Can't buy me business models

John Addis

Can't buy me business models

“Guitar groups are on their way out, Mr Epstein.” With those words, Dick Rowe of Decca Records turned down The Beatles. Well, supposedly. Rowe denied saying them ‘till his last breath, but history charged him anyway.

What few people understand is that Rowe wasn't an outlier. Every major label on both sides of the Atlantic repeated his error, without it making an iota of difference to their long-term wellbeing. Yes, this was indeed a business model made in a sky with diamonds. If you missed a few stars, well, it didn't matter.

For many Londoners, Liverpool remains a distant, provincial city, reached by a nightmarish train trip from Euston to Lime Street. Rowe sent his assistant to The Cavern, who was evidently impressed. Nineteen days later, after a 10-hour drive in a snowstorm, The Beatles auditioned for Decca.

It did not go well. In Anthology, McCartney admits “we weren't that good,” although Lennon, contrary to the last, said, “we were just doing a demo. They should have seen our potential.” Had Liverpool been closer to London, Rowe might have. Instead, he signed The Tremeloes, from Dagenham, Essex – a place not known for its golden silence – a reasonable cab ride east of his Hampstead office.

The Beatles were turned down by six major UK labels, including EMI, before George Martin signed them to EMI-owned Parlophone in ‘62. The story of missed opportunity then made its way across the Atlantic, told in fascinating detail in this Slate Culture Gabfest podcast. Here's the US Billboard Hot 100 chart from April 4, 1964:

No act has ever repeated The Beatles' occupation of the top five spots in the Billboard charts. But check out the column on the far right in the image above. Those five songs were distributed on three different labels, only two of which were owned by EMI's Capitol Records. How so?

Well, Capitol saw the entire UK as a musical backwater. The US had invented rock and roll and the Yanks weren't about to be pushed around by a country that last topped the US charts with Acker Bilk, a trad jazz clarinet player from Somerset that had lost half a finger in a sledging accident.

EMI didn't push it. Instead, it banged on the industry's biggest doors; Atlantic Records, RCA, Columbia and Mercury, all of whom gave the Capitol response. Rowe may have looked stupid for knocking back The Beatles but he was in good company. Only after three independent labels took a subsequently successful flyer on an unknown UK outfit did Capitol capitulate. The result was five songs by the same artist in the same chart, on three separate labels.

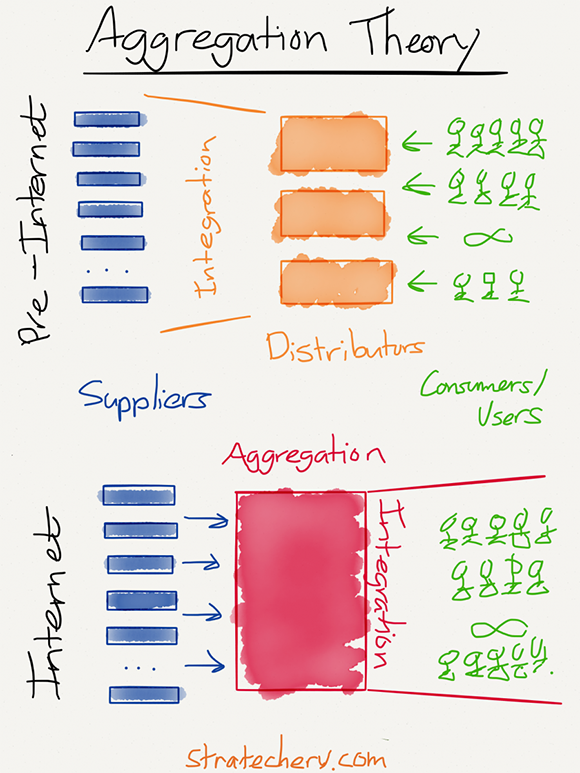

Which makes you wonder, right? Had George Martin not been around, would an entire industry have missed the biggest act of all time? Well, it's possible. This illustration from Ben Thompson of Stratechery explains why:

Prior to the Internet suppliers, distributors and consumers combined to form a typical value chain. For investors, this is a critical model to understand because it shows how a business can capture more of the chain's value.

