Would Ansell pass Buffett's four filters?

Recommendation

At the 2003 Berkshire Hathaway annual meeting, Warren Buffett was asked: 'Could you just take us through your filter process when it comes to selecting a company?'

Buffett answered, 'It's a question of … Can I understand it? If it makes it through that filter … Does it have some kind of sustainable long-term competitive advantage? If it makes it through that filter … How do I feel about the management in terms of their ability and honesty? And if it makes it through that filter … What's the price? ... And if it gets through all four filters, I sign my name to the check.'

Before getting to Ansell, there's good reason to believe Buffett is already looking at Aussie stocks. In a 2015 interview with Fairfax Media, he said: 'If you come back in two or three years, you will find we have got four or five Australian equities ... There is money to be made in Australian equities over the next 10, or 20, or 30 years'.

Key Points

-

Simple business, decent moat

-

Shareholder friendly management

-

Fair price; Hold

We can only guess, but we suspect glove and condom maker Ansell will at least make it to his watch list. Here's why.

Simple business

Buffett's first filter is a matter of simplicity, and is one reason he has generally avoided the tech sector. When an industry is characterised by lots of technological change, companies are difficult to value. The best product today could be obsolete tomorrow.

But glove making isn't the stuff of glitzy party conversation. It's a steady, boring business and that's why we like it. Ansell was making rubber gloves before Buffett – now 85 years old – was even born.

Aside from the occasional innovation in materials – such as the invention of nitrile gloves as an alternative to latex in 1990 – glove making has barely changed in decades. It also has a straightforward manufacturer-distributor business model.

Berkshire Hathaway owns many industrial and consumer goods businesses, such as Fruit of the Loom, Duracell and recent addition Precision Castparts. Manufacturing businesses account for 17% of Berkshire's revenue. Buffett will have no trouble understanding Ansell's business.

Competitive advantages

You're probably familiar – perhaps intimately familiar – with many of Ansell's household brands. Strong brands mean that Ansell can typically charge a little more than generics due to trust and customer loyalty. They're a powerful competitive advantage.

A household name is one thing but when it comes to Ansell's 'moat', economies of scale are the crocodiles and piranha.

Ansell has significant fixed costs, such as manufacturing equipment, sales staff and head office expenses. Therefore, as it sells more gloves, the average cost goes down. Ansell is the market leader in most of its product categories and its size ensures it can remain profitable at prices that would leave smaller competitors losing money, and that's a significant barrier to newcomers trying to enter the market.

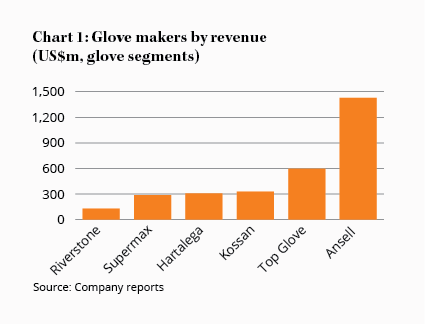

The benefits of scale show up all though Ansell's financial reports. Firstly, compared to competitors, Ansell has more pricing power with customers and can push back on suppliers, which explains its industry-leading gross margin of 41%, compared to 32% for Supermax – a distant second place.

Scale also means that Ansell can outspend competitors on research and development. The company released 50 new products in 2015, which we expect will help it maintain market share.

Scale also means that Ansell can outspend competitors on research and development. The company released 50 new products in 2015, which we expect will help it maintain market share.

Finally, companies need to reinvest in capital equipment to maintain their factories. With more gloves being churned out of its machines, Ansell's capital expenditure is spread across a higher volume of sales – capex came to around 5.1% of sales in 2015, compared to 7.9% for the second largest manufacturer, Top Glove.

With only a small proportion of sales needing to be ploughed back into the business to maintain its standing, the majority of profits flow through as free cash flow, which can be returned to shareholders as dividends or through share buybacks.

Ansell has a free cash flow margin of 7% – nothing spectacular, but still respectable – and a healthy return on equity of 16%. This business isn't a financial juggernaut to rival Cochlear or ResMed, but there's still every reason to believe its competitive advantages will preserve its market-leading position over the long term.

Good management

As Buffett has said, 'you can't make a good deal with a bad person'. We employ this principle religiously at Intelligent Investor and avoid businesses where management give us the heebie-jeebies, even when the financial proposition appears favourable.

Everything about Ansell's management, however, points to it being on the shareholder's side. Chief executive Magnus Nicolin doesn't beat around the bush during company presentations and doesn't sugar coat bad news.

Management also has a good track record on capital allocation. Ansell bought back 30% of its stock between 2003 and 2013 at an average price of $11, before raising capital at $18.50 to buy BarrierSafe Solutions in 2014, the largest maker of single-use gloves in the US and a very savvy deal (see Ansell buys US market leader).

With the share price now well off its highs, management has put repurchases back on the table, and we expect the company to have reduced its share count by around 4% when the current program ends in August. Given Ansell's limited opportunities to reinvest in organic growth and what we consider an undervalued share price, we think buybacks are in the interest of shareholders.

Furthermore, Ansell has a good incentive structure in place to align management with the company's owners. Some 30% of the chief executive's pay is tied to long-term performance, which is based on earnings per share growth over a rolling three-year period, and the bonus is only awarded if Ansell's return on equity is above 12%. Though this encourages the use of debt, Ansell has a clean balance sheet and the condition ensures that shareholder capital is being used efficiently and that the company doesn't hoard cash or use it to expand into less profitable endeavours.

Fair price

There's plenty to like about Ansell. But it isn't worth an infinite price, and if there's one thing Buffett is known for, it's his unwillingness to overpay.

Ansell's enterprise value is 11 times earnings before interest and tax, compared to an average EV/EBIT ratio of 16 for its competitors listed above (with none having an EV/EBIT below 12). So it's clear Ansell is cheap on a relative scale. But with a free cash flow yield of 6.0% and forward price-earnings ratio of 13, the stock's valuation is attractive on absolute measures too – even though we only expect earnings per share to grow in line with the economy over the long term.

No-one can know what Buffett will or won't buy as he aims his $90bn 'elephant gun' at the Australian market. But Ansell is a simple, well managed business, with strong competitive positions, and it's going for an attractive price, albeit slightly above our recommended Buy price so we'll stick with HOLD.

Note: The Intelligent Investor Growth Portfolio and Equity Income portfolios own shares in Ansell. You can find out about investing directly in Intelligent Investor and InvestSMART portfolios by clicking here.

Disclosure: The author owns shares in Ansell.

Recommendation