Intelligent Investor

Ethical Share Fund

A listed fund investing in Australia's best businesses & tomorrow’s leaders

Why invest in the Intelligent Investor Ethical Share Fund?

INES provides exposure to a portfolio of ESG screened growth companies. Investors can match financial goals with their principles in a value investing active ETF.

Launched in 2019, INES has had a prosperous beginning. Portfolio manager Nathan Bell took advantage of the FY22 market excitement and took profits for the fund from several excellent performing investments.

The current market climate has favoured the cyclical resource giants, who do not pass our ethical filters. This means high-quality businesses, like CSL and ResMed, and our collection of founder-led mid-to-small cap companies, are trading at their most attractive valuations in years. Opportunities abound and Nathan has put the cash to work.

Higher interest rates and fears miracle weight loss drugs will drastically reduce healthcare are creating the best opportunities we've seen since COVID. INES's small cap holdings are poised for long-term outperformance, while the country’s best healthcare stocks are trading at their most attractive prices in at least five years.

— Portfolio Manager, Nathan Bell.

INES has implemented an investment style and process that systematically takes into account environmental, social, governance and ethical considerations. In addition, an external party has verified the INES investment process reliability.

Benefits of investing in the Intelligent Investor Ethical Share Fund

•

A patient value investing approach from a team with a 20+ year track record of success.

•

A portfolio of today's market leaders and the next generation of quality compounders.

•

Meets strict operational and disclosure practices required by the Responsible Investment Association Australasia (RIAA).

•

Low management fee and no performance fee - more returns stay in investors pockets.

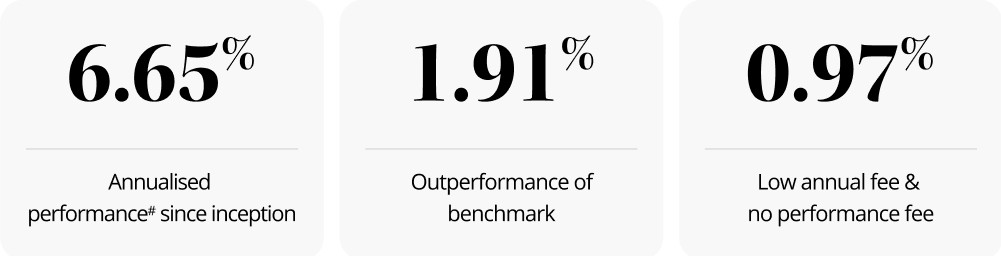

Performance# (after fees) as at 31 Oct 2023

| 1 yr. | 2 yrs. p.a. | 3 yrs. p.a. | SI p.a. | |

| Total Return | -6.22% | -8.15% | 3.40% | 6.65% |

| S&P ASX 200 Accumulation Index | 2.95% | 0.44% | 8.88% | 4.74% |

Note: inception date 11 June 2019

#Past performance is no indicator of future performance.

Top 10 holdings as at 31 Oct 2023

| Auckland International Airport Ltd | 7.03% |

| Audinate Group Limited | 6.61% |

| RPMGlobal Holdings Limited | 6.05% |

| CSL Limited | 5.86% |

| Telstra Corporation Limited | 4.70% |

| Wesfarmers Limited | 4.52% |

| Aussie Broadband Limited | 4.35% |

| Carsales.com Limited | 4.13% |

| ResMed Inc | 4.00% |

| Pinnacle Investment Management | 3.85% |

Secondary issue offer & indicative timetable

| ASX Code | INES |

| Offer opens | Monday 13 November 2023 |

| Offer Closes | Friday 24 November 2023 |

| Allotment Date | Thursday 30 November 2023 |

| Listing Date | Friday 1 December 2023 |

| Minimum Investment amount | $2,000 |

| Management Fees | 0.97% per annum |

Units will be issued at the Net Asset Value price per unit as calculated at close on Friday 24 November 2023. The number of units issued to you will be your application amount divided by the NAV per unit, rounded down to the nearest whole unit.

This Fund is for investors with a higher risk appetite looking to gain exposure to a concentrated portfolio of the best ethically screened ASX listed stocks our Intelligent Investor analysts can find.