As Thompson says, “The best way to make outsize profits in any of these markets is to either gain a horizontal monopoly in one of the three parts or to integrate two of the parts such that you have a competitive advantage in delivering a vertical solution. In the pre-Internet era, the latter depended on controlling distribution.”

An example of horizontal integration might be a big bank buying lots of smaller ones in order to control the distribution of mortgages. An example of vertical integration might be a company providing dispatch services to the taxi industry expanding into taxi licences and payments systems.

The beauty of both models is that once you've locked up control of the value chain it doesn't matter what the customer thinks. You can deliver an appalling, over-priced service, as did Cabcharge, for example, and still prosper. As Paul Weller sang in Going Underground, “The public gets what the public wants.”

In the music industry, distribution had been wonderfully integrated with supply through people like Rowe. It was the model that was the haymaker, not a particular band that passed through it. As if to prove the point, a few months after missing out on The Beatles Rowe signed The Rolling Stones.

This long and winding road leads us not to her door but the second part of the diagram. By aggregating customers rather than distributors or suppliers, a dramatic shift in power takes place, from value chain monopolists to their customers. This is a point lost on many investors. Once a product like a music track, book or advertisement can be digitised, the cost of distributing it falls to zero, with transaction costs often not far behind.

Thompson again: “[These factors have] fundamentally changed the plane of competition: no longer do distributors compete based upon exclusive supplier relationships, with consumers/users an afterthought. Instead, suppliers can be aggregated at scale leaving consumers/users as a first order priority.”

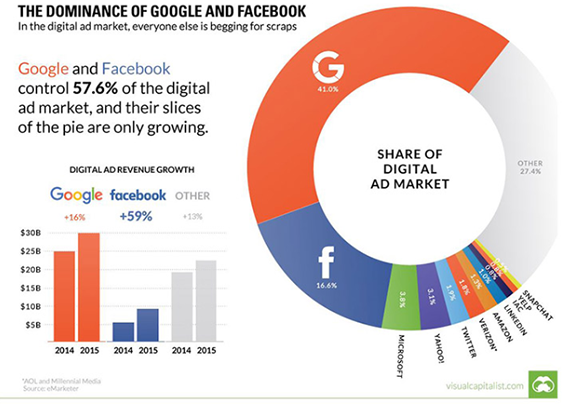

Let's run through a few examples. Newspapers aggregated news, opinion, sports coverage and advertising. Google broke this model by aggregating huge audiences with journalism, permitting searches for individual stories that interested them. Targeted advertising came as a very profitable afterthought. Facebook then took targeted advertising to the next level through people's newsfeed.

Amazon has integrated distribution in books, groceries, video, music and other categories through a vast ecommerce platform with one click payment and fast delivery that attracts vast numbers of users. Its services are so good a major part of its business is now supporting other online retailers. Amazon now accounts for more than half of all online sales growth in the US.

This shift, to a business model that aggregates suppliers and customers by focussing on customer experience, has a number of implications for investors.

First, a focus on customer aggregation has created monopolies the likes of which we have never seen. Amazon controls 50 per cent of the US market for books and accounts for more than half of all online sales growth. Google controls 68 per cent of US online searches (90 per cent in Europe). In the third quarter of 2010, Facebook passed 500 million active users. This year it will surpass two billion. In the last (US) quarter, Netflix added 7.05 million subscribers, beating its own expectations by two million. It now has 100 million paying subscribers while Uber has 40 million monthly active riders.

These businesses are only just getting going, which is my second point. The Internet permits customer aggregation on an unprecedented global scale, allowing giant companies to grow at rates formerly seen only by businesses with much smaller footprints.

Alphabet (formerly Google) recently reported first quarter revenue growth of 22 per cent year-on-year (yoy). Amazon managed a similar figure while Facebook recently announced a 50 per cent yoy increase, similar to that achieved by Alibaba, China's online commerce giant.

These would be impressive figures for much smaller companies. Yet Facebook and Amazon's market cap is now almost $US500 billion, Alphabet's $US690bn, Alibaba's $US390bn and Netflix a mere snip at $US71bn. It really is quite astonishing.

