Australia's top 10 apartment spots

|

Summary: Is oversupply overstated? The popular apartments narrative isn't the whole truth, as the data shows there are still demand suburbs with low levels of development in growing economies. |

|

Key take-out: Investors worried about apartment oversupply can look to the data to find Sydney's supply is still in check, and there are very promising pockets in the "oversupplied" markets of Brisbane and Melbourne. Long-term rental demand is strongest in premium inner-city areas and a holiday haven, though the latter might ease on changing conditions. |

With record levels of apartment development in Australia, concerns persist about oversupply. And, while in most markets development is being absorbed by buyers and renters, it’s clear the oversupply of apartments has stifled capital and rental growth in that segment of the market.

Despite this, apartments remain a preferred option for many investors. As is the case with property in general, location plays a major role in determining demand among buyers and renters.

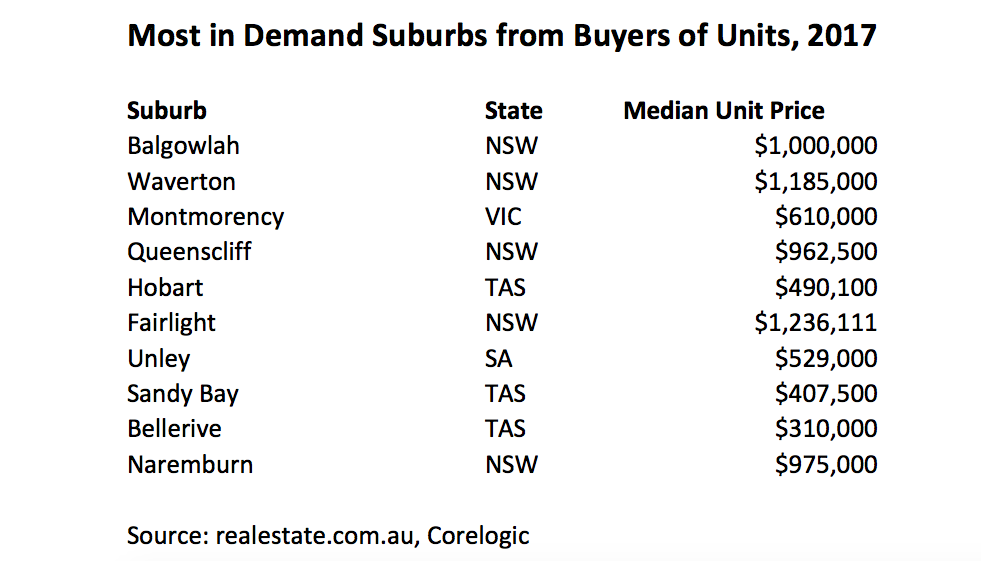

Demand is determined by looking at the number of website visitors looking to buy in a given area and comparing this to the number of local listings. Not surprisingly, suburbs with low levels of development in growth economies tend to see the highest levels of demand.

Sydney dominates

Sydney is the city least likely to be oversupplied for apartments. Indeed, it contains half of the most in-demand suburbs for apartment buyers with areas like the northern beaches and lower north shore dominating activity. Specifically, Balgowlah, Queenscliff and Fairlight make up the top 10 suburbs for investors, while Waverton and Naremburn on the lower north shore also feature. While many Sydney suburbs are perennial favourites, they come with high prices – many at a median of more than $1 million. For newer investors, getting a deposit and loan at this price can be challenging.

Silver linings elsewhere

In contrast, an oversupply of apartments is of greatest concern in Melbourne and Brisbane, where the number of apartments being built has continued to outstrip demand based on the respective population size of each city. In fact, of the two cities in question, only Montmorency features in the top 10 in-demand suburbs nationally. The outer north-eastern Melbourne suburb is a low-density area, however, it appears that its townhouses and apartments are becoming popular with local buyers.

Adelaide suburbs generally don’t feature on high-demand lists. Unley, however, has bucked the trend, for apartments at least. Located directly south of the Adelaide CBD, proximity and lifestyle appear to be a clear attraction for buyers.

