or around 6% on average over that time period, while inflation averaged around 2.7% over the same period. Investors were being rewarded in real terms, that is they were earning a sufficient return while still maintain the purchasing power of their money over time.

Today, however, the yield you receive from Australian bonds is around 2.5% with inflation hovering around 1.7% at the last print. Given inflation expectations are around 2% and if you assume that the Reserve Bank of Australia continues to maintain its inflation target in the 2% - 3% range than it is quite possible that going forward the income generated from Australian bonds is barely going to keep pace with inflation. Quite a different outcome than what bond investors have experienced over the last 15-20 years.

So if the income I’m likely to generate from a portfolio of Australian bonds (in this case with a large exposure to Australian government and semi-government bonds) is unlikely to generate much of a return above inflation then why hold it? Well for the other reason you hold bonds: diversification.

Does holding the iShares Composite Bond ETF provide diversification?

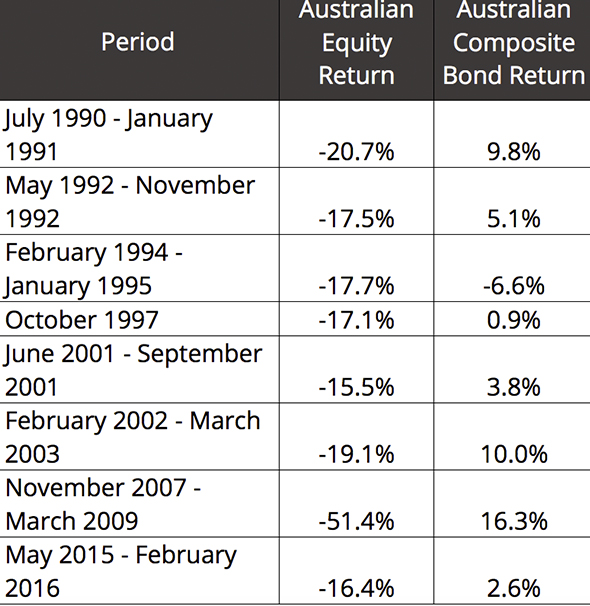

Bonds typically (but not always!) tend to do well in an environment when equities fall as investors tend to flock to the “safety” of government bonds. In addition, central banks tend to lower interest rates in times of economic distress in order to stimulate growth, a fall in interest rates is a positive for bond prices. The chart below outlines the performance of bonds in an environment where equity markets have fallen by 15% or more. Typically bonds have provided positive returns when equity markets have fallen but that doesn’t mean we couldn’t experience a 1994 situation again, especially if central banks raise interest rates beyond market expectations.

Even excluding the prospect that a market shock might occur there might be other scenarios where it still makes sense to hold a portion of your portfolio to defensive low yielding bonds. For instance a scenario where deflationary pressures persist and central banks are unsuccessful in stimulating growth and therefore inflation remains low, then in that environment bonds are still likely to provide you with a real return, albeit at a slimmer margin than they have done so in the past.

It is important to remember that the holding to the iShares Composite Bond ETF forms part of a broader diversified portfolio and acts as a core holding to defensive bonds while other holdings in the portfolio act to generate higher levels of income or growth.

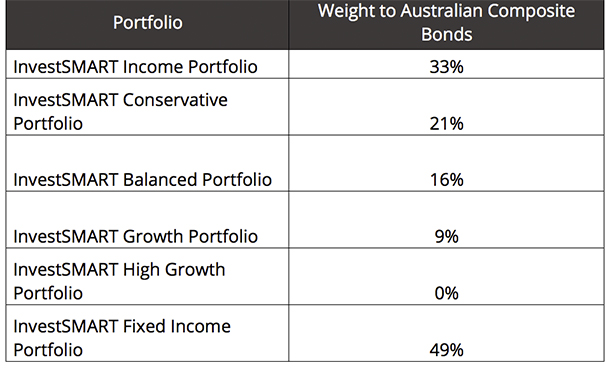

Target Weighting of Australian Composite Bonds in the InvestSMART portfolios (as at 31 March 2015)

Frequently Asked Questions about this Article…

The iShares Composite Bond ETF (ASX Code: IAF) is an exchange traded fund that provides exposure to the Australian bond market. It invests in Australian government bonds, semi-government bonds, supranational and sovereign entities that issue Australian dollar denominated bonds, and corporate bonds. The ETF aims to track the Bloomberg AusBond Composite 0 Yr Index.

The InvestSMART Diversified Portfolio includes the iShares Composite Bond ETF as it offers a source of income and diversification against the equity portion of the portfolio. Bonds have historically provided both income and diversification benefits, although current low interest rates mean investors may need to choose between these benefits.

Investing in the iShares Composite Bond ETF depends on your investment goals. Currently, yields from Australian bonds are around 2.5%, which may barely keep pace with inflation. However, bonds still offer diversification benefits, especially in times of equity market downturns.

The iShares Composite Bond ETF provides diversification as bonds typically perform well when equities fall. In times of economic distress, central banks often lower interest rates, which can positively impact bond prices. This makes bonds a defensive asset in a diversified portfolio.

Alternatives to the iShares Composite Bond ETF include the Vanguard Australian Fixed Interest Index ETF (ASX Code: VAF) and the SPDR S&P/ASX Australian Bond Fund (ASX Code: BOND). These ETFs provide similar exposure to the Australian bond market but may track different benchmarks.

Duration measures the sensitivity of bond prices to changes in interest rates. A duration of 4.7 years means that if interest rates fall by 1%, the bond portfolio would rise by about 4.7%, and vice versa. Understanding duration helps investors assess interest rate risk in their bond investments.

An investor might choose bonds despite low yields for their diversification benefits. Bonds can provide stability in a portfolio, especially during equity market downturns or in scenarios where deflationary pressures persist and central banks struggle to stimulate growth.

The iShares Composite Bond ETF fits into a diversified investment strategy by acting as a core holding of defensive bonds. It provides stability and diversification, while other portfolio holdings aim to generate higher levels of income or growth.