The third point to understand is the virtuous circle established by this new business model. More customers begets more data, which begets better services – think Gmail, Facebook Messenger and Amazon Prime – which begets more customers.

There's likely to be a second-order impact in this regard. Because the new monopolists enhance their market position by doing a better job for their users, the backlashes experienced by old-style monopolists are less likely. If competition regulators try to restrict their market power it is they who might face a backlash, from consumers.

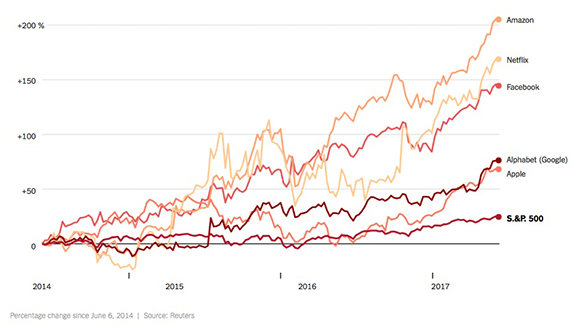

Fourth, only some of the optimism embedded in these market capitalisations has merit. Apple (disclosure: I'm a shareholder), Amazon and Facebook are now so large they account for almost a third of the S&P 500 index (Alphabet is listed on NASDAQ). Here's the chart showing the price rises of major tech stocks over the past few years:

If you're looking to invest in some of the best business models the world has ever seen, well, join the queue. And be prepared to pay a hefty price for the privilege. We're probably going to have to wait for a temporary slip in some of these business to get a chance of a reasonable price (I won't bore you with the multiples, but they're high). In the meantime, local online monopolists like Trade Me still fly under the radar.

Finally, whilst it's tempting to believe these battles have already been fought and won, many industries still operate on the old model of command and control. Think banking, finance, transport, health and energy. The Internet is already having an impact on industries like these but there's a long way to go, which is why understanding aggregation theory is important. Almost every stock in your portfolio is likely to be affected by it one way or another. As Fairfax CEO Greg Hywood, the late Reg Kermode of Cabcharge and Ahmed Fahour, CEO of Australia Post, might admit, it is indeed a Revolution.

That's it. Thanks for your time. I'll wish you a wonderful weekend and let you Get Back to your brekkie.

Coda: Interestingly, the music industry has fared better in the Internet era than newspapers and book publishers. Apple's iTunes aggregated customers by focussing on user experience, as aggregation theory indicates, weakening the label's grip on distribution. But they retained more control over supply. Then, the arrival of streaming services like Spotify, Amazon Music and Tidal opened up more distribution channels, reducing Apple's dominance. It's not as good as it was back in Rowe's day but it could have been worse. Which is to say I might have chosen a better metaphor than the music industry for this piece, but then we wouldn't have had the chance to reminisce about The Beatles, and what could be better than that?

Last week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

- Share markets mostly declined over the last week, albeit modestly except in Australia where worries about the economy weighed particularly on consumer stocks and lower oil prices weighed on energy shares. Chinese shares were an exception and saw strong gains. Bond yields rose slightly in the US but fell elsewhere. Despite falling prices for oil and iron ore and a rise in the $US, the $A surprisingly rose.

- UK election upset – bad for UK, not much impact globally. Not helped by a bunch of missteps and maybe even a Brexit rethink, the Tories did far worse than expected in the UK election. This puts a cloud around Theresa May and is messy for the UK economy and its Brexit negotiations, and hence, is a negative for the British pound and share market. However, the UK is just 2.5 per cent of world GDP and it's hard to see significant implications for global investment markets. Just noise – unless you are in the UK or have a big exposure there!

- Former FBI head James Comey's congressional testimony hasn't changed the risks around President Trump. It really contained nothing new and no “smoking gun”. Democrats may want to see Trump impeached, but it won't have convinced Republicans that he should be, and they have comfortable control of the House of Representatives where impeachment would start. The chance of impeachment is low for now but this may change once the Democrats, as looks likely, get control of the House after the November 2018 midterms. In the meantime, the pressure remains on the Republicans to get the key elements of their agenda – tax reform and tax cuts, deregulation, Obamacare reform – passed before they lose control of Congress. Our base case remains that they will.

