Blue Sky's liquid alternative

Summary: Blue Sky Alternatives Access Fund uses an LIC structure to provide permanent capital for the manager of private equity-style investments and liquidity for investors. The fund invests in water entitlements, property, private equity and venture capital. The LIC aims for a benchmark of 8 per cent pa and the historical performance of the underlying funds stacks up. |

Key take-out: This LIC offers a diversified portfolio of alternative assets without the usual liquidity risk. |

Key beneficiaries: General investors. Category: LICs. |

It seems each month the LIC space becomes more congested. Right now the flavour of the month is small cap investors with a number just listing and a few more in the pipeline. As the LIC market place gets more crowded it will be those who offer something different and give investors access to something previously inaccessible that will stand out. Blue Sky Alternatives Access Fund Limited (BAF) is doing just that.

History

BAF comes out of Blue Sky Alternative Investments Ltd (BLA), an alternative asset manager established by Mark Sowerby in 2006. Sowerby, originally from a town called Warren in NSW, came to private equity after a background in agribusiness. Blue Sky, based in Brisbane, has grown to a market cap of $355 million and has $1.35 billion in assets under management. The business now has offices in Sydney, Melbourne, Adelaide and New York with 80 staff. Not bad for the boy from a town 120km north-west of Dubbo.

Why the LIC structure suits BAF

BAF pulls together three core components from its selection of unlisted investments into one vehicle anyone can access. Previously only accessible to institutional investors and high net worth individuals, the BAF LIC came about from the desire to allow retail investors to gain access to alternative asset classes.

Another big reason for the LIC's existence is the structure of the financial planning and advice space. With the majority of planners using investment platforms such as BT Wrap and brightday an LIC gives the lucrative advice industry access to Blue Sky's services.

One major issue for investors in this space is liquidity. Private equity and property investment generally is illiquid and this is a daunting prospect but it is a necessary part of the investment. The LIC structure overcomes this issue by allowing for the permanent capital needed for the manager of PE-like investments and the liquidity needed for the investor.

Unique opportunity

What is unique about BAF is it isn't an investment into one alternate asset class. There are other private equity and venture capital LICs out there (Bailador Technology Investments immediately comes to mind). Investing in these you get just private equity and venture capital exposure and the returns tend to be quite lumpy. You can also invest in property through a REIT and then you can look to invest in agriculture through a business like Webster Limited (WBA) or Select Harvest (SHV). With these two companies you are taking on single commodity risk as well, in the form of walnuts and onions for the former and almonds for the latter. No one else is bringing all of this together.

The aim, return profile and asset allocation

The team at BAF aims to hit a set benchmark of 8 per cent pa. To achieve this they will use a combination of funds individually weighted. The portfolio is constructed based on the maturity profile of the investments.

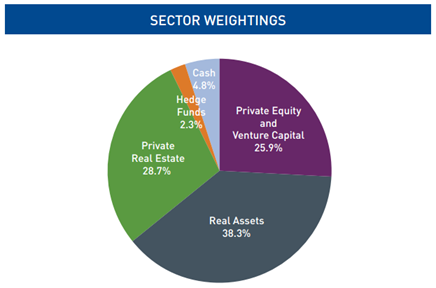

The highest weighted asset in the portfolio is the Water Fund and real assets at 38.3 per cent. These real assets are the most liquid in the portfolio with the team able to redeem units in the fund almost immediately. The property component is the second largest in the LIC at 28.7 per cent. Typically the projects have a two year investment horizon. Private equity and venture capital make up 25.9 per cent and have an investment horizon of approximately four to five years.

The lower the investment horizon the lower the returns but also the lower the risk.

Blue Sky chief investment officer Alex McNab highlights the dividend policy: “The modelling we've done suggests that the fund can support a dividend in the mid-single digits, somewhere between 4 – 6 per cent. What we're going to find is that the cash flow profile could be a little bit lumpy in that if we exit a couple of private equity deals in one quarter than we'll have a lot of cash coming back.”

The likelihood of the extent of that cash coming back to shareholders will depend on the investment environment at the time. “If it was now for example we would be looking to reinvest because we are seeing a lot of interesting opportunities,” he says.

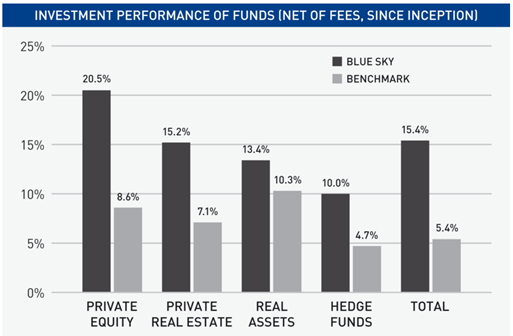

The historical performance of the underlying Blue Sky funds stacks up to suggest the team has in the past been able to meet the and exceed the 8 per cent pa benchmark after fees. It is important to note the private equity returns shown below are an aggregate of Blue Sky's total private equity returns, not just one fund, as a number of the private equity deals were established as single purpose vehicles. Although the inception dates aren't clear all date back prior to 2008.