Hobart’s (pictured below) relatively small size makes affordability a big driver of demand in Tasmania’s capital.

The cheapest suburb in the nation’s top-10 list of units is Bellerive in Hobart, at a median price of $310,000. While demand is high, the size of the Hobart market coupled with the relatively slow growth of the Tasmanian economy are key considerations for prospective buyers. Nevertheless, right now, demand is strong and it’s supporting price growth. The Hobart CBD and Sandy Bay areas also score a place among the most in-demand markets for apartments.

What about rental demand?

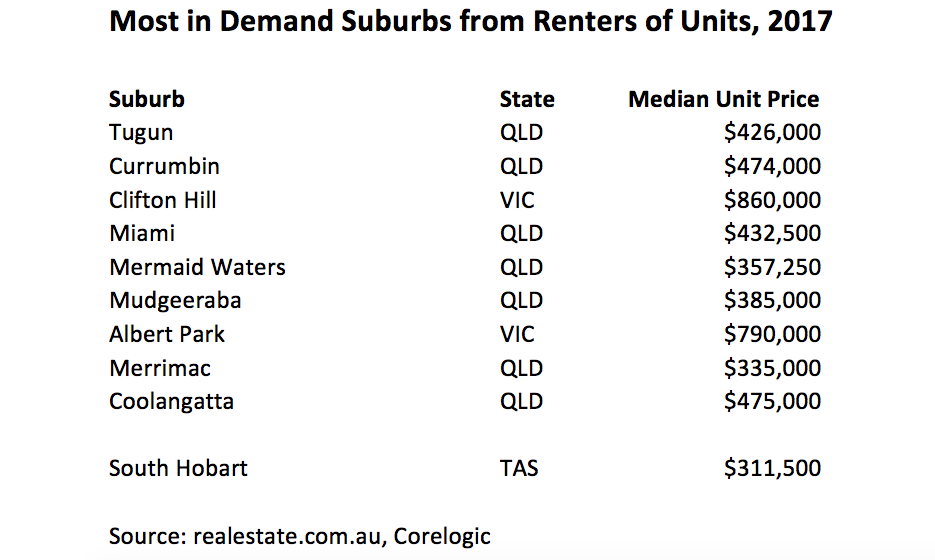

While it’s important to invest in a location where prices are likely to rise, ensuring you have a tenant is also important. Suburbs that are experiencing far stronger rental demand than available properties are generally easier to lease and have more potential for rental growth. They also tend to be at lower price points than the top-buyer suburbs.

One thing to consider is that although these areas are popular with renters, they are not necessarily among the most in-demand for buyers. As a result, future median price growth may not be as strong as properties that rank among the top suburbs for buyers.

The area with the highest rental demand continues to be the Gold Coast (pictured below), accounting for seven of the top 10 most in demand suburbs for renters.

The Gold Coast’s growing popularity reflects the strong jobs growth the region is achieving on the back of the upcoming 2018 Commonwealth Games and associated infrastructure development. A possible risk, however, is that rental demand might come off once the infrastructure is in place and the Games have come and gone. On the positive side, supply levels are not over the top and interstate migration, particularly from New South Wales, is expected to continue.

Outside of the Gold Coast, two Melbourne suburbs rank high among apartment renters. Clifton Hill and Albert Park are premium inner-suburban areas, with neither suburb exposed to much new development and these low supply levels are supporting higher rental demand.

At the cheaper end of the high rental demand list is South Hobart, with a median of just $311,500. Although Tasmania is not a growth economy, very low levels of supply have likely meant that the state is currently undersupplied for housing. This appears to be supporting higher levels of rental demand in inner Hobart.

Finally, a word of caution on relying on median price growth as an indicator of future performance when it comes to the apartment market. Instead, looking at locations where more people are looking to buy or rent, relative to listings, is generally an indicator of good performance compared to low-demand locations.

Although oversupply may be an issue in some parts of Australia, apartments continue to be a good investment in many low-supply areas.