- Upside risks to oil and gas prices from a boycott of Qatar and a new flare up of the Iran (Shia)/Saudi (Sunni) tensions are overstated. Tensions erupted in the Middle East between several Arab countries led by Saudi Arabia imposing a boycott on Qatar over the latter's support for extremists and IS (which is Sunni and seen by some as “aligned” to Saudi Arabia) undertaking a terrorist attack in Iran. Putting aside the debate about who is supporting extremists – some say both sides are – the tensions pose some upside risks to oil and gas prices. Qatar accounts for about 1 per cent of world oil production and much more in relation to gas. But both are shipped via sea as opposed to through Saudi Arabia and are so far unaffected by the boycott. Both Iran and Saudi Arabia are big oil producers but unless their supplies are disrupted due to war (which is most unlikely) it's hard to see much impact from Saudi/Iran tensions. In fact, the oil price fell over the last week, due to rising US oil stockpiles. A diplomatic solution is likely around Qatar and the Sunni/Shia conflict will likely just continue to bubble along, without direct Saudi/Iran conflict, but putting upside pressure on oil and gas prices may rise if the boycott does start to affect Qatar's energy exports.

- Australia saw relief over the last week in that the economy did not contract again in the March quarter, as had been feared, allowing the nation to rack up 103 quarters without a recession. All good, but it would be wrong to get too excited. Growth was just 0.3 per cent quarter-on-quarter and annual growth slowed to 1.7 per cent year-on-year, its lowest since the GFC. Yes, bad weather disrupted housing construction and trade and this will pass. But the weather impact on trade will actually worsen in the current quarter resulting in another quarter of poor growth. More fundamentally, consumer spending is heavily constrained by record low wages growth and high levels of underemployment resulting in household disposable income growth of just 1.8 per cent over the last 12 months. This is at a time when the contribution to growth from housing construction and the wealth effect from home price gains are likely to slow. Strong public infrastructure spending, an eventual return to trade contributing to growth, and a lessening in the detraction from mining investment, should all ensure that Australia will avoid a much-predicted recession. However, growth is likely to remain subdued and well below Government and RBA expectations for a return to 3 per cent posing downside risks to the inflation outlook. As a result, we remain of the view that the chance of an interest rate hike any time soon is very low and the probability of another rate cut before year end has pushed up to around 40-50 per cent. Yes, the RBA remains reluctant to cut rates again and showed no signs of an easing bias in its June post-meeting Statement, but then again, it's been a reluctant rate cutter all the way down since 2011. Ideally, given the declining potency of monetary easing, this should be a time for tax cuts and growth enhancing structural reforms like de-regulation but it's hard to see this coming out of Canberra. For investors, all this highlights the desirability of maintaining a decent exposure to global shares relative to Australian shares and doing so on an unhedged basis as rising rates in the US at a time of flat or falling rates in Australia will maintain downwards pressure on the $A.

Major global economic events and implications

- US data remains solid with the May services conditions ISM index remaining strong and job vacancies rising to record levels and unemployment claims remaining ultra-low telling us that the labour market remains very tight.

- As expected, the European Central Bank made no changes to monetary policy. Its risk assessment regarding growth was revised up to balanced but President Draghi remains dovish on the back of underlying inflation remaining well below target. Later this year it may announce a tapering of its quantitative easing program through 2018 but political risk around Italy will make it wary of moving quickly. March quarter Eurozone GDP growth was revised up to 0.6 per cent from 0.5 per cent taking annual growth to 1.9 per cent, reinforcing other indicators pointing to stronger growth.

- Services conditions improved in Japan in May according to the Markit PMI adding to confidence regarding Japanese economic growth. While March quarter GDP growth was revised down to 0.3 per cent quarter-on-quarter from 0.5 per cent, this was due to weaker inventories and is positive for future growth.

