InvestSMART International

Portfolio

Access globally known brands & mega cap companies like Apple, Microsoft and Amazon at a low cost.

Why invest in the InvestSMART

International Equities Portfolio?

International Equities Portfolio?

Australia represents less than 2% of the world’s share market value and 50% of our market is made up of 20 companies which are heavily concentrated in the financial and resources sectors. As a result, many Australian investors hold portfolios that are not well-diversified.

The International Portfolio is invested in a blend of our 5 – 15 preferred Exchange Traded Funds (ETFs), where each ETF invests in a different market sector to the others, thereby lowering volatility, minimising overall risk, and increasing the potential for long-term growth.

With InvestSMART’s International Equities Portfolio it has never been easier to own a professionally managed portfolio of international exchange traded funds to diversify your portfolio and access global shares and mega cap companies like Apple, Microsoft, Amazon and Tencent.

Benefits of investing in this portfolio:

•

Professionally managed portfolio of international ETFs

•

Low management fees of 0.55% per year of your investment amount and capped at $880 per year no matter your investment size*

•

Online reporting and end of year tax reporting

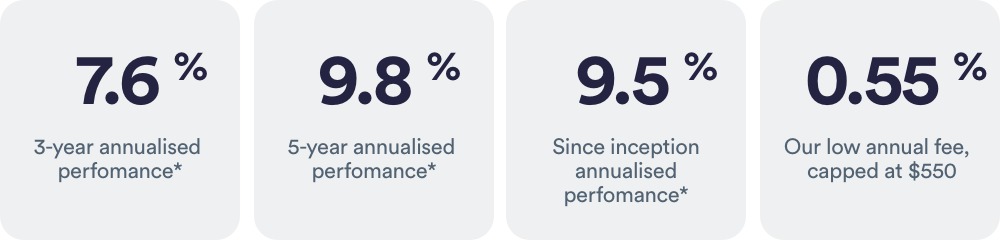

Performance# to 31 Aug 2022

| 1 yr | 3 yr | 5 yr | SI p.a. | |

| Capital Return | -11.32% | 5.55% | 7.56% | 7.56% |

| Income Return | 1.60% | 2.06% | 2.20% | 1.89% |

| Total Return | -9.72% | 7.61% | 9.76% | 9.45% |

| Average of 1048 peer funds^ | -12.83% | 5.44% | 8.23% | 9.00% |

| Excess to Peers | 3.11% | 2.17% | 1.53% | 0.45% |

| Note: Past performance is not a reliable indicator of future performance. | ||||

Top Holdings

| iShares Core S&P 500 ETF | 38.19% |

| iShares Asia 50 ETF | 7.80% |

| Apple Inc | 1.96% |

| Microsoft Corp | 1.60% |

| Amazon.com Inc | 0.85% |

| Alphabet Inc Class A | 0.58% |

| Alphabet Inc Class C | 0.54% |

| Tesla Inc | 0.52% |

| UnitedHealth Group Inc | 0.42% |

| Johnson & Johnson | 0.41% |

Offer: 3 complimentary coupons to InvestSMART Bootcamp if you invest during the offer period+

