Westpac: Interim result 2016

Recommendation

This morning's interim result from Westpac showed reasonable growth in most areas, but unfortunately the biggest growth of all was in its impairment charge, which almost doubled from a year ago to $667m, or 0.21% of average loans (up from 0.11% a year ago).

Most of the increase came from a total of $252m relating to four major problem borrowers in the institutional banking division (thought likely to include Peabody Energy, Slater & Gordon and Arrium).

That charge represents around half the combined exposure to the four borrowers, so there could be more to come. Elsewhere, though, things don't look too bad and management said it expected that 'asset quality will remain sound overall' and that the second-half impairment charge will be lower than the first. We'll take them at their word, but it's an important reminder that the past few years have been the exception rather than the rule in relation to impairment charges.

Key Points

-

Impairment charge almost doubles due to big names

-

Margins higher due to rate rises

-

Shares offer reasonable, not exceptional, value

Also showing unhealthy growth was the number of shares on issue, which jumped 5% thanks to last year's rights issue and underwritten dividend reinvestment plan and reduced a 3% rise in cash earnings to a 2% contraction in cash earnings per share.

Loans and margins increase

The increased cash earnings were largely the result of a 6% increase in loans to $641bn, including an 8% increase in mortgage lending (maintaining the bank's 23% market share). Housing remains Westpac's largest lending exposure by far, accounting for 67% of the total, compared to 17% for business, 12% for institutional and 4% for 'other consumer' (such as credit cards and personal loans).

The increase in loans was matched by a 5% increase in deposits, to $442bn, maintaining the bank's market share, also of 23%, and nudging up its deposit to loan ratio from 68.5% to a very healthy 69.0%.

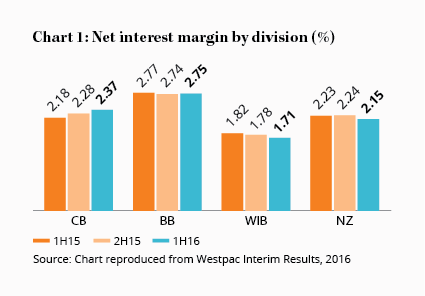

The net interest margin (NIM – the difference between the interest received on the loans and the interest paid on deposits and other funding) increased by 0.06 percentage points from a year ago to 2.07%. This was thanks in large part to the bank's decision to lift mortgage rates independently of the RBA, which helped the consumer banking business increase its NIM by 0.19 percentage points to 2.37%. Business banking NIM saw a slight rise, while the New Zealand and institutional businesses both fell (see Chart 1).

All told, net interest income rose 10% to $7.65bn on a cash basis. Non-interest income, however, fell 4% to $2.97bn, due to the partial sale of BT Investment Management last year as well as some pressure on credit card fees.

'Aspirational' targets

Operating expenses rose only 4% to stand at 41.6% of income, in line with the second half of 2015, but 0.85 percentage points higher than the first half. Management said that expense growth was likely to be 'just above 3%' for the full year, but maintained its target of reducing the expense-to-income ratio to below 40% by the 2018 financial year (although we will believe that when we see it).

The 3% increase in earnings combined with a 15% increase in shareholders' equity – following last year's underwritten dividend reinvestment plan (DRP) and rights issue – to cause a 1.7 percentage point fall in return on equity (ROE), from 15.9% to 14.2%. Management has also retained its ROE target of 15% – and that also looks 'aspirational' for the time being. Even so, 14.2% is very healthy compared to reduced return expectations on other available investments and the bank's higher capital balance also makes it slightly less risky.

An interim dividend of 94 cents will be paid, up 1 cent on last year's interim dividend and in line with the final. Combined with the fall in earnings per share, that pushes the payout ratio up to 80% from the mid-70s over the past couple of years. Even at this level the dividend looks sustainable so long as impairments don't deteriorate further, although that's largely cosmetic in our opinion – indeed we'd actually prefer to see the dividend cut if the bank can make anything close to its targeted ROE of 15% on its retained earnings.

| Six months to March ($m) | 2016 | 2015 | (%) |

|---|---|---|---|

| Net interest income | 7,653 | 6,934 | 10 |

| Non-interest income | 2,966 | 3,086 | (4) |

| Total income | 10,619 | 10,020 | 6 |

| Operating expenses | 4,419 | 4,254 | 4 |

| Impairment charge | 667 | 341 | 96 |

| Profit before tax | 5,533 | 5,425 | 2 |

| Cash earnings | 3,904 | 3,778 | 3 |

| EPS ($) | 1.18 | 1.21 | (2) |

| Interim dividend | 94c fully franked (up 1%) ex date 12 May 2016 |

||

With cash earnings roughly offsetting the growth in risk weighted assets and the final dividend (net of the DRP), the common equity tier one (CET1) capital ratio saw the full benefit of last November's rights issue, rising from 9.5% to 10.5%, comfortably fulfilling APRA's 'sense check' of being in the top quartile of international peers.

Full-year earnings to fall

Expectations for full year earnings will fall a little following this result, from a consensus of around $2.44 to perhaps $2.40 – which would be 4% lower than 2015 and would put the stock on a price-earnings ratio of about 12.4 and a fully franked dividend yield of 6.4%.

If we bump up the impairment charge from 0.2% to a more realistic 'through-the-cycle' charge of 0.5%, however, then the earnings per share would drop to an adjusted $2.05 and the PER would rise to about 15. That's still pretty reasonable, though, for such a strong business earning a through-the-cycle return on equity of around 11.4%.

We'd want to see a slightly larger margin of safety before upgrading the stock to Buy, but investors who particularly value the high dividend yield and who aren't already heavily exposed to banks might take a nibble at Westpac at current prices. This is what our Equity Income Portfolio did recently, increasing its weighting from about 1.6% to 2.6% (alongside a purchase of Commonwealth Bank, taking its combined weighting in the big four banks from about 3.2% to 5.2%).

This still leaves us well below our maximum recommended weighting of 10% for Westpac itself and 20% for the banking sector as a whole, however, which fits with the fact that we think the stock (and sector) offer respectable rather than exceptional value at current levels. HOLD.

Note: The Intelligent Investor Equity Income Portfolio owns shares in Westpac and Commonwealth Bank. You can find out about investing directly in Intelligent Investor and InvestSMART portfolios by clicking here.

Recommendation