- Chinese exports and imports surprised on the upside in May telling us overall economic growth is solid. Chinese CPI inflation rose in May to 1.5 per cent year on year, but producer price inflation fell to 5.5 per cent from 6.4 per cent as the commodity price surge a year ago drops out. No pressure for PBOC tightening here.

Australian economic events and implications

- Apart from news of soft March quarter GDP growth, there was good and bad news on the trade front in Australia. The March quarter current account deficit fell to just 0.7 per cent of GDP, its lowest level since 1979. But as a collapse in the April trade surplus attests, this won't be sustained in the current quarter as coal exports have been hit by Cyclone Debbie and capacity constraints will prevent the disruption being made up for in May and June. As well, and even more fundamentally, iron ore and coal prices are now well off their highs from earlier this year. Meanwhile, ANZ job ads continued to grow in May pointing to continued solid jobs growth for now. However, housing finance fell in April as bank rate hikes and APRA moves reinforced a view that the Sydney and Melbourne property markets have peaked (at least in terms of price growth).

- While the Fair Work Commission announced a 3.3 per cent increase in the minimum wage the impact is likely to be minor. Only 2.3 million workers are on awards and maybe only a few per cent of all workers are on the minimum rate. Australian wages need to accelerate but raising them by decree won't do the job when what's needed is more demand in the economy.

Shane Oliver is head of investment strategy and chief economist at AMP Capital.

Next Week

Craig James, CommSec

Job market and consumer confidence in focus

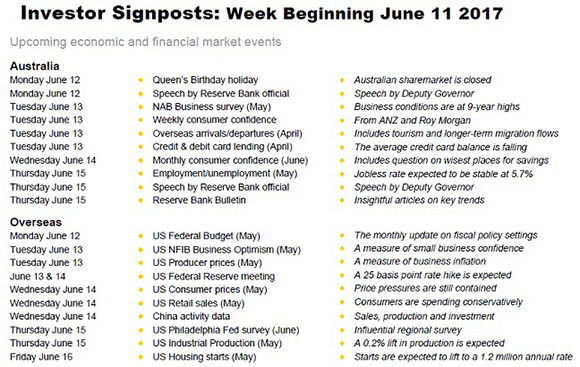

A raft of key indicators is released over the coming week but the spotlight is primarily on the job market and consumer confidence figures.

- In Australia, the week kicks off on Monday with a public holiday in all states and territories except Western Australia and Queensland. But the Reserve Bank Deputy Governor Guy Debelle is scheduled to deliver a speech to the Global FX Code of Conduct Launch in Hong Kong via video link.

- On Tuesday, National Australia Bank releases the monthly business survey while ANZ and Roy Morgan issue weekly consumer confidence figures. And the Australian Bureau of Statistics (ABS) releases the Overseas Arrivals and Departures publication.

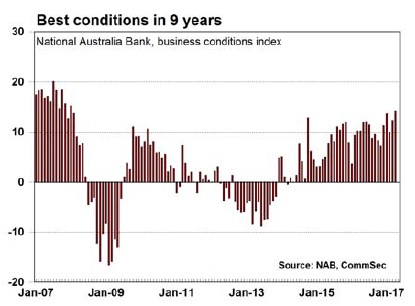

- Aussie businesses are clearly in good shape. The NAB business conditions index rose from 12.3 points to 14.3 points in April, a 9-year high. And the business confidence index rose from 6.5 points to 12.9 points, a 7-year high.

- Even consumer confidence has been improving, hitting an 8-week high in the latest week.

- In terms of the arrivals/departures figures, most interest is in the inflow of Chinese tourists, rising at a double-digit annual rate. And the credit card data should continue the trend of consumers cutting outstanding debt.

- On Wednesday another reading of consumer sentiment is issued – this time the monthly survey conducted by Melbourne Institute and Westpac. The monthly survey is largely a check on the weekly version. The same questions are asked by both surveys and the sample sizes of each survey are broadly the same.

- The main benefit of the June consumer sentiment survey is an additional quarterly question about where consumers believe are the wisest places to put new savings.

- In the March survey “Real Estate” had its lowest ‘favoured' reading on record (since 1973) at 11.6 per cent. Most people favoured putting new savings in the bank as the wisest place for savings (29.0 per cent of respondents).

