What to do when yield becomes expensive

For 20 years now, Japanese interest rates haven't risen above 1%. The demand for safes over that period barely budged. Japanese savers weren't getting much in the way of returns but at least they got something.

But when rates turned negative earlier this year, demand took off. The Japan Times reports that Cainz, a home improvement retailer, experienced a 60-70% increase in safe sales since the beginning of the year. Whilst Japanese banks are prepared to live with negative returns, Japanese savers aren't. Weird things happen at the sharp end of ‘unconventional monetary policy'.

In Australia, we have our own version of weird. When we recommended Sydney Airport in the High yield and safe mini-portfolio on 1 Feb 13 (Long Term Buy – $3.18) we did so for the 6.90% yield, expecting (but not banking) on some capital growth. That same argument applied to ALE Property, offering a yield of 6.6%, and BWP Trust, delivering 5.9%. In hindsight these were salad days – high income stocks with some nice growth prospects at reasonable valuations.

Key Points

-

Bond market predicts low growth and inflation

-

Avoid chasing yield, focus on valuation

-

Growth relatively cheaper than yield

What has occurred in the two years since is astonishing. Sydney Airport's share price has more than doubled, while ALE Property and BWP Trust, both stocks for which the words ‘safe and boring' could have been invented, have risen 80% and 46% respectively (see Brickbats and bouquets – Part 1). From Japanese safes to Sydney Airport, the effects of low interest rates on investor behaviour cannot be overstated. Yield is now the sharemarket equivalent of cat nip.

The performance from our high yield mini-portfolio echoes that of our Equity Income Portfolio, which returned an average of 15.7% per year in the three years to last December – 6.4% a year ahead of the index. Grabbing an early seat at the front of the yield train paid off. Unfortunately, this is no consolation for investors now scrambling to find an empty carriage.

All this raises a few questions for income investors: What impacts do lower interest rates have on stock valuations? How should that influence my investing mindset? And finally, what income-focused opportunities still exist in a yield-obsessed world? Here and in part two on Friday, we'll attempt to answer these questions.

Historical lows

When value investors think of rapid price increases in conservative, income-based stocks like BWP Trust and ALE Property, the word ‘bubble' is rarely far away. There is, however, a sound basis for these moves. In a world where GDP growth averages, say, 3% a year and inflation hovers around 2%, a 6.6% yield from the like of ALE Property looks okay. But if GDP growth and inflation each fall to 1% a year, 6.6% becomes seriously attractive.

That's essentially what's happened over the past two years. Relatively speaking, dependable yield has been in demand, which, to a large degree, explains why the prices of these stocks and others like them have charged up. ‘But in demand relative to what?', you ask.

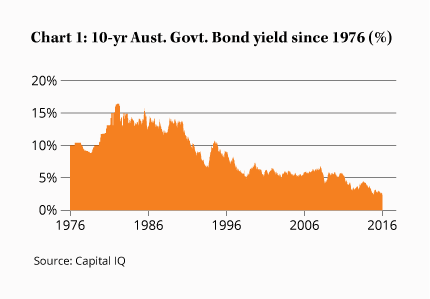

Here, we can't avoid government bond yields, which define the risk-free rate of return against which other asset classes are measured. In Japan right now, 10-year government bonds (ie those set to be repaid in ten years' time) yield -0.08%, 10-year US Treasuries yield 1.85% and 10-year Australian government bonds 2.34%, having fallen from 2.9% earlier in the year.

In these countries and elsewhere, bond yields are at historical lows. That tells us expectations for interest rates are also at historical lows, which in turn tells us that the same is true about expectations of future growth and inflation. This has to be the case, for investors to be happy to get 1.85% a year from 10-year US T-Bills. Against that backdrop, the rapid price increases in the stocks featured in our mini-portfolio makes more sense.

Is the bond market right about low growth and inflation expectations? Well, high sovereign and consumer debt, excess capacity, low wages growth, technology and high savings rates certainly support that view.

Moreover, since the 1980s, interest rates have been in long-term decline and bond yields indicate they're likely to stay that way for many years yet. Investors hoping for the quick return of modest inflation, GDP growth of 4% and interest rates above 6% may well be disappointed.

Changing expectations

Only recently have investors wrapped their heads around this unsettling possibility. After the GFC, the fear was that quantitative easing would produce excessive inflation. The concern now is a future defined by anaemic growth and deflation. If things do play out this way, it's a game changer for investors accustomed to average, annual double-digit returns.

None of this is to predict an outcome, merely to prepare for the possibility. There are five ways we recommend you do so.

1. Modify your expectations – If, like me, you lived through the 1980s when mortgage rates hit 17%, accepting the possibility of near-zero rates for the next decade is hard. But rates have been falling for the last 30 years and at no time has inflation broken out. The bond market inherently accepts this argument but, looking at my portfolio returns over the last decade, I still struggle with it.

That potentially sows the seeds of a future problem. In a low-inflation, low-growth world, demanding the same kind of returns as we've got in the past could take us up the risk curve to a place we shouldn't really be. If 6% was okay a few years ago, 4% isn't so bad now.

2. Don't overcomplicate it – In researching this subject, your analytical team produced a voluminous email chain addressing, amongst other things, bond yields, equity risk premiums and the Gordon growth model. Yes, our interior lives are fascinating. None of this should concern you. If in our valuations we reduce our growth expectations by the same amount as our discount rate, everything ends up the same anyway.

Investors that require certainty over nominal values in the short term use bonds and cash. That's not what we're about. We can salt away our savings for decades, safe in the knowledge that over long periods shares have either trounced bonds or lost by tiny amounts. Understanding that is far more important than anything else, except perhaps that once you've dived in, you need to be brave enough to see it through.

3. Focus on valuation – The bond market could be wrong. Circumstances can change dramatically, especially over long time frames. But if you're keeping things simple and focusing on valuation it need not matter, a point we hope to make clear in part two.

4. Don't get hung up on where your returns come from – Investors relying on regular dividend cheques to cover living expenses have less flexibility here but for those that don't, try and be agnostic about whether your returns come from dividends or capital growth.

When a clear preference emerges - as is the case with dividends now - mispricings follow, which is why high-yield stocks have been bid up by hungry income investors. This is a mistake. As Gaurav Sodhi says: ‘A company isn't worth more because it chooses to distribute profits rather than reinvest them. In fact, the opposite case can be made. If we want to compound our money over time, we should allow businesses to reinvest their earnings without a valuation penalty and, equally, be careful about rewarding management for their capital decisions.'

5. Seek dividend ‘truth' – In the rush to meet the demands of income-hungry shareholders, some companies have committed to unsustainable dividend policies. BHP Billiton, Origin Energy, and ANZ are just three companies to have cut their dividends. With high payout ratios and earnings growing slowly – or going backwards – more will undoubtedly follow. Two years ago there were stocks with dependable yields at reasonable prices. That is no longer the case. Prices have risen and dependability has declined. There's a greater risk now that the yield you receive will be lower than the one you based your decision on at the time of purchase.

Where does that leave us? Heading towards part two on Friday, where we'll bypass the market's preoccupation with yield and focus on what the market is not interested in: stocks that pay acceptable yields but offer capital growth for an attractive level of risk.