To make sure this fund is suitable for you, please read our Target Market Determination for this Fund.

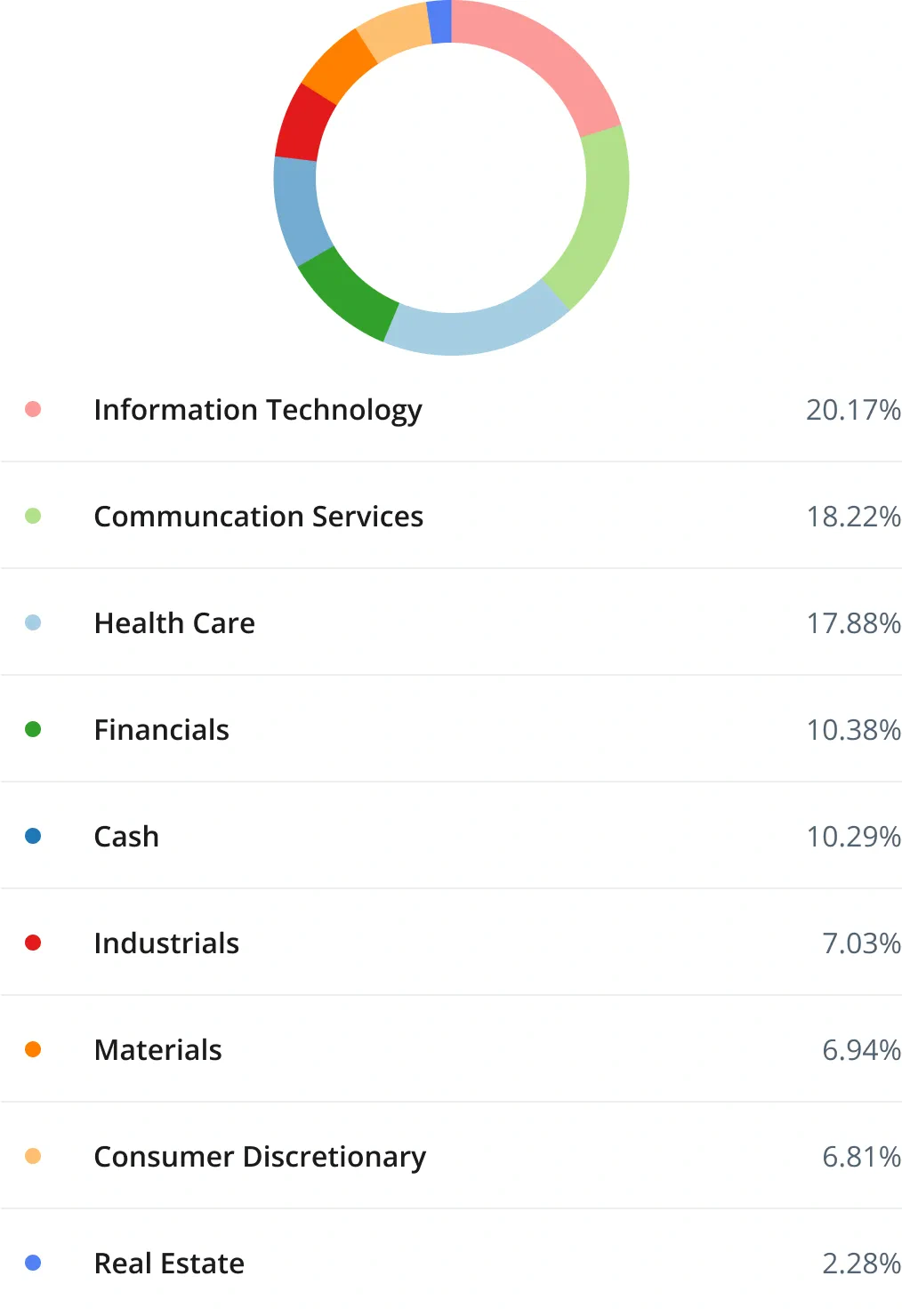

Intelligent Investor Ethical

Share Fund Sector Allocation

Share Fund Sector Allocation

Articles about the Intelligent Investor Ethical Share Fund

FAQs

What are the benefits of participating in a secondary offer?

