Build it and growth will come

The bulk of the current debate on housing is about prices, but the main game for the Reserve Bank and the economy more generally is new dwelling construction.

Yesterday’s building approvals figures showed that new dwelling approvals dipped a little in August after a strong rise in July. The monthly series is inherently volatile, which is why the Australian Bureau of Statistics produces a trend series to smooth out the lumps and bumps – and this confirms that the number of dwelling approvals has risen for 19 straight months.

Clearly, new construction is on an upswing, albeit a relatively gentle one.

It is little wonder the share prices for the likes of Boral, Leighton Holdings, Stockland, Devine and others have been moving higher in recent months.*

The importance of a housing construction pick-up over the next few years is vital for several reasons.

As the level of mining investment falls away and leaves a potential pock mark on the pace of economic growth, housing construction needs to take up some of that slack, thereby ensuring bottom line GDP growth is sustained somewhere near the 3 per cent trend.

The minutes from the September meeting of the Reserve Bank board noted that “information from liaison were consistent with further recovery in the established housing market and moderate growth in dwelling investment”. There is no reason to doubt this mildly positive outlook, even with the softer approvals data yesterday. What’s more, in the recent Pre-Election Fiscal and Economic Outlook, Treasury outlined its forecasts for dwelling investment to rise by 5 per cent in 2013-14 and a further 5.5 per cent in 2014-15 (A pre-election budget on the sober side, August 13). If correct, dwelling investment will contribute around 0.25 per cent to bottom line GDP in each year.

Another critical element behind the need for there to be a solid and sustained lift in housing construction is related to demographics. Australia’s population is increasing by around 1 million people every 2.5 or three years through a mix of immigration and natural increase. This is around 400,000 per annum. This means Australia needs to build a lot more houses for these extra people to rent or buy.

Assuming the average size of each household is 2.5 people, this means there has to be a net increase in the housing stock of around 160,000 each year. When knock-downs and rebuilds are added to this, Australia needs to build close to 185,000 dwellings a year to meet ongoing demand. If there is not a construction increase to meet this extra demand, perhaps linked to state or local government zoning laws or infrastructure requirements, and new construction falls short of this, then good, old-fashioned supply shortages will underpin an unwelcome lift in house prices.

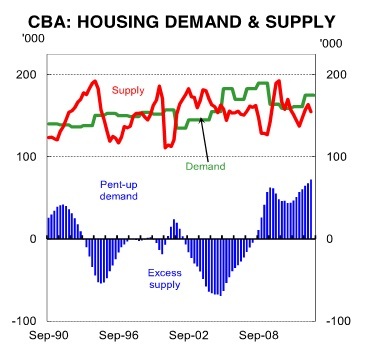

Indeed, a shortage of supply at the moment appears to be a factor driving the recent house price appreciation. The economists at the Commonwealth Bank estimate that there is a shortage of around 75,000 houses and this is rising, based on underlying demand of around 185,000 new houses a year.

Clearly, new supply has to lift to an annualised rate of 200,000 or so for several years to not only satisfy the fresh demand but to clear the pent-up demand from what has been a couple of years of under building. This is around 10 to 15 per cent higher than the level of recent new building approvals which means further momentum in the upswing in construction is likely over the next year to 18 months.

All up, the housing market is responding to easy monetary policy, higher demand and limited supply. Of these three drivers, the only constant is growing demand driven from population growth and other demographic changes. While higher interest rates are likely in 2014, monetary policy will remain on the easy side for some time as the Reserve Bank encourages GDP growth to lift to a 3 per cent and faster growth pace with housing being one of the vital elements of that pace of expansion.

Housing construction activity is set to continue to trend higher which will is exactly what the Reserve Bank and Treasury is hoping and aiming for.

*The author owns shares in Boral.