A deficit debate that's all out of whack

I interrupt my series on the instability of capitalism for a special report on the serious problem of Australia’s budget deficit. As everyone knows, the world will end tomorrow unless Australia’s government plugs its $12 billion 'budget black hole'.

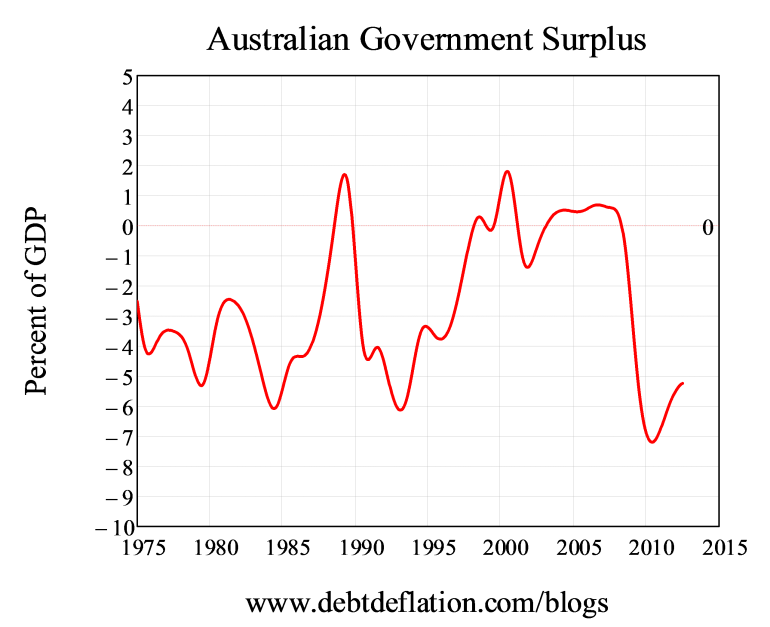

And I have proof! After all, we have 40 years of data showing the ratio of the budget deficit (and sometimes surplus) to GDP. Let's see how the current deficit compares to other years since 1975. And look, it's one of the worst ever!

Figure 1: Budget position as percent of GDP since 1975

Okay, now that I've done my bit for hysteria, let's take another look at that same data. It covers an almost 40-year history of the Australian economy, mixed with a 40-year history of the bluster of Australian politicians, with each side praising its budget management skills and rubbishing those of its opponents.

What if the truth, as opposed to the bluster, is that the economy controls the politicians far more than they control the economy – despite their competitive ‘my surplus is bigger than your surplus’ rhetoric?

After all, the revenue side of the government’s balance sheet reflects current taxes as applied to current incomes, and the ups and downs of the latter act with far more speed than the government changes gears (let alone drivers). So revenue is largely out of government control.

Ditto the expenditure side. The government can do things like slash spending on universities by $3 billion this year, but it can't abolish universities completely (though it might feel that way sometimes) to balance the budget. Equally it can fiddle pensions, Medicare levies and unemployment benefits, but it's still tinkering at the edges: the vast majority of government spending is locked in, and influenced again primarily by the ups and downs of the economy.

That’s not to say that discretionary government policy can’t have an impact on economic performance. Clearly it can, as the tragic situation in Europe shows: the single-minded obsession with reducing government deficits via savage austerity has made Europe’s downturn worse than what it experienced during the Great Depression. What I’m considering here is the average impact of government policy over the very long term, including periods of booms, bust, and the occasional period of tranquillity.

The one thing that the government can do over that longer-term perspective is bias the direction of spending one way or the other against the trend that the economy pushes back onto it. For the last 40 years, with the sole exception of the Rudd government during the GFC (global financial crisis for non-Australian readers), the shared fetish of our political parties has been with achieving surpluses, not deficits (the opposite could be said to have applied in the post-WWII years until the early 70s, with the Whitlam government being its last gasp).

The probable aggregate causation is thus something like 90 per cent or more of the budget position reflects the economy’s impact on the government, while 10 per cent of less represents the impact of the government’s deliberate decisions to attempt to achieve a surplus.

This gives us a way to interpret the average budget deficit over the last 40 years: it irons out both political parties (now there's an attractive thought), and pretty much tells us what the economy needs the government to do – not vice versa (apart from the impact of the single-minded emphasis upon running surpluses since the 'Dark Days' of the Whitlam era).

Secondly, even critics like me have to admit that the last 40 years have on average delivered good outcomes in the Australian economy – nowhere near as good as in the 50s and 60s mind you, but better than most of the OECD.

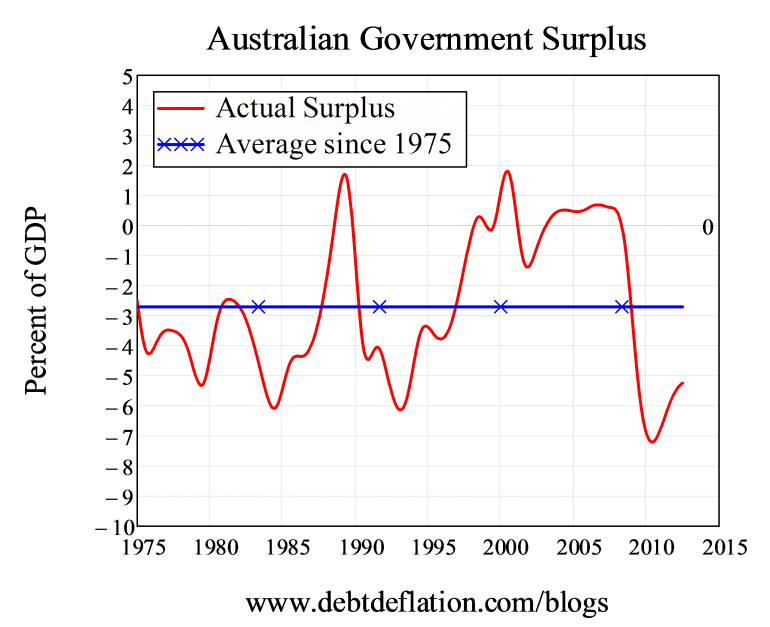

So since the economy drives the budget rather than vice versa, what does the data tell us is the economy's 'preferred' level of the budget deficit?

