Wesfarmers sales surprise

Recommendation

Wesfarmers' third-quarter sales may have seemed like ‘same old, same old'. Bunnings and Kmart thrived, while Target underperformed. Coles continues to limp along, with Woolworths likely to beat the smaller supermarket chain convincingly when it releases its own sales results tomorrow.

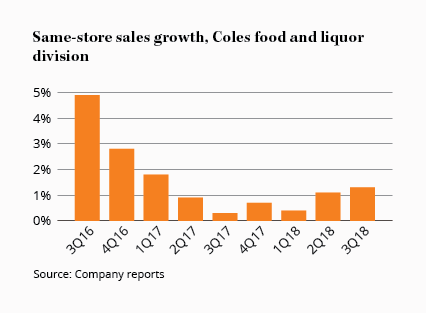

But it pays to dig a little deeper, and for that Wesfarmers' conference call provided us with a useful shovel. Starting with Coles, same-store sales in the food and liquor division grew by 1.3% adjusting for public holidays. It's consistent with recent sluggish sales results – see the chart – and the numbers need to improve.

However, outgoing Coles managing director John Durkan highlighted that customer satisfaction scores were the best they had been in seven quarters. Improving customer satisfaction was a lead indicator of Woolworths' sales recovery in late 2016, so it's a good bet we'll see something similar at Coles. Durkan also remains adamant that Coles will lift profit in the current half, suggesting the supermarket group may have hit bottom.

Key Points

-

Early signs of improvement at Coles

-

BUKI deserves a chance

-

Downgrading to Hold

Target's sales remain weak, with same-store sales falling 3.2% on an Easter-adjusted basis – and that comes on top of a 16.0% decline in the previous corresponding quarter. But resetting ranges takes time, and there are early signs that Target's new apparel and homewares offer is resonating with customers. We remain confident Guy Russo can turn Target around.

Kmart was much better, with same-store sales increasing 6.8% in the third quarter. The department store chain has been pre-emptively reducing prices to counter the threat from Amazon. While Kmart won't be immune, particularly once Amazon Prime launches, its low prices – Kmart's average sell price is $6 – and attractive merchandising should help shield it.

Bunnings ANZ was again the star of the Wesfarmers show, with same-store sales rising 7.7%. Favourable weather helped, and housing activity continues to support growth. Everyone – including us – is expecting sales growth to slow, but Bunnings has surprised before. We expect Bunnings to continue to produce above-market sales growth for some time yet.

The beast from the east

Even at Bunnings UK & Ireland (BUKI) the news could have been worse. Sure, it was easy to focus on the 15.4% decline in same-store sales in the third quarter, but March was a terrible month in the UK thanks to a vicious cold snap. While weather will always be an issue for BUKI, same-store sales in January and February were down by 5–8% (March was down in excess of 20%).

It's also worth remembering that BUKI's weak sales results come from the 227 Homebase stores which haven't yet been converted to Bunnings. The 23 Bunnings pilot stores are apparently growing much more strongly, with management calling out a figure of around 10%. We still doubt Wesfarmers will announce its exit from the UK at its forthcoming Investor Day on 7 June, as some market participants seem to be expecting.

In other Wesfarmers-related news – there's always something going on at a company this size – New Hope Corporation recently announced the settlement of legal action initiated by the Bengalla Mining Company. With Wesfarmers owning a 40% stake in Bengalla, and management having called out the legal action as a reason why it hadn't yet sold the stake, a sale might be imminent.

The thing about investing is that ‘good news' isn't needed for the share price to rise; only that things seem less bad. These results help explain why Wesfarmers' share price has bounced slightly since our upgrade to Buy several weeks back and, with the stock now trading above our $42 Buy price, we're downgrading to HOLD.

Note: The Intelligent Investor Equity Growth and Equity Income portfolios own shares in Wesfarmers. You can find out about investing directly in Intelligent Investor and InvestSMART portfolios by clicking here.

Intelligent Investor is loading up the van and going on tour in April and May, with events on the NSW central and north coast, the QLD mid-north coast and in Perth, Adelaide, Melbourne, Sydney and Canberra. If you'd like to hear us talk about building a portfolio to weather any storm, book your spot here.

Disclosure: The author owns shares in Wesfarmers.

Recommendation