| Offer opens | Monday 19 September 2022 |

| Offer closes | Friday 30 September 2022 |

| Minimum Investment amount | $10,000 |

| Brokerage cost | Greater of $4.40 per trade or 0.044% per trade per security |

Capped management fees*

| Amount invested | Our capped fees |

|---|---|

| $0 to $100,000 | 0.55% p.a. |

| $100,000+ | $880 p.a. |

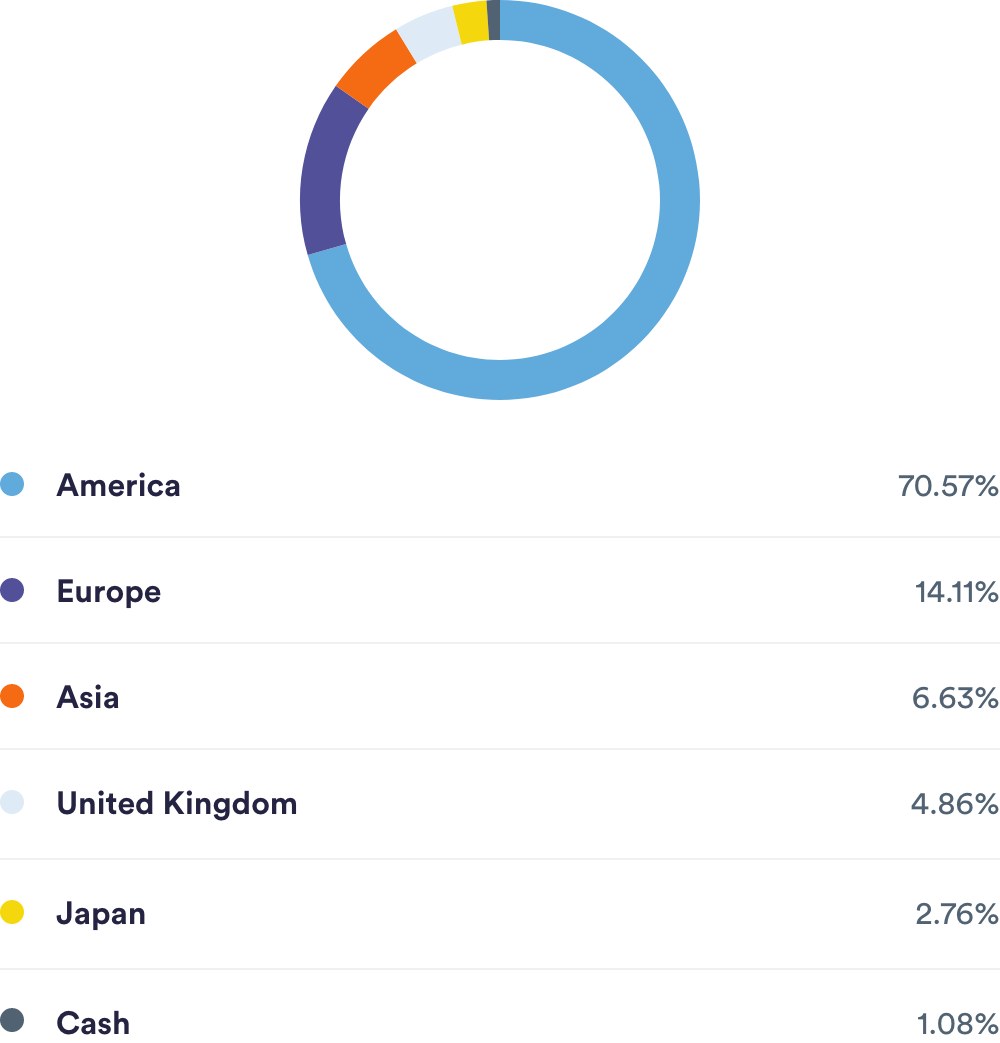

InvestSMART International Equities Portfolio Country Allocation

Recent articles about the

InvestSMART International Portfolio

InvestSMART International Portfolio

Our investment committee

The primary role of our Committee is to oversee the general management and ongoing monitoring of our investment solutions and investment strategies.

FAQs

What risk and impact on portfolio returns does currency fluctuations have?

There are some foreign exchange risks to the portfolio as the Australian dollar is freely floating and could appreciate and depreciate versus other currencies over the period you're invested. Be aware these movements can also work in your favour. The overall impact on the international portfolio is low and InvestSMART believe's it is more cost effective for the management of the portfolio not to hedge possible currency risks.

Do I own the shares/ETFs?

Yes. Investors have legal ownership of the shares and they are held on a HIN (Holder Identification Number) registered with CHESS in the investors name.

Should you wish to withdraw your investment with InvestSMART you can transfer your shares out to a brokerage account of your choice.

Find out more in the Help Centre.

Do I receive dividends and where do they go?

Yes, your InvestSMART PMA will receive dividends from the holdings. InvestSMART does not participate in dividend reinvestment plans. As the dividends from your holdings are paid they will go into the cash component of your account. You will see these via the Dividends & Interest tab and Deposits & Withdrawals tab within the My Account or quick links section.

Clients can elect to have the dividends paid out in a monthly income sweep. At the end of each month all dividends and interest received by your account will be tallied and paid out to the bank account you nominated in your application form.

If you do not have an income sweep in place the dividends will remain as cash and invested when your portfolios cash percentage exceeds the investment models.

Can I hold more than one portfolio in an account?

Yes, you can hold multiple portfolios within a single account but you can only hold one diversified portfolio per Professionally Managed Account (PMA) with single asset class portfolios alongside it. For example, you could hold the InvestSMART Growth Portfolio with both the InvestSMART International Equities Portfolio and InvestSMART Hybrid Income Portfolio alongside it but you could not hold both the InvestSMART Growth Portfolio and InvestSMART Balanced Portfolio in the single Professionally Managed Account (PMA).

If you wish to invest in multiple diversified portfolios then you will be required to open multiple Professionally Managed Accounts (PMAs).

Diversified Portfolios

- InvestSMART Conservative

- InvestSMART Balanced

- InvestSMART Ethical Growth

- InvestSMART Growth

- InvestSMART High Growth

Single Asset Class Portfolios

- InvestSMART International Equities

- InvestSMART Australian Equities

- InvestSMART Property & Infrastructure

- InvestSMART Hybrid Income

- InvestSMART Cash Securities

- InvestSMART Interest Income

Intelligent Investor Funds

- Intelligent Investor Growth Fund

- Intelligent Investor Income Fund

- Intelligent Investor Ethical Fund

- Intelligent Investor Select Value Fund

Can I set up a regular contribution plan or easily add to my portfolio when I want?

Yes you can. You are able to set up a regular contribution plan or add funds at any point for your InvestSMART PMA.

When setting up your account you can elect to have a monthly direct debit from your bank account into your InvestSMART PMA. The minimum monthly direct debit amount is $100.

If you are already invested click on Investment Preferences to set up or amend the regular contribution plan in the Quick Links section or the My Account section when you are logged in.

To add funds whenever you wish click on the Add Funds link in the Quick Links section or in My Account.

Can I withdraw at any time?

Yes, you can withdraw your funds at any time using the Withdrawal Request feature via the My Account section.

Your investments are not subject to a minimum investment period, and there is no exit fee.

You should, however, always consider the suggested timeframe of your chosen model portfolio(s) and associated brokerage charges to sell your holdings.

The holdings are very liquid and trade as ETFs on the ASX.

We usually have funds returned to clients in 4-5 business days from the submitted withdrawal request. Withdrawal requests are processed the following day they're received.

If you have multiple model portfolios in your InvestSMART PMA you can choose which investment the funds are drawn from via the Withdrawal Request section.

+ The Complimentary Bootcamp Offer (Offer) is available to new and existing investors in the InvestSMART International Equities Portfolio where the investment is funded between 19 - 30 September 2022. Maximum three free Bootcamp offers per investor during offer period. RRP is $148.50. We will send you a coupon to redeem the Offer within 30 days of funding your investment. The coupon must be used by 31 December 2022. See PDS to determine whether this product is right for you and for further information