By going through this offer process, you avoid paying brokerage and the buy/sell spread.

If you participate in this offer, your units will be allocated at the Net Asset Value (NAV) at the closing value on the offer close date. However, we do not know what this will be until the offer is closed.

How liquid is the fund/how easily can I buy/sell units?

The Intelligent Investor Funds are listed on the ASX and the Fund offers to buy and sell units to provide liquidity for investors at the Net Asset Value (NAV). The NAV can be viewed in the Key Facts section for each Fund and is updated on our website every minute the market is open.

After viewing the NAV on the fund page, look at the Fund on your brokerage platform. During market hours, you will typically see 100,000 units sitting one cent above the NAV price on the "sell" side and 100,000 units sitting one cent below the NAV on the "buy" side. These units are the Fund sitting in the market, providing liquidity at the buy and sell price. If your order is more than 100,000 units, the Fund will create additional units on the spot to meet demand. The Fund will typically come into the market after the whole market is open, e.g. 10:15 am.

The Fund will create and redeem units on demand. Therefore, this Fund is unlike a listed investment company where you must buy or sell to another investor.

To buy and sell units, you must do this via a broker or share trading platform. Occasionally, we run offers where you can purchase directly through Intelligent Investor.

Does the fund pay dividends and will they be franked?

Yes. The Fund aims to pay half yearly distributions. All applicable franking credits are passed onto the investor. The distribution is made up of all realised capital gains and income received by the Fund minus expeneses and capital losses.

When do I need to transfer funds?

Funds transfer MUST be made before 5 pm (Sydney/Melbourne time) on the offer closing date.

This date will be shown on the offer page, under the timetable on the right-hand side. However, we would recommend not leaving your transfer to the last minute as some investors may need to make multiple transfers due to their bank's daily transfer limits.

Once my units are listed, how do I buy more or sell?

Units are available for purchase or sale on the ASX during each trading day. Click here for more information about transacting at the right price.

You can buy or sell more units through your share broking service.

Don't have a share broker?

If you have ETF units held with the share registry (Link Market Services), you'll need to open an account with a share broker, like CommSec or Nabtrade, and then ask the share broker to initiate an 'Issuer Sponsored Transfer'.

This will transfer the ETF units from the share registry to your share trading account.

You can then sell on the ASX directly.

Who is the share registry/What is a share registry?

A share registry maintains investor information including distribution reinvestment preferences, bank details, tax information and communication details for all investors.

Who is the Share Registry?

As emailed on 23/03/2022 (see email), all units for IIGF, INES and INIF are now held through Link Market Services. Therefore, we no longer use Registry Direct as of 23/03/2022.

How to access the share registry

If you already have a login with Link, you can log in here.

How to register your holdings on Link Market Services

If you don't have a login with Link, go here to register.

When registering your holding on Link Market Services:

- Enter ISFM - InvestSMART Funds Management as the issuer.

- Enter your HIN (starts with an X) or SRN (starts with the letter I)

- Enter your postcode

Screenshot of example

.png)

Need Help?

We’re here to help, visit our Help Centre

RIAA’s RI Certification Symbol signifies that a product or service offers an investment style that takes into account environmental, social, governance or ethical considerations. The Symbol also signifies that Intelligent Investor Ethical Share Fund (ASX: INES) adheres to the strict operational and disclosure practices required under the Responsible Investment Certification Program for the category of Product. The Certification Symbol is a Registered Trademark of the Responsible Investment Association Australasia (RIAA). Detailed information about RIAA, the Symbol and Intelligent Investor Ethical Share Fund (ASX: INES) methodology, performance and stock holdings can be found at www.responsiblereturns.com.au, together with details about other responsible investment products certified by RIAA.

The Responsible Investment Certification Program does not constitute financial product advice. Neither the Certification Symbol nor RIAA recommends to any person that any financial product is a suitable investment or that returns are guaranteed. Appropriate professional advice should be sought prior to making an investment decision. RIAA does not hold an Australian Financial Services Licence.