China takes the corporate debt crown

China likes to be the biggest at everything; it has the world’s largest population, soon-to-be the largest economy, the biggest dam, the largest army, and so on. It has just added a new title to its long list of crowns -- the largest corporate debt.

China has more outstanding corporate debt than any other country in the world including the US, according to Standard and Poor’s latest report, Credit Shift: As Global Corporate Borrowers Seek $60 Trillion, Asia Pacific Debt Will Ovetake U.S and Europe Combined. The credit ratings agency estimates total outstanding corporate debt in China at $US14.2 trillion at the end of 2013, compared with $US13.1 trillion for the US.

The country’s debt profile is actually the mirror opposite of the US. The American government and consumers are highly geared, while the corporate sector has gone through painful deleveraging after the global financial crisis. On the other hand, the Chinese central government and consumers are in a relatively robust financial situation, while Chinese companies are the most heavily indebted in the world, says Terry Chan, a Melbourne-based S&P credit analyst.

Like the global shift in economic and military power from the Atlantic to the Asia Pacific region, the centre of gravity for global corporate debt markets will also be shifting to Australia’s neighbourhood. Corporate debt in the region will surpass the combined total of North America and Europe in two years time.

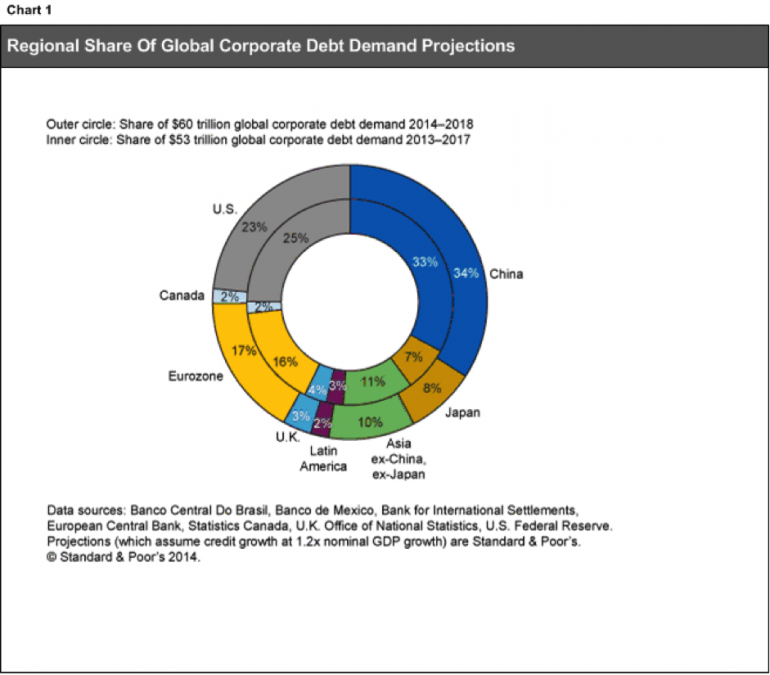

Standard and Poor’s estimates the debt financing need for China will reach a staggering $US20 trillion at the end of 2018, which accounts for a third of the global refinancing and new debt demand that estimated at $US60 trillion.

What does this global shift in the debt market mean?

It means international finance and the debt market is becoming more risky. It's simple: emerging market debts are more risky than debts from developed markets. Chinese corporate issuers will soon account for about 30 per cent of global corporate debt, with an estimated one-quarter to one-third of the total financed by the country’s notorious shadow banking sector.

It means that 10 per cent of global corporate debt is exposed to the opaque Chinese shadow banking sector. This is pretty scary, and the only silver lining to the problem is that Chinese banks are likely to be the largest lender to corporate issuers from China, unlike the subprime mortgage securities that were diced, repackaged and sold around the world prior to the GFC.

We are seeing evidence of a deterioration in Chinese corporate debt over the last few months. The country recently experienced its first ever corporate debt default since the debt market first developed in the 1990s, with solar-panel maker Chaori defaulting on its debt back in March. Shanxi Haixin, one of the country’s largest private steel makers, also failed to honour its loans.

There have been many cases of near defaults on so-called trust products, which are more or less thinly disguised corporate loans to companies. Local government and banks often stepped in at the eleventh hour to rescue the troubled loans.

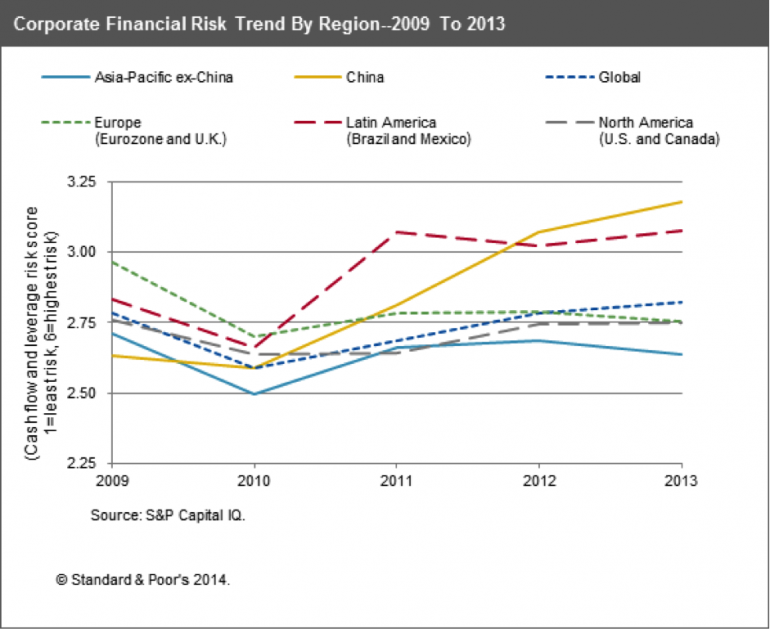

It is interesting to see how the quality of Chinese corporate debt deteriorated considerably between 2009 and 2013, the years following the country’s massive stimulus package that saddled borrowers with excess capacity as well as debts.

Standard and Poor’s uses cash flow and leverage ratios as a proxy for credit risk and ranks the quality of corporate debt from one to six, one being minimal risk and six being highly leveraged. Chinese companies started off in 2009 as the best positioned to service debt and became the most highly leveraged in just four years.

Two sectors -- property and steel -- are in particularly bad shape and these two industries have significant bearing on Australia’s largest export earner -- iron ore. China’s property sector is highly leveraged -- especially for thousands of small to medium sized developers who don’t have easy access to China’s state-owned banks.

The sector suffers from oversupply, especially in third- and fourth-tier cities. The slowdown in the sector is regarded as one of the biggest downside risks to the economy, which would have a flow-on effect on construction steel demand. The price of iron ore has declined 25 per cent so far this year.

With China’s large and still-expanding contribution to global corporate debt, the higher financial risk is causing overall corporate risk to increase globally. As the world’s second largest national economy, any significant reverse for China’s corporate sector could spread to other countries, warns Standard and Poor’s.