Coal shoulder: Progress for divestment campaigners

It may seem like a slow build, but the fossil fuel divestment campaign is growing faster than any previous divestment campaign and poses significant risk to coal, oil, and natural gas firms.

These findings come from “Stranded assets and the fossil fuel divestment campaign: what does divestment mean for the valuation of fossil fuel assets,” a new study from the University of Oxford.

Oxford reports 350.org’s fossil fuel divestment campaign is gaining traction faster than previous divestment efforts against Apartheid, tobacco, and pornography, posing a serious reputational risk to the world’s biggest fossil fuel companies.

Small Direct Financial Impact – With One Exception

The report seeks to answer the central question facing fossil fuel divestment campaigners: Can their efforts create a direct impact on some of the world’s richest and most powerful companies?

In terms of pure dollars, the answer is no, not really. Oxford’s researchers concluded that of the $12 trillion in assets among university endowments and public pension funds, the largest potential limit of divestment is between $240-$600 billion, with another $120-$300 billion in debt.

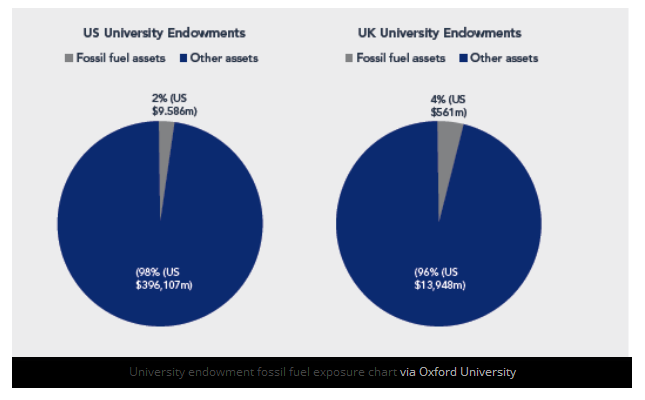

Those figures translate to about 2-3 per cent fossil fuel equity exposure for US university endowments, 4-5 per cent for UK university endowments, and 2-5 per cent of public pension funds. Hence, the recent Aperio Group analysis that found fossil fuel divestment only increases ordinary market risk for higher education by less than 0.01 per cent.

This also means the direct impacts of fossil fuel divestment on equity or debt for fossil fuel companies will be limited at best, and their share prices are “unlikely to suffer precipitous decline” because divested stock will likely find neutral investors.

One exception stands out from this finding – coal. Oxford reasons the devaluations of coal companies will be more substantial because while they only represent a small fraction of overall fossil fuel market capitalisation, they’re much less liquid and alternative investors are less likely to be found than for oil and natural gas stocks.

But Stigmatisation Is A Major Threat To Companies

However, while the direct financial impact of divestment by major investment and pension funds on fossil fuel entities is small, the researchers believe stigmatisation – the potential reputational damage upon targeted companies – can have big financial consequences.

Oxford contends that stigmatisation creates a negative image for firms and scares away suppliers, subcontractors, potential employees, and customers, which in turn leads shareholders to demand management changes and can bar stigmatized firms from competing for new business or completing mergers.

In addition, stigmatisation can lead to restrictive new legislation by governments – a trend found in every existing divestment campaign. For fossil fuel companies, this could translate into a carbon tax or other law that would reduce their corporate valuation, and “a handful of fossil fuel companies are likely to become scapegoats.”

As a result, stigmatisation from divestment has a multiplying effect on the larger campaign, increasing the negative perception of holding investments in target firms and speeding up results of the overall campaign.

Fossil Fuel Divestment Happening Faster Than Ever Before

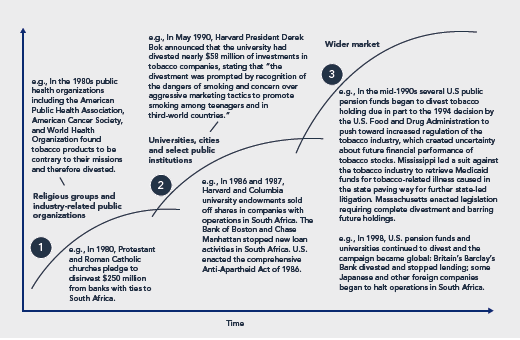

Which all brings us back to 350.org’s fossil fuel divestment campaign. Oxford finds three waves of any divestment campaign: reach religious groups and public organisations; then reach universities, cities, and public institutions; then reach an international market.

Compared to previous campaigns, Oxford concludes 350 is ahead of the typical curve. “From the perspective of the three waves of divestment the fossil fuel campaign has achieved a lot in the relatively short time since it’s inception: 6 colleges and universities…along with 17 cities, 2 counties, 11 religious institutions, 3 foundations, and 2 other institutions,” said report author Ben Caldecott.

But perhaps most significantly, Oxford’s analysis doesn’t fully consider the pending $6 trillion carbon bubble that could lead to rapid devaluation of fossil fuel stocks that could happen if the international community heed’s the IPCC’s carbon budget warning, or if the 60 carbon pricing systems worldwide take hold and force proven assets to stay in the ground, unburned.

Silvio Marcacci is principal at Marcacci Communications, a full-service clean energy and climate-focused public relations company based in Washington DC.

Originally published on CleanTechnica. Republished with permission.