- On Thursday, the ABS releases the May jobs data. And it will need to be pretty special to top the April figures.

- In April, employment rose by 37,400 in April after rising by 60,000 in March. And the unemployment rate fell from 5.9 per cent to 5.7 per cent. The only glitch was hours worked which fell by 0.3 per cent. But even on this measure, hours worked were up by 1.3 per cent over the year – the strongest annual growth in 11 months.

- The Commonwealth Bank Group is tipping no change in employment in May and no change in the jobless rate.

- Also on Thursday, the Reserve Bank releases its quarterly Bulletin – a report containing articles that provide valuable insights into Reserve Bank thinking on key issues.

- And the Reserve Bank Deputy Governor Guy Debelle delivers another speech on Thursday, this time to the Thomson Reuters industry event in Sydney.

Overseas: US Federal Reserve hogs the limelight

- After an unusually quiet week, the US economic calendar is more congested in the coming week. And on Thursday the monthly download of activity data is released in China.

- The week begins on Monday in the US with the May data on the Federal Budget to be released. The budget deficit has taken a back seat to other issues in recent years but that could all change with flagged tax cuts and infrastructure spending.

- In the US on Tuesday the National Federation of Independent Business (NFIB) issues the May survey of small business sentiment. On the same day the producer price index for May is released while the usual weekly data on chain store sales is also issued.

- The US Federal Reserve also meets over Tuesday and Wednesday with the decision announced at 4.00am AEST on Thursday. Economists are in broad agreement that the Fed will lift rates by a quarter of a percent. But the commentary will be important in guiding future rate expectations.

- In the US on Wednesday the usual weekly data on mortgage applications is released together with data on consumer prices and retail sales for May. The core measure of consumer prices (excludes food and energy) may have risen 0.2 per cent in the month to keep the annual rate stubbornly below 2 per cent.

- Retail sales may have risen 0.2 per cent in May after a solid 0.4 per cent gain in April.

- In China on Wednesday the May data on retail sales, industrial production and investment are released – potentially market-moving for the Aussie dollar.

- On Thursday in the US the usual weekly data on claims for unemployment insurance is released with import/export prices, Philadelphia Federal Reserve survey and production.

- And on Friday in the US, housing starts, capital flows data, consumer sentiment and the NAHB housing market index are scheduled.

Craig James is chief economist at CommSec.

Readings & Viewings

Australian retailers are scared stiff of global retail titan Amazon, and for very good reason. The online juggernaut has just unveiled a new strategy to go after low-income customers.

The bottom line is that traditional retailers are feeling the hurt. Sears and Kmart are the latest.

It seems retail is definitely under attack on every front. Phones chain Verizon is laying off workers as a result of Yahoo.

And now high-end department store Nordstrom is looking at going private.

We've shopped around and found a veteran trend forecaster with more than a couple of reasons for the retail slowdown. Number one, “fashion is old-fashioned”.

Sick of hearing about these category killer companies? Buy yourself a ticket to the new Museum of Failure.

Retailers will also have their eyes on the Federal Reserve Bank next week, which is almost certainly likely to announce another interest rate rise. But the next question is, will China follow suit?

Meanwhile, the Global Financial Crisis was the trigger point for a major overhaul of US financial regulation, with the former Obama administration signing into law the Dodd-Frank Financial Regulations to prevent government-insured banks from making risky bets. But those rules are being repealed.

The GFC is rapidly becoming a distant memory, but financial scams haven't disappeared. A former HSBC currency trader has just been arrested over a £2.7 billion currency scam.

This is almost a banking story. In many respects, the Canadian housing market is a bellwether for Australia. Like ours, its residential property market has been running hot and many have predicted a downturn. Now, it seems Canadians are using their houses as ATMs.

London is pulling out all stops to land the massive Saudi Aramco IPO.

Onto another theme now and, perhaps surprisingly, just seven venture-backed start-ups went public in the US in the first quarter of 2017, down from a peak of 39 three years ago.

Is Silicon Valley slowing? No, it just seems to be loving its FAANGs a little more. There's growing concern it's just for the bros, though.