Abbott's Alan Jones script has just been destroyed

The federal government’s hand-picked economic modeller to evaluate the impact of the Renewable Energy Target, ACIL-Allen, has found that a wind-back of the scheme’s target would end up costing electricity consumers money, to the benefit largely of fossil fuel suppliers and generators.

This is even though the modeller was instructed by the government to attribute no monetary value whatsoever to carbon emissions.

Also, the modelling suggests that the renewable energy industry should be able to meet the current level of the target without a blowout in the cost of renewable energy certificates to the price cap.

This result is contrary to the intuition dominating the Coalition backbench but entirely consistent with the findings of several other major Australian energy market modelling analysts – including ROAM Consulting, Sinclair Knight Merz, Intelligent Energy Systems, Schneider Electric and Bloomberg New Energy Finance.

Each of these analysts have independently come to the same conclusion that while there is an extra cost to consumers to subsidise the roughly 20 per cent of their power coming from renewables (additional to levels in 1997), this is more than offset by the extra renewables supply squeezing down prices for the remaining 80 per cent of supply coming from conventional generators.

According to ACIL Allen’s draft findings – presented yesterday to stakeholders and tweeted by Michael Mazengarb (the government has refused to publicly release the presentation) – the nationally average wholesale price of electricity generation is suppressed by around $15 per megawatt-hour as a result of the RET, relative to no scheme at all.

Household consumers consequently end up a net $232 better off by 2030 as a result of the RET, according to ACIL Allen’s draft findings.

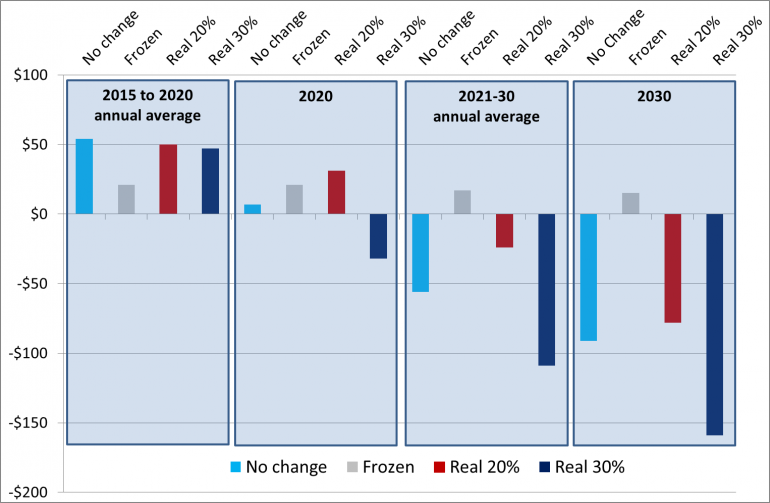

The modeller also examined the electricity bill impact of different alternative targets for the RET over time compared to no target at all, which are detailed in the chart below.

Overall the results suggest that the higher the target the greater the savings to consumers across the period to 2030. Increasing the target such that renewables had 30 per cent share by 2030 (equates to 53,000 gigawatt-hours by 2030) works out the best for household consumers. Freezing the target at the current level of renewable energy supply would keep costs low in the short-term but leave consumers worse off over the longer term, because it means renewables would have little suppressive impact on wholesale electricity market prices.

Annual impact on average household electricity bill of RET under different targets

Source: ACIL Allen draft findings presented to stakeholders on 23 June 2014, obtained via tweets from Michael Mazengarb

Indeed, this freeze scenario probably underestimates the cost to consumers because ACIL has assumed a cost to compensate owners of existing renewables of $40 per renewable energy certificate or LGC. Many of these projects would have been financed on the basis of a much higher certificate value, especially given the abolition of the carbon price, and so costs to compensate would be higher.

If the target was adjusted downwards from its current legislated level to 20 per cent market share in 2020 (‘real 20 per cent’), as is being pushed by incumbent fossil fuel suppliers, it is estimated this would generate a small saving for households in the short-term of $4 per annum over the next five years. But the loss of extra competition that would be added over time in the generation market means that wholesale power prices end up around $7-$8 per megawatt-hour higher under a 'real 20 per cent' scenario versus no change. This means household consumers are better off if the scheme was left unchanged relative to energy suppliers' favoured option.

The net dollar impact on retail prices for trade-exposed heavy industry, taking into account the RET’s suppression of wholesale market prices, is not explicitly spelled out in the modeller's presentation. Yet based on other data provided by the modeller, it suggests the trade competitiveness of electricity intensive industry would be enhanced by the RET.

Below is a picture taken of ACIL Allen’s slide illustrating RET costs as component of retail price paid by typical heavy industry, such as an oil refinery, cement plant or Aluminium smelter (apologies for its poor quality but, as mentioned above, government wouldn’t supply the original presentation). It shows that the extra renewables subsidy costs paid by industry would peak at about 6 per cent on a power price of approximately 7 cents per kilowatt-hour, or 0.42 cents.

Meanwhile, ACIL Allen has said the RET is likely to suppress wholesale power prices in the east coast National Electricity Market by about 1 cent per kWh and 1.5 cents on average across Australia. So overall they end up with a two-to-one financial gain.

Cost of RET subsidy relative to overall retail electricity price paid by energy-intensive, trade exposed industry

Source: ACIL Allen draft findings presented to stakeholders on 23 June 2014, obtained via tweets from Michael Mazengarb