Behind the unofficial rise in mortgage rates

Summary: Amid stagnant wages growth and softening house prices, many mortgage lenders have been adjusting their rates higher this year.

Key take-out: New borrowers, and those on variable rate loans, will need to think seriously about the prospect of rising rates, irrespective of the RBA's holding policy.

The Reserve Bank has once again left the cash rate frozen at 1.5 per cent, marking 21 months since we last saw any change in monetary policy.

But the RBA's dogged stance on rates hasn't stopped a bevy of lenders, including the major banks, from moving their interest rates higher over recent months.

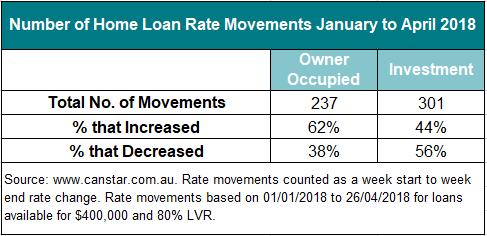

Data from financial comparison site Canstar, commissioned by InvestSMART, shows there has been more than 500 individual mortgage rate product moves by banks and other lenders since the start of this year. This includes around 240 rate changes on owner-occupier mortgage products, and a further 300 on investment property products.

Of these changes on owner occupier loans, 62 per cent were actually increases, with most of these rises tied to fixed rate loan products of varying durations. There have also been upward movements in a number of variable rate products, including on owner-occupier principal and interest and interest-only loans.

On average, lenders have been lifting their fixed and variable rates by around 10 to 15 basis points, however some have been lifted them by as much as 30 basis points (0.30 per cent). While it is still possible to grab fixed rate loans below 4 per cent, even on periods up to three years, they are becoming harder gems to find.

In the interest-only investment loans space (the prime target of the Australian Prudential Regulation Authority's lending clampdown), the rate moves have been mixed, ranging from cuts to rises. Most interest-only loans are between 4.5 per cent and 5.5 per cent, but some are being priced closer to 6.5 per cent.

The mortgage rate rises have come despite clear indications that segments of the residential property market are softening, with data just released by CoreLogic showing a fall in dwelling values over April amid tighter credit conditions.

On Tuesday the governor of the RBA, Phillip Lowe, noted that some households will likely find it even harder to secure a home loan in future as a result of the fallout from the banking royal commission and the rise in US money market rates.

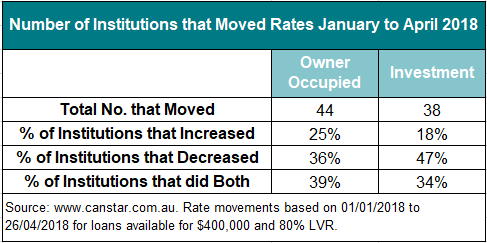

Canstar's full breakdown of all the mortgage interest rate moves across Australia from January to the end of April, by both lender and product type, shows that lenders have been moving their rates up and down on hundreds of different loan products, often multiple times, as they continue to fine tune their loan books.

For property investors, what's interesting is that in the investment loan space, the trend has largely been down, with 56 per cent of the total changes recorded as decreases. But that has evolved in a climate where lenders have been forced to reduce their investment loan books through tighter approval processes, including lowering their loan to valuation ratios.

The tables below show both the total number of rate movements since January, and the number of institutions that have moved their rates.

So what's really going on? A lot of the changes are purely a reflection of retail price competition, with lenders often playing a cat and mouse game to win new business, either directly or via mortgage brokers. Yet, especially in terms of fixed rate loans, there is also the added dimension of rising offshore funding costs stemming from the recent rises in US official interest rates.

According to Steve Mickenbecker, Group Executive Financial Services at Canstar, many of these rate movements are a combination of market competition and the recent introduction of tighter new APRA controls.

“We're also seeing wholesale funding move upwards, and you'll see that more in the fixed rates. Mickenbecker says.

He adds that there's two ways the banks can be competitive without affecting their loan books: by bringing out new products or ‘specials', or by adjusting their fixed rates.

The Canstar data shows variable rates are generally down for owner-occupied P & I loans.

“When you look at owner-occupied interest only, there's little respite,” Mickenbecker says. “Owner-occupiers who are interest-only are the part of the market that is most vulnerable and most likely to feel any RBA rate increases.”

So while variable rates are still a preference for borrowers, according to Mickenbecker, fixed rates are worth crunching the numbers on, especially in light of a possible future RBA rise.

The RBA's latest minutes have given little away in terms of when official rates will move higher.

“This year and next, our central scenario remains for the Australian economy to grow a bit faster than 3 per cent,” governor Lowe told a dinner in Adelaide on Tuesday, adding that if there is a gradual lift in wages and inflation, and a lowering in unemployment “it is reasonable to expect that the next move in interest rates will be up”.

“The Board's view is that while this progress is occurring, the best contribution we can make to the welfare of the Australian people is to hold the cash rate steady and for the Reserve Bank to be a source of stability and confidence.”

But the official view on rates is certainly not deterring lenders from taking matters into their own hands, and raising them as they see fit.

For current and potential borrowers, including investors, it will be just as important as ever to shop around and consider locking into a low fixed rate loan to counter further upward moves at the retail level.