Wesfarmers gets its priorities right

Recommendation

More than anything, the broking analyst reaction to Wesfarmers' Strategy Day was telling. Held earlier this month, one analyst called it a ‘waste of time'. Another said the 5–10 year timeframe Wesfarmers adopts was too long for the 2–3 years his clients use.

The strategy-based presentation was bereft of financial data the analysts could plug into their detailed-but-dubious models. No wonder they have trouble seeing the value behind ‘strategy'. Broking analysts aren't interested in whether Wesfarmers will be successful over the next ten years.

But the presentation was music to our ears – and the market's it seems. Managing director Rob Scott was at pains to highlight the growth opportunities within Wesfarmers' existing businesses. An acquisition isn't on the radar, and will only be ‘pursued opportunistically' in any case.

Key Points

-

No immediate acquisitions

-

Previous management made mistakes

-

Long-term focus reiterated

Scott declared that Wesfarmers has ‘no problem being smaller', implying that management might return capital to shareholders rather than buy businesses. Potential sales of assets like the Bengalla coal mine stake, Kmart Tyre & Auto, and the Coles hotel portfolio mean debt levels will probably continue to fall.

Scott wasn't afraid to critique his predecessors either. Wesfarmers had become too focused on meeting short-term budgets, he said, as well implying that past acquisitions were highly priced. We concur with Scott's criticisms, as we've said before.

|

Never fear, we're not members of the Rob Scott fan club yet. It's too early to call his seven-month tenure a success. Some actions he has taken, including the sale of Homebase, could be perceived as removing irritants while they can still be blamed on former management. |

In fact, this shift in management focus was largely behind our upgrade of Wesfarmers two months ago in Wesfarmers and the canny Scott. The market's increasing comfort with Scott's approach helps explain why the stock is up 19%.

A return to Wesfarmers paying more than lip service to long-term shareholder returns is welcome. We can't help but wonder if Michael Chaney's influence is playing a role here.

So if all this helps paint Wesfarmers' big picture, what detail did the presentation reveal?

The detail on retail

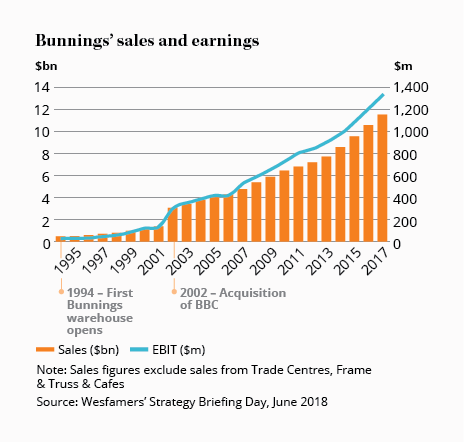

Well, Bunnings will be even more important to Wesfarmers following the Coles demerger. But with 369 stores and dominance of the ‘big box' hardware market, the retailer is closer than ever to maturity. While Bunnings intends to open 10–14 stores a year, the 9% sales growth rate the division has achieved over the past 15 years is likely to begin tapering off.

The Strategy Day confirmed that it would be more evolution than revolution for Bunnings. The retailer intends to expand and tailor its range, as well as continue to improve its digital platform. Perhaps the most significant opportunity however is engaging with commercial customers – including tradies – more effectively. Taking share from commercial wholesalers could help Bunnings maintain above-market growth for a while yet.

Coles, which should be demerged later this calendar year, is in something of a holding pattern until new managing director Steven Cain joins in September. While current managing director John Durkan delivered the Coles presentation, one presumes Cain – currently on gardening leave from Metcash – had some input.

Watch out Metcash

Interestingly, one of the slides in the Strategy Day pack, glossed over by Durkan, highlighted how Coles intends to take market share from the independent grocery sector (which accounts for 17% of the Australian market compared with 5% in the UK). As the former head of supermarkets at Metcash, Cain should have some good ideas how.

Coles intends to boost its private label penetration (one hopes by improving the product quality rather than just the packaging). But it will also follow in Woolworths' footsteps by rolling out smaller store formats than the company has traditionally preferred. Indeed it sounds like the store network needs updating: Durkan highlighted that capital expenditure will rise 20% to $1.2bn in 2019 as the refurbishment program steps up.

The Department Store division remains a tale of two brands. Kmart considers itself a product development company as much as a retailer and, to that end, it has started wholesaling to retailers in Indonesia and Thailand. Offshore growth was mentioned, although there are no plans to launch big box department stores anywhere overseas.

On Target

Target's turnaround is gathering pace, with most major categories returning to growth. The strategy is to sell quality fast fashion at price points up to 50% below international chains like Zara and H&M. But it will do so from a smaller footprint; with around half the brand's stores unprofitable, Target will close around 20% of its floor space over the next five years as leases expire.

The last major division, Industrials, is also Wesfarmers' most diversified. While it contains a few of the company's weaker and more cyclical businesses, there's potential for many of them to expand into adjacent areas.

The outlook for chemicals, energy and fertilisers, however, doesn't look promising in the short term. The WesCEF division has been benefiting from production disruption at a competitor's ammonium nitrate plant, but market oversupply means the future looks less rosy. The LPG market is also in decline, while increasing competition in Western Australian natural gas retailing is expected at some point. The 2018 financial year could be the high water mark for this division.

Industrials down

Elsewhere in Industrials, the Blackwoods distribution and Workwear businesses are both still in turnaround mode. Workwear is, however, further advanced, and it's likely to be another year before the benefits of Blackwoods' restructuring are reflected in the financial results. All up, it means earnings for the Industrials division are likely to fall in 2019.

In the end, the Strategy Day provided relatively few details about the growth opportunities open to Wesfarmers' existing divisions. But management rarely signals the details – it doesn't want competitors to get wind of them after all.

What we can be more certain about is that, under Rob Scott, Wesfarmers is making more of the right noises. We certainly understand why he was hired, although it will be his execution that drives long-term performance.

Nevertheless, management's words are a guide to a company's future priorities. And with the next ten years to think about, Scott looks to have it right. HOLD.

Note: The Intelligent Investor Equity Growth and Equity Income portfolios own shares in Wesfarmers. You can find out about investing directly in Intelligent Investor and InvestSMART portfolios by clicking here.

Disclosure: The author owns shares in Wesfarmers.

Recommendation