Deleveraging isn't over yet

Commercial lending declined sharply in August and may fall further now that growth has passed its peak. But recent declines in the exchange rate are set to support domestic activity and create an impetus for further investment within the non-mining sector.

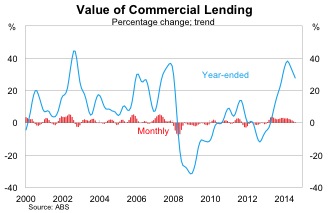

The value of commercial lending continues to show signs of moderation, with seasonally-adjusted estimates declining by 16 per cent in August. That result isn't as bad as it first seems and appears to largely reflect a timing issue, following an unusually strong and temporary pick-up in activity during June and July.

Nevertheless, if we ignore the recent volatility there is clear signs that commercial lending has eased somewhat since earlier this year. The value of monthly activity is now at its lowest level since February and lending appears to have contracted during the September quarter.

At this stage, however, none of this weakness is appearing in the trend estimates, which continue to be supported by the unusually strong results in June and July. On a trend basis, commercial lending rose by only 0.2 per cent in August and should begin to decline over the remainder of this year.

Based on previous episodes, particularly in 2002 and 2007, there is a risk that lending growth could decline sharply now that it has passed its peak. Conditions for the non-mining sector remain difficult and while low interest rates are supporting activity they have yet to result in a sharp rise in non-mining investment.

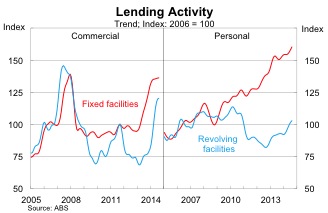

Further complicating matters is the fact that the surge in lending activity has been relatively narrow, with a number of firms remaining cautious and preferring to refinance or pay down existing debt balances. As a result, business credit rose by only 3.4 per cent over the year to August.

The decline in commercial lending in August was driven by an almost 19 per cent fall in lending via fixed facilities; this offset strong growth in July. Revolving facilities -- such as credit card and overdrafts -- also declined by 9.6 per cent in August after falling by 27 per cent in July.

Personal lending has also picked up recently, although as yet hasn't shown up in either retail trade or motor vehicle sales. That could be a sign of weakness -- with households relying increasingly on credit to maintain or increase living standards -- but it's probably too soon to arrive at that conclusion, particularly given the volatility of these data.

On balance, commercial lending activity remains relatively elevated but is clearly not without its risks. Unless the non-mining sector heats up, lending activity will decline over the remainder of this year and continue to ease into next year.

Many businesses continue to deleverage -- which may not be great for near-term activity but remains a smart decision for at-risk firms -- and that partially explains why business credit remains modest. But it is also likely that many small and medium-sized businesses are struggling to get timely and adequate access to credit and that is weighing on both their sales and investment.

For the Australian economy to successfully rebalance we will need to see more momentum among smaller businesses. A key part of the equation is the exchange rate, which has depreciated recently, but will need to fall further to support Australia's export sector and encourage households to shift away from imported goods towards Australian made products.