The investments

The Water Fund

The Water Fund is the largest allocation in the LIC and McNab says this is due to the liquidity – it is also the asset class they have the highest amount of conviction in. In Australia there is a functioning market for water. Water entitlements are pieces of paper that give someone the right to take a certain amount of water out of a river each year in perpetuity. If you don't have one of those entitlements you are not allowed the water. It is highly monitored and regulated. Every pump in the Murray-Darling Basin has a meter on it.

Each year, depending on how much it has rained, the government will declare how much of the water the entitlement holder will receive. In a wet year they might get 100 per cent of face value of the entitlement. In a dry year they might get 5 per cent. Depending on the price of water some farmers will decide it is not worth their while to grow a crop that year due to the expense. They can sell what is called their temporary allocation of that year's water.

Blue Sky makes money by selling their temporary allocation. This provides income. On top of this is the long term capital growth in the value of water, which is determined by the value of crops that are grown with it. “These days farmers don't talk about returns per hectare, they talk about returns per megalitre because water is the limiting factor of production. As you see the price of water go up you start to see farms being converted to low value crops like rice to high value crops like cotton, almonds, citrus where you can make a lot more money per megalitre of water and as that happens is the clearing price for water goes up and up all the time,” McNab says.

There are risks involved in investing in water entitlements. This stuff does just fall from the sky. If there is a year of good rainfall then there will be more water and the price will be lower. But there is risk involved with any investment and the risk of a year of good rainfall is uncorrelated with the risk of a weak stock market.

Regulatory risk is also present. The Murray-Darling Basin scheme was proposed by current Prime Minister Malcolm Turnbull when he was the minister for water and it was legislated when current Minister for Water Resources Barnaby Joyce was shadow minister for water. It was legislated with bipartisan support. BAF is comfortable with the risks around this. McNab also added, “If anyone tries to change it watch how fast South Australia squeals.”

Property portfolio

The property allocation of the portfolio is made up of three parts.

Residential development: This is very much Brisbane focused. This is the city the team is familiar with but also on a relative basis the fundamentals of the Brisbane property market are much more attractive than that of Sydney or Melbourne. These projects are typically projects of approximately 50 apartments with a turnaround period of approximately two years. “We are not doing five year projects here and that helps to control the risk,” McNab says.

Student accommodation: This is very much an unpenetrated market here in Australia. As an example of this in the UK there are 23 beds per 100 students, in Australia it is 8 beds per student. Blue Sky is developing four projects, two in Brisbane, one in Melbourne and one in Adelaide. The key risks associated with these projects are in the construction, selecting the right locations and most importantly the occupancy rate once the doors open.

Commercial and management rights make up a very small portion of the property portfolio as well.

Private equity and venture capital

When it comes to private equity BAF is a growth capital investor. In basic terms the team provide capital to help an already established business with a product and clients grow sales and become scalable. You will not see them buy a business with lots of leverage, put in a new management team and sell it off.

The team members at BAF have specifically been investing in what they call the essentials – businesses people need, not want. This is due to the team's fundamentally weak outlook for the economy. Examples of these are Foundation Early Learning and HPS. Foundation Early Learning is childcare centres across Australia with approximately 20 centres. HPS stands for Hospital Pharmacy Services and is the biggest provider of outsourced pharmacy services to private hospitals in Australia. The exit strategy for both of these will be through either trade sales or IPO.

When it comes to venture capital Blue Sky chooses to sit back and invest in businesses that have reached a certain stage of maturity. By taking this approach they will get fewer deals that deliver them 100 times their money but also a lot fewer that go to zero. Venture capital only makes up 4 per cent of the BAF portfolio currently.

Investment case

This is as close to a pure agriculture play on the thematic of Australia as Asia's food bowl than you can get on the market due to the high allocation to water entitlements. Instead of taking single commodity risk e.g. almonds with Select Harvest or location risk with property you are getting a diversified exposure to Australia's agriculture industry.

Combine the above with the property portfolio returns and the private equity investments – you are getting a truly diversified portfolio of alternative assets without taking the liquidity risk that comes with it. If the alternate asset class is something that is under represented in your portfolio, which the statistics says it is, than BAF is your ticket. The acronym TINA sums it up: when it comes to a listed investment company that combines alternative assets There Is No Alternative other than BAF.