What Holds should you Buy? Pt 1

Recommendation

Fund managers have a bad case of the willies right now. Altair Management hit the headlines recently when chief investment officer Philip Parker decided to ‘hand back client monies out of equities' which he deemed ‘far too risky'. The liquidated fund was small to the point of barely being worth the effort but we appreciate the reasoning. With just 11 stocks on our Buy List, we don't need convincing that opportunities are thin on the ground.

George Soros's former business partner Jim Rogers takes it one step further, arguing that Trump will lead the US further towards bankruptcy, saying ‘this is all going to end very, very, very badly.' Which is quite bad.

Still, there's always bonds, right? Er, no. For almost a year now bond market guru Bill Gross has been saying sovereign bonds are not worth the punt. Last week he warned risks are at levels not seen since 2008. ‘Instead of buying low and selling high', he told Bloomberg, ‘you're buying high and crossing your fingers.'

Key Points

-

A good Hold can be a reasonable Buy

-

Have a plan to deal with volatility

-

Modify expectations and don't reach for yield

What about property? Please, don't get me started. Most investors are already overexposed to this asset class. And that's before their bank shares are taken into account. With net yields from residential property around that paid by term deposits, many investors are gambling on ever higher prices because, you know, property always goes up.

Gold and cash troubled

Gold? Well, maybe. Well known fund manager/life coach Tony Robbins recommends a 7.5% portfolio allocation to the yellow metal. But as Graham Witcomb eloquently wrote last year, Gold is a bad investment, even in bad times.

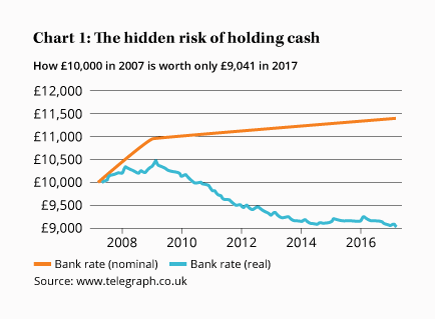

So cash it is. Aside from digging a hole under the tomatoes and hoping the neighbours don't see, or, worse, the kids, what else can one do? But even cash has its problems. Over the long term it's a terrible investment, as this chart from the UK Telegraph shows (just imagine the pound signs are dollars – it really doesn't make much difference.)

The effects of record low levels of inflation still manage to substantially diminish real spending power over time. The other issue is that in ‘going to cash' many investors are effectively trying to time the market, potentially missing a surprise rise like the Trump bump. That's not to say members shouldn't build cash reserves as prices rise and the risks of owning shares surpass the benefits – but over the long term, holding too much cash will hurt performance.

What to do now?

These points flashed through my mind whilst talking to Craig Bannister yesterday. After 20 years in Singapore, he's sold up and returned to Sydney. But he thinks Sydney property prices don't stack up; that stocks look fully valued; that cash isn't an option; and nor are bonds. And he's not quite sure what to do now.

Craig isn't alone, either, which is why we've developed the ‘Holds to Buy' mini-portfolio shown in Table 1. It follows the ‘Okay yield and growth' mini-portfolio from the What to do when yield becomes expensive special report of June last year.

Regardless of nomenclature, the purpose remains the same; investors prepared to pay a reasonable price for reasonable income, with some growth potential, need not grab a wad of cash and head to the vegetable patch, or the bond or property market.

