A market booster in the wings

Summary: Shares around the world have taken a hit of late, particularly in the Australian market where they have dived 7% to their lowest levels since February. But with the US economy creating the biggest number of jobs per month in 14 years and influential figures in the US Federal Reserve urging patience on their tightening policy, investors shouldn’t be concerned. |

Key take-out: Against the powerful combination of strong growth in the US and a more dovish US Federal Reserve, the current downturn in the market will most likely be temporary. While timing is uncertain, investors should expect a recovery in late 2014 to early 2015. |

Key beneficiaries: General investors. Category: Shares. |

I realise stocks are taking a pounding at the moment, the Aussie market in particular, with the All Ordinaries index down 7% over the past month as I write. As I described in an earlier article, such a fall verges on a market correction (though there is no precise definition).

Yet I still don’t think investors should be alarmed by this. Amidst all the pessimistic rhetoric, notably from the International Monetary Fund (IMF) last night as it cut growth forecasts for the third year in a row, the data is still showing why the bull run has long way to go still.

The US economy especially is at an interesting juncture. Clearly economic growth is performing well and much better than expectations. The latest estimate of GDP, for instance, showed that the economy expanded by 4.6% in the June quarter.

Now admittedly that follows a fall of 2.1% in the March quarter but, as I highlighted last month, it would be a mistake to regard the June result as merely a rebound. It’s more the case that the strong growth momentum was interrupted by severe weather. Now that has abated the momentum has returned.

With that in mind, last Friday’s payrolls are less of a surprise. The economy is surging and strong jobs growth is merely one more symptom. Just how strong that jobs growth has been stands as a testament to the strong momentum the economy actually has. It’s incredible.

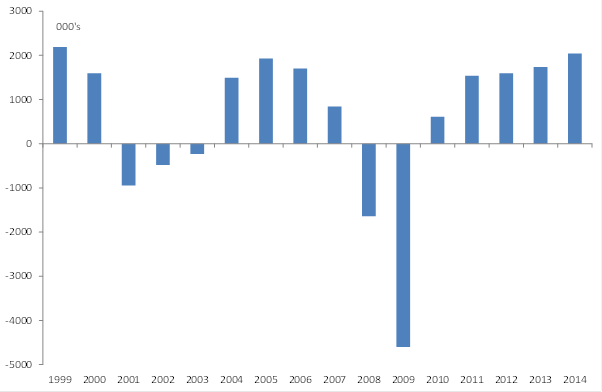

Following the 248,000 jobs that were created in August, the US economy has produced over two million jobs this year. That’s 227,000 per month, which is the strongest result since 1999 and even stronger than anything we saw through the noughties – especially the pre-GFC boom years.

The unemployment rate for its part is at its lowest since 2008 and is already very close to meeting the US Federal Reserve’s end-year 2015 forecasts.

Chart 1: Strongest jobs growth in 14 years

Now that by itself is all very positive for the global equities environment – it is a key reason why I am still bullish and why I don’t think investors should worry about the current price action.

It’s not the only reason though and, increasingly, I think there is another factor that will act to support equities later this year and early next year. The Fed is actually becoming more dovish!

We’ll obviously find out more this week: the Fed minutes are released and a large number of Fed officials are speaking. As it stands now the more senior and influential voters (on the Fed Committee) are urging patience in tightening (scaling back bond purchases).

For instance, recent comments from William Dudley, the vice chair of the Federal Reserve Open Markets Committee and the president of the Federal Reserve Bank of New York, are particularly important in that regard. Dudley and the US Fed chair, Janet Yellen, would be of one mind on policy and it’s highly unlikely the rest of the committee as a majority would ever vote against the Chair and Vice chair.

Dudley, noting that there are ‘dissenters’ on the committee, stated: “Right now with inflation running below 2%, we really need the economy to run a little hot for at least some period of time to actually push inflation back up to our objective.”

These comments have been backed by two other Fed presidents recently from the Minneapolis and Chicago Federal Reserve banks. The Chicago Fed president, Charles Evans, argued that “we should be exceptionally patient in adjusting the stance of US monetary policy, even to the point of allowing a modest overshooting of our inflation target to appropriately balance the risks to our policy objectives.”

The Minneapolis Fed president, Narayana Kocherlakota, added to that: “There is no harm in having low unemployment in the country except in so far as that generates wage pressures and that shows up in inflation. But I don’t see that in my inflation outlook.”

With the way things stand now, there is very little risk of inflation – that is consumer inflation – overshooting. Recent inflation outcomes have actually moderated slightly, and that’s before the maximum impact of the surging US dollar and slumping commodity prices, crude oil in particular. Falling oil prices have caused an 8% drop in US petrol prices in recent months: US gasoline now at US91 cents per litre from a peak of nearly $US1 per litre in May.

That’s a powerful disinflationary combination right there: a strong US Dollar and falling crude prices. Logically, it could see inflation soften quite substantially over the coming months and that is in fact my expectation.

In fact, it’s already moderating. The Fed’s preferred measure of inflation, the core PCE deflation, slipped to 1.5% in August from 1.6% the month prior and a peak of 1.7% in May. Back then the annualised (three-month average) pace of inflation was 2.4%, which is over the Fed’s comfort zone. That’s now dropped down to 1.2%, coinciding with the spike in the US dollar.

On top of that, the Fed has also downplayed the fall in the unemployment rate more generally and has noted instead that measures of underutilisation show unemployment rates between 7 and 12% – a clear signal that it’s unlikely the Fed will hike soon.

The above two facts – strong growth and a more dovish Fed – make for a powerful combination. Against that backdrop stocks will most likely turn. While I don’t know when that will be exactly, I suspect it will be late 2014 to early 2015. But much will depend on how quickly the market reacts to the changing Fed rhetoric.