Will Carsales' river run dry?

Recommendation

If you're as old as I am, you might remember scouring the classifieds section of the newspaper for a job, car or house (probably in that order). Advertisements were small, detail was lacking, and photos were non-existent.

Yet these tiny classified ads were so important to newspaper group Fairfax Media in the 1990s that they generated revenue of more than $1bn a year. These ads were the liquid in Fairfax's famed ‘rivers of gold'.

As the internet bloomed a decade later, few print groups saw the writing on the wall, let alone the computer monitor (although Intelligent Investor said it was Time to cancel your newspaper sub in 2007). Classified ad revenue has now migrated almost fully online in western countries.

Key Points

-

Britain's car classifieds incumbent facing new competition

-

Carsales protected by diversification and distance

-

Lifting price guide

One of the rare print publications that made a successful transition was the UK's Auto Trader magazine. Auto Trader launched its first website in 1996, published its last print edition in 2013, and is now the UK's largest car classifieds site. About 80% of car dealers advertise on www.autotrader.co.uk, with around two-thirds of British used cars sold on the site.

Like Carsales.com in Australia, Auto Trader is by far the dominant car classifieds player. You can see selected financials for both companies in Table 1. The numbers show what good businesses these are, although the business models are somewhat different (Carsales receives revenue partly based on leads delivered to dealers, while Auto Trader sells them subscription packages).

| Auto Trader plc | Carsales.com | |

| Revenue growth 2014-2017 (%) | 31 | 58 |

| Operating margin 2017 (%) | 67 | 45 |

| Return on capital emp. (2017) (%) | 62 | 40 |

But as time marches on, so does the competition. Auto Trader Group plc is facing a new entrant called CarGurus, which has done some damage to the incumbents in its US home market (which is more fragmented than the UK). CarGurus launched in the US in 2007 and the UK in December 2015.

CarGurus' ‘thing' is that it uses algorithms to rank cars advertised for sale. Cars are ranked from ‘Great deal' to ‘Overpriced', with dealer reviews also making a difference to rankings. The idea is that car buyers can quickly identify the best deals from the best dealers. Dealers who offer attractively priced cars tend to turn over their inventory more quickly, which helps drive profitability.

Copycat strategy

Auto Trader is meeting the threat from CarGurus with something of a copycat strategy. It has recently launched dealer reviews and now uses algorithms to identify cars as ‘great price', ‘good price' and ‘priced low' (the difference between these categories however isn't entirely clear).

| If you're researching Carsales' international competitors, be careful to avoid confusion. Auto Trader Group plc, the listed British company, is no relation to the Cox Automotive-owned www.autotrader.com, which is a leading US car classifieds site. Cox Automotive owns Australia's www.carsguide.com.au as well as Britain's number 2 player, www.motors.co.uk. CarGurus is now a competitor to both Autotrader in the US and Auto Trader Group plc in the UK. |

Since June 2017, Auto Trader Group's share price has fallen about 20%. But there are many reasons for the decline other than new competition from CarGurus. Worries about the UK consumer and a fall in used car transactions are just two.

Auto Trader Group still commands a premium, with the stock trading on an enterprise value to earnings before interest, tax, depreciation and amortisation (EV/EBITDA) multiple of 16 (see Table 2). So Auto Trader shareholders seem reasonably unconcerned two years after CarGurus' launch, and it's still too early to know whether the interloper will be successful.

So what does this all mean for Carsales in Australia?

| Auto Trader plc | Carsales.com | |

| EV/Revenues (2018e) | 11.1 | 8.2 |

| EV/EBITDA (2018e) | 16.0 | 17.1 |

| Free cash flow yield (2017a) | 5.1 | 3.5 |

Well, Carsales has an advantage because Australia is a small and distant market. There's a reason why Amazon launched in 14 other countries before this one. Carsales should be able to analyse global trends in its industry – and take evasive action – before they hit Australia.

Powerful incumbent

But we can't ignore that new competitors for Carsales might emerge. Or that existing ones, like the Cox Automotive-owned www.carsguide.com.au, could make new incursions. What's clear from the Auto Trader experience, though, is that it would take time to disrupt a powerful incumbent like Carsales.

It would also take money – and lots of it. For the nine months ended 30 September 2017, CarGurus (which listed on Nasdaq last year), spent a whopping 74% of its US$226m in revenues on sales and marketing. That's a lot of brand-building.

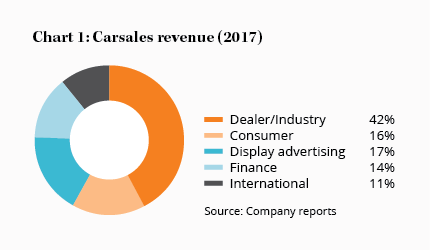

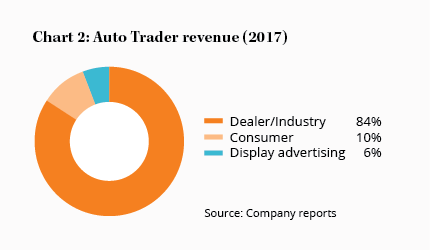

You might also be surprised to learn that Carsales is significantly more diversified than Auto Trader. The latter operates only in the UK market and 84% of revenues derive from dealers. Carsales' business is much broader (see Charts 1 and 2).

While Carsales remains the least internationally diversified of the ‘big three' online classifieds players (the others being Seek and REA Group), it has recently acquired the remaining 50% of its South Korean car classifieds venture for a reasonable $244m. Carsales also has smaller investments in South America and south-east Asia, adding growth potential and – importantly – outward focus.

Widen the moat

This outward focus is important in technology-enabled businesses. It's something to watch over time: how is Carsales taking lessons learned here and overseas and using them to ‘widen the moat'?

For now, Carsales is making some easy gains by increasing prices for dealers. It has recently lifted its price per lead from $45 to $48, a hefty 7% increase. Jacking up prices is a potentially risky way to boost profit, particularly in a low margin and deflationary industry such as car retailing. It's important that Carsales prove to dealers that its services boost their businesses, rather than simply exercise its pricing power.

The price rise will undoubtedly support Carsales' profit this financial year and next, so earnings per share should rise by around 10% in 2018. At the current price, that places the stock on a forecast price-earnings ratio of 26 and an EV/EBITDA multiple of 17. That's too rich to consider buying given the risks of disruption, cyclical weakness and dealer pushback, but we're lifting our Buy and Sell prices to $12 and $19 respectively.

That partly reflects our view that, having analysed an overseas player under attack, we're comfortable it will be difficult to dislodge Carsales from its strong position in Australia. Carsales may not be impregnable but the drawbridge is certainly up. HOLD.

Note: The Intelligent Investor Growth and Equity Income portfolios own shares in Carsales. You can find out about investing directly in Intelligent Investor and InvestSMART portfolios by clicking here.

Disclosure: The author owns shares in Seek and Fairfax Media.

Recommendation