Whether you're Craig, or someone that has come into a bit of cash and wants to do something sensible with it, or merely rebalancing your portfolio after selling down a few winners but are now struggling to find places to put the proceeds, this mini-portfolio is for you.

| Company | Current Price ($) |

Latest Recommendation | Max. Portfolio Weight (%) |

Sell Above ($) |

Free Cash Flow Yield* |

Expected FY17 Dividend Yield (%) |

|---|---|---|---|---|---|---|

| Amaysim (AYS) | 1.91 | 13 Apr 17 (Buy – $1.89) | 4 | 3.50 | 6.2 | 5.5** |

| ASX (ASX) | 51.65 | 17 Feb 17 (Hold – $51.74) | 8 | 70.00 | 4.0 | 3.9 |

| Flight Centre (FLT) | 37.16 | 4 May 17 (Hold – $33.80) | 6 | 50.00 | 4.8 | 5.2 |

| IOOF (IFL) | 9.56 | 22 Feb 17 (Hold – $8.44) | 6 | 12.00 | 6.0 | 5.4 |

| Navitas (NVT) | 4.42 | 11 Apr 17 (Buy – $4.37) | 5 | 7.50 | 1.7*** | 4.3 |

| Perpetual (PPT) | 54.42 | 28 Feb 17 (Hold – $51.61 | 6 | 70.00 | 5.2 | 4.9 |

| Sydney Airport (SYD) | 7.61 | 3 May 17 (Hold – $7.05) | 8 | 10.00 | 4.1 | 4.4** |

| Trade Me (TME)**** | 4.84 | 25 Feb 17 (Buy up – $4.61) | 6 | 7.50 | 5.3 | 3.5** |

| Virtus Health (VRT) | 5.43 | 28 Mar 17 (Hold – $5.99) | 5 | 9.00 | 7.5 | 4.9 |

| Wesfarmers (WES) | 40.51 | 14 Jun 17 (Hold – $40.50) | 8 | 55.00 | 5.5 | 5.2 |

| *Over the past 12 months. | ||||||

| **All dividend yields fully franked, except for AYS, SYD and TME, which are unfranked. | ||||||

| ***NVT FCF yield should normalise around 6% as capex subsides. | ||||||

| ****TME figures in AUD. | ||||||

In part two next week we'll get into a little more detail about these businesses and their financial metrics. Before then, though, let's make a few general points about the mini-portfolio and the thinking behind it:

1. Try not to reach for yield – This is really about modifying your expectations and focusing on valuations rather than an eye-catching yield. We're in a low inflation, low growth world. Against that backdrop, expecting a double-digit return without racing up the risk curve is unrealistic. The stocks in this portfolio have been selected with that in mind. Their yields are reasonable and their growth prospects fair.

2. A Sell price is around fair value – We don't like to hold overvalued stocks so we set our Sell price around fair value. That doesn't mean the share price will rise to that price – situations change, of course – but the gap between the price at the last recommendation and the sell price does approximate to the extent of the margin of safety as we see it.

3. Which means it's okay to buy Holds – It seems odd to recommend a stock deemed a Hold but it makes sense when you think about it in the above context. We believe all our Holds are undervalued to a degree, but not by as much as a Buy recommendation, where the margin of safety is necessarily greater. The longer term your view and the more diversified your portfolio, the less you should need to rely on a big margin of safety (although it's always nice, hence why we're so fussy). And in an environment where all asset classes appear expensive, buying a mildly underpriced stock with a Hold recommendation is more easily justified.

4. Expect volatility – One of the many weird things about the current market is the extent to which it has absorbed shocks like Brexit, Trump, North Korean missile tests, ballooning sovereign debt and record low interest rates with barely a murmur. Volatility is at record lows, causing investors to worry about investors not being worried. This is unlikely to last. After buying some of the stocks in this list please don't get panicked out of them if and when another shock does have an impact. Volatility is the value investor's friend and should be embraced.

After some very successful years it's important to remember that holding high-quality stocks purchased at reasonable prices is your best protection against inflation, and every other risk. Hopefully, the stock suggestions in this mini-portfolio will help you acquire a few more of them.

Note: The Intelligent Investor Growth Portfolio and Equity Income portfolios own shares in Amaysim, ASX, Flight Centre, IOOF, Perpetual, Sydney Airport, Trade Me and Virtus Health. You can find out about investing directly in Intelligent Investor and InvestSMART portfolios by clicking here.

Disclosure: The author owns shares in ASX.

Recommendation