A case for diversification in three charts

You have $1,000,000 in ASX 200 stocks. You are drawing $60,000 a year to meet your living expenses. To remain level your portfolio needs to generate you a 6% return per year (not taking into consideration running costs of your portfolio). There’s a correction, the market drops 10% in two weeks. You now have $900,000. To cover your $60,000 a year you now need a return of 7%. Things just got a little harder.

Predicting corrections in the stock market or any other market is near impossible. There are plenty of talking heads, articles and blogs offering opinions on the outlook for markets. The issue is we don’t know who to listen to until after the fact and markets rarely react when they should. If we pay less attention to forecasts and more attention to history and facts it is difficult to go past studies on diversification.

Being prepared for the unpredictable means accepting it is going to happen and being adequately diversified for when it does.

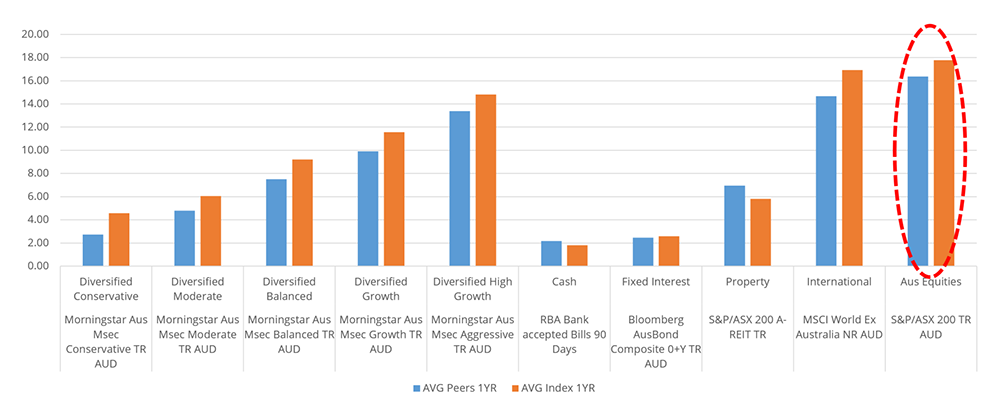

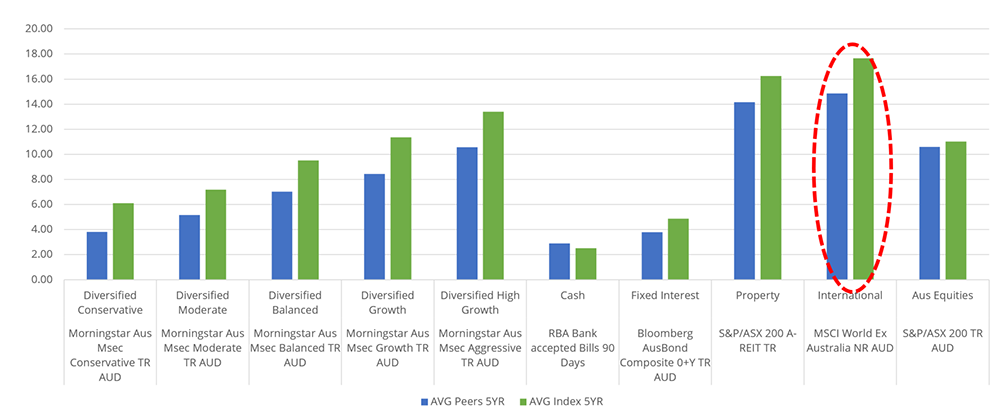

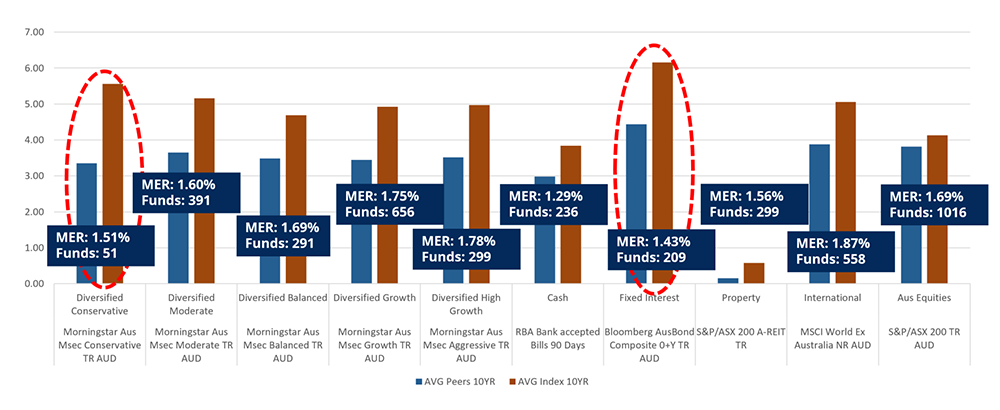

The charts below show the returns of the major asset classes across one year, five years and ten years. Over the course of individual years’ different asset classes perform better than others. The tough thing is predicting which one will outperform and when.

What we see happen is individual investors chasing returns. Funds flow from poor performing asset classes into the asset classes that have performed well. This is the best way to achieve a poor return as investors are moving to where yesterday’s returns were, not tomorrows.

Avoid the temptation to predict markets and chase returns by investing in a diversified portfolio. As the ten-year charts show you, the multi-asset class portfolios in the long term smooth out your returns with far less heartache. If you also choose a low fee, index approach you can maximise the funds you invest by paying fund managers less and paying fewer transaction costs leaving you with more funds to compound over time.

Let the noise makers give someone else a headache and keep funds in your own account and not in the pockets of fund managers and brokers. Now get on with your life, let your portfolio remain stable as others panic and focus on the things that matter.

Frequently Asked Questions about this Article…

Diversification is crucial because it helps manage risk by spreading investments across various asset classes. This strategy can smooth out returns over time, reducing the impact of market volatility and making it easier to achieve long-term financial goals.

You can achieve diversification by investing in a mix of asset classes such as stocks, bonds, and real estate. Consider using low-fee index funds to maximize your investment and minimize costs, allowing your money to compound over time.

During a market correction, it's important to stay calm and avoid making impulsive decisions. Instead of chasing returns, focus on maintaining a diversified portfolio that can withstand market fluctuations and continue to meet your financial needs.

Predicting market corrections is challenging because markets are influenced by numerous unpredictable factors. Many opinions and forecasts exist, but it's often unclear who to trust until after the fact. Focusing on diversification and historical data can be more reliable.

Chasing returns can lead to poor investment outcomes because it often involves moving funds into asset classes that have already performed well, rather than those poised for future growth. A diversified portfolio helps avoid this pitfall by balancing risk and return.

A low-fee, index-based approach minimizes costs associated with fund managers and transactions, allowing more of your money to stay invested. This strategy can enhance compounding over time, leading to potentially higher long-term returns.

To stay focused during market volatility, concentrate on your long-term financial goals and maintain a diversified portfolio. Avoid getting distracted by market noise and predictions, and trust in your investment strategy to weather the ups and downs.

Historical data provides insights into how different asset classes have performed over time, helping investors make informed decisions. While past performance isn't a guarantee of future results, it can guide diversification strategies and risk management.