Another RBA warning on housing

The Reserve Bank of Australia (RBA) has weighed in yet again on the introduction of macroprudential policies to slow down lending activity.

In a speech yesterday, the RBA's Head of Financial Stability Luci Ellis -- who has been critical of such intervention in the past -- noted that “risks had been building” and that the RBA and the Australian Prudential Regulation Authority (APRA) are discussing “steps that could be taken to reinforce sound lending practices”.

Only a couple of months ago the RBA derided macroprudential policies as the “latest fad”. Now they seem completely on board, with RBA assistant governor Malcolm Edey last week noting that he expected “an announcement before the end of year”. What prompted the change in direction is unclear but it's a welcome development.

As the centre of the debate is rising speculative activity -- particularly in Melbourne and Sydney -- which currently accounts for almost half of new mortgage lending (The dangers of a wildly imbalanced housing market, September 9). Obviously, according to Ellis, “that can't continue forever”.

But such an outcome was easily predicted and it's a shame that it has taken the RBA so long to recognise the potential risks. Low interest rates have always been associated with a rise in speculative activity and the risk increases further when rates are at a historically low rate. The longer they stay at a low level the more likely that imbalances develop and the greater the risk of a nasty correction.

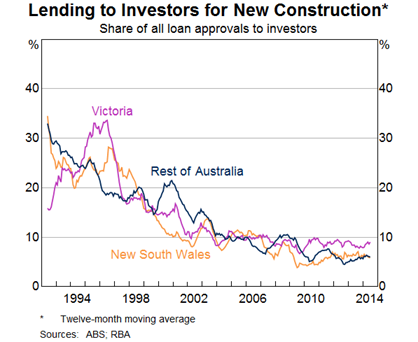

Making matters worse is that a vast majority of investor activity has been unproductive. Less than a tenth of new investor activity has been directed towards increasing the housing stock, with the remainder an investment in existing property.

Given the low rental yields in Australia -- a result of awfully generous negative gearing and capital gains concessions -- few new investors buy existing property for their income flow. As a result, over 90 per cent of investor activity in the property market is speculation; a gamble that prices will continue to rise.

It goes without saying that this is a particularly risky strategy, although one that has proved lucrative in the past. But there is good reason to believe that Australian house prices won't replicate these past gains (Why property is no longer a safe bet, September 10).

Even the RBA governor Glenn Stevens has questioned whether ‘baby boomers' have allocated too much of their wealth to the property sector (Have baby boomers made a big investment mistake?, September 4).

Currently it remains unclear what form these macroprudential policies will take. Based on previous musings by the RBA, they appear to favour increasing the interest rate buffers that banks apply to customers seeking out a loan.

By comparison, other countries have imposed restrictions on the level of loan-to-valuation ratios (LVRs) or house price-to-income ratio. It's not particularly clear where APRA sits on this discussion and ultimately it will be their role to enact and monitor these policies.

But what can we expect from such policies? According to a recent report by the International Monetary Fund (IMF), “empirical studies thus far suggest that limits on loan-to-value and debt-service-to-income ratios have effectively cooled off both house price and credit growth in the short term”.

Restrictions on LVR borrowing in New Zealand has resulted in a noticeable decline in risky lending and house price growth has moderated somewhat – although on the latter it can be difficult to disentangle the effect of macroprudential policies and the impact of interest rate normalisation.

The housing market in England -- which introduced macroprudential policies only a few months ago -- is also showing signs of moderation.

On the basis of that evidence, property investors in Sydney and Melbourne should be getting nervous and new investors may want to be a little more cautious.

However, it's important to note that macroprudential polices are not a panacea for all our property problems. They are not designed to address affordability nor are they necessarily equitable. Addressing housing affordability in the medium-term will require a very different approach to housing by governments at the state and federal level and by our major banks.

It's also worth noting that an overzealous regulator could potentially crash the housing market if they introduce overly harsh macroprudential policies. Given the RBA and APRA have been slow to act and overly cautious, that doesn't seem like it'll be a risk but it is worth keeping in mind.

In my opinion, our regulators have taken too long to act and any attempt to unwind our imbalanced property market will result in prices declining somewhat (though that shouldn't be interpreted as a reason to avoid intervention). The extent to which will largely depend on the economic climate at the time and whether low interest rates can support non-mining investment and employment.

It's hardly ideal for house prices to be falling right now -- not while we face so many other challenges -- but the systemic risks of not doing anything vastly outweigh any short-term pain.