It's 2.7 per cent: for the last 38 years, the average budget deficit has been 2.7 per cent of GDP.

Figure 2: Actual and average budget position since 1975

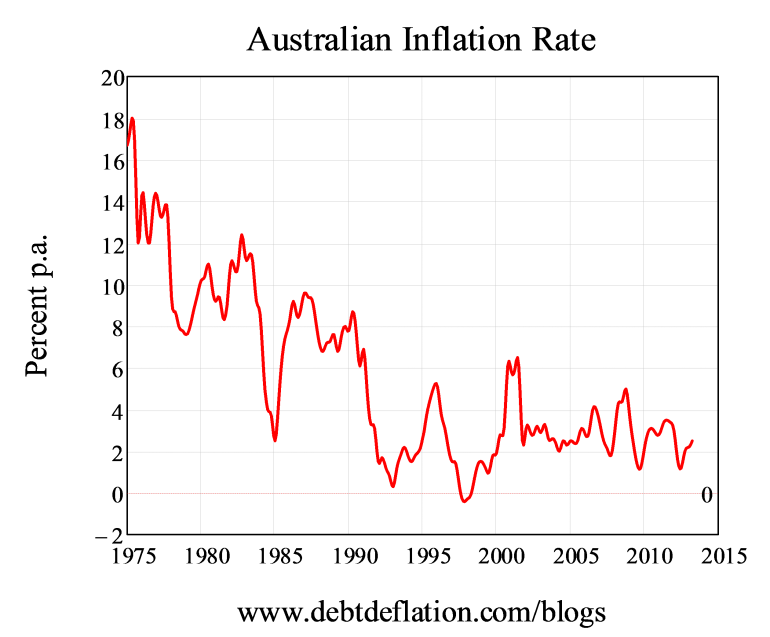

Has the sky fallen in as a result – or rather has inflation skyrocketed, since that’s one of the alleged impacts of a government that continually runs budget deficits?

Figure 3: Australian Inflation Rate Since 1975

Whoops… Apparently not. And obviously we can reject the ‘budget deficits will cause your currency to depreciate’ argument in Australia’s case. So at best a deficit of the order of that currently being contemplated by the Gillard government of about 1.5 to 2 per cent of GDP is no big deal.

Now let’s put hysteria to one side for the moment and think: why might an economy function very well with a deficit that, on average, equals almost 3 per cent of GDP?

This data goes against the mantra that dominates both political parties in Australia – and most of their counterparts in the rest of the world for that matter – that a government should ‘balance its books, just like a household’. But can this really be true, given that the country that portrays itself – and is currently seen – as the best-managed fiscally in the world can’t achieve balance?

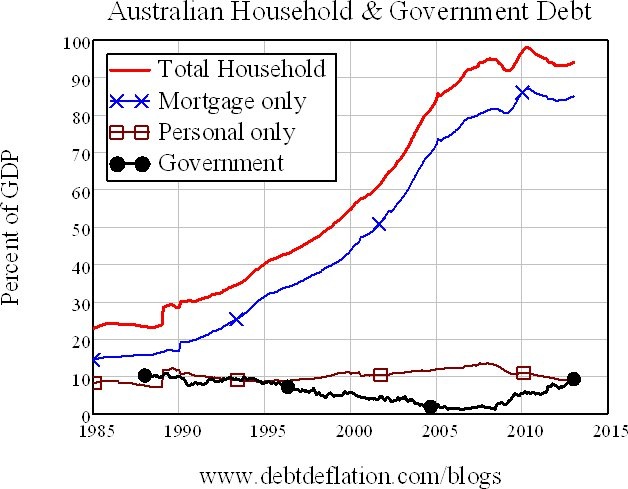

For a start, the ‘governments should be as responsible as households’ mantra is a farce: if governments really did that, we’d now be embarking on the biggest debt-financed spending spree ever. Australian households in particular have resorted to debt finance far more so than their government. Even after the Rudd stimulus and subsequent deficits, Australian government debt has only just exceeded household non-mortgage debt, and it is only slightly more than 10 per cent of total household debt.

So let’s forget the 'the government should balance its books like a household' nonsense. This data instead suggests that the average target for government shouldn’t be a deficit of zero, but a deficit of about 3 per cent of GDP – roughly equal to the average rate of economic growth for the post-WWII period. The deficit would be smaller when the economy was booming – and would possibly be a surplus during extreme booms – and larger when it was growing well below trend.

Figure 4: Australian household debt far exceeds government debt

That would not result in a household-sector-like blowout in debt, but in a level of government debt which was relatively constant compared to GDP – versus the obsession both parties have with getting that debt to zero.

If 3 per cent is the proper goal for a government deficit during times of tranquil growth, then the current expected deficit in the order of $25 billion – or roughly 1.7 per cent of GDP – is the sort of target you’d set during a boom, when you were trying to restrain private demand.

Not even the bulls believe we’re in a boom anymore, so the current level of the government deficit is probably less than the economy is currently ordering. Its impact is likely to put a further drag on growth – and, if the usual post-election farce occurs, sharp “the deficit is worse than we thought” cuts may well amplify the downturn. Welcome to political anorexia, brought to you by bad, anti-empirical economics.