An unhappy new year for the Aussie dollar?

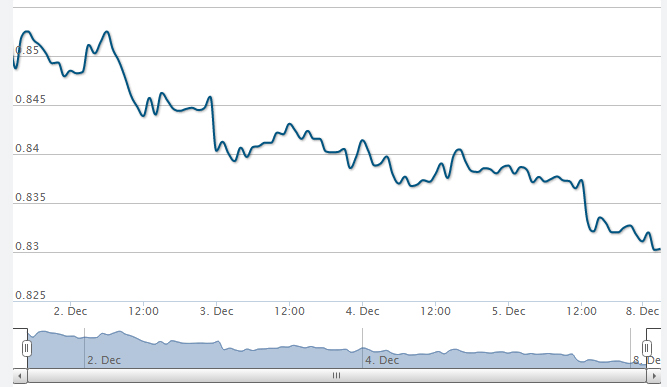

It may not be a happy new year for the Australian dollar as it continues to plunge to fresh lows, heading downwards possibly as low as US80c.

The Aussie plunged 2.3 per cent last week and was second only behind the Japanese yen as the week's biggest loser. We're currently watching support at 0.8250 with big picture losses toward US80c a possibility moving into January.

The Reserve Bank's shift toward a dovish policy stance, falling commodity prices, US dollar strength and a slowdown in overall global growth have conspired to send the Australian dollar lower. We have now lost over 10 cents in the three months since September.

All eyes on China

A softening in Chinese growth exports could leave the Australian dollar particularly susceptible to a further sell off. There's plenty of Chinese data out this week, from trade balance figures to Wednesday's inflation reports and Friday's industrial production numbers. All these should give ample indication as the market looks to gauge the health of China's economy.

Lower oil prices are certainly helping China, however slowing industrial production and fixed asset investment indicate stimulus may be required to avoid a more severe slowdown.

Other influences on the Australian dollar this week include key jobs data on Thursday: employment change and the unemployment rate. The NAB Business Confidence survey will also be of interest, followed by home loans on Wednesday and the Melbourne Institute's inflation expectations on Thursday.

We're seeing resistance for AUD/USD at 0.8479/84, 0.8540/65 and 0.8641/79, with support noted at 0.8307, 0.8066/81 and 0.8008.

Expectations grow for a US rate rise in Q3 2015

The greenback surged to fresh highs Friday as November's non-farm payrolls report showed 321,000 new jobs were added to the economy. The reading is the biggest in almost three years and comfortably surpassed economist's median estimates, which placed monthly job additions at just 230,000.

The report is the latest in a string of positive data sets and adds additional scope to expectations the Federal Reserve will look to raise rates in the third quarter of 2015. With many analysts now expecting the FOMC to adjust terminology and remove the phrase “considerable time” from its interest rate rhetoric at next week's December meeting, the number of long positions will only increase.

In contrast and perhaps highlighting the diverging economic fortunes, the euro suffered the biggest weekly decline since September as ECB officials intimated it may consider broad-based asset purchases in January if its next round of targeted long term refinancing options are not well received when proffered to banks this Thursday.

Having fallen comfortably below previous support at 1.24 the euro touched lows at 1.2270 as attentions turn to investor confidence and German industrial production for more guidance through Monday.

Matt Richardson is Corporate Foreign Exchange Dealer at OzForex, a global supplier of online international payment services and a key provider of Forex news. OzForex Group Limited is a publicly listed entity with shares traded on the Australian Securities Exchange under the code "OFX".