Wesfarmers counts on Chaney

Recommendation

Investing's about taking the rough with the smooth. But for Wesfarmers shareholders, the past five years have been as serene as a mountain lake on a calm day. With just a hint of pride, outgoing chairman Bob Every noted in this year's annual report that the company's total shareholder return had been 11.5% a year over the past five. You'd have to be happy with that.

Wesfarmers remains an above-average business, as well as one we'd love to own. The fact that Every has handed over the chairman's baton to former managing director Michael Chaney is unequivocally positive too. More on that later.

But the share price is down 15% since Wesfarmers: Interim result 2015 from 25 Feb 15 (Hold – $45.49). Ripples are appearing on this once-tranquil lake and it's time to review the valuation and Wesfarmers' story. In preview, the stock is edging closer to an upgrade and you should put it on your watchlist.

Key Points

Investor concerns about grocery market

Bunnings remains a strong performer

Michael Chaney's appointment positive

Table 1 shows an updated sum-of-the-parts valuation. While technically a conglomerate, only a couple of Wesfarmers divisions' make much difference to the valuation so they're the ones we'll concentrate on here.

Woolworths slides

Clearly, Coles is significant to Wesfarmers' valuation. And there's been a big shift in market sentiment towards grocery retailers over the past year – witness the near-25% slide in Woolworths' share price this calendar year. Woolworths has problems with more than just sentiment, having recently announced that 2016 first half profits will fall 28%-35% as it lowers grocery prices and improves service.

| 2015 | Low multiple | High multiple | Low value | High value | |

| EBIT ($m) | x | x | ($m) | ($m) | |

| Coles | 1,783 | 10 | 14 | 17,830 | 24,962 |

| Home improve. | 1,088 | 12 | 16 | 13,056 | 17,408 |

| Office supplies | 118 | 10 | 16 | 1,180 | 1,888 |

| Target | 90 | 15 | 25 | 1,350 | 2,250 |

| Kmart | 432 | 6 | 9 | 2,592 | 3,888 |

| Resources | 50 | 1,000 | 2,500 | ||

| WesCEF | 223 | 7 | 11 | 1,561 | 2,453 |

| Industrial & Safety | 90 | 10 | 15 | 900 | 1,350 |

| Less Corp./Other | (105) | (1,400) | (1,400) | ||

| Total | 3,769 | 38,069 | 55,299 | ||

| Less Net debt | (6,209) | (6,209) | |||

| Firm value | 31,860 | 49,090 | |||

| Value per share ($) | 28.29 | 43.59 |

While the headlines tell you Aldi is taking market share from the big two, the fact is there's not much evidence of that yet. If there were, Coles wouldn't have produced same-store sales growth of 3.6% in the first quarter of 2016.

Rather, Aldi's long-term success has come at the expense of the independent grocery sector. But with aggressive store-opening plans – particularly in South Australia and Western Australia – it could yet become a bigger threat to the majors.

The real explanation is that some of Woolworths' shoppers have been switching to Coles, which is why the former's same-store sales fell 1.0% in the first quarter. And investors have become concerned that Woolworths' drastic but necessary price cuts could trigger a price war with Coles.

The risks have risen, it's true. But both Wesfarmers' and Woolworths' management are keenly aware they operate in a duopoly and there's little sense in risking lower margins industry-wide.

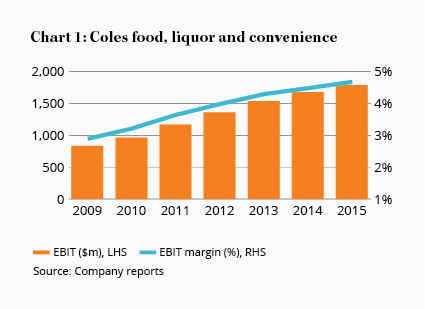

We've slightly reduced our 'low' and 'high' multiples for Coles to reflect the higher risks. Coles is slowing after the phenomenal earnings growth since its acquisition – see Chart 1 – and, having seen the damage inflicted on Woolworths, it won't let margins expand forever.

These multiples imply Coles' food and liquor business deserves a premium to Woolworths'. But with the market now less willing to apply a 'duopoly' premium, weakness has beset both companies' share prices.

One-horse race

While grocery retailing is a duopoly, home improvement is effectively a one-horse race. Masters' struggles are as well-known as Bunnings' success. With the home improvement market valued at about $45bn, Bunnings – with sales of $9.5bn – has room for above-market growth.

Bunnings has been reporting decent sales growth for many years (see Chart 2). Same-store sales growth was 8.8% in 2015, for example. But as it grows larger, the business necessarily becomes more cyclical.

Indeed, management admitted as much on the 2016 first quarter conference call. It attributed recent strong sales growth to housing market turnover and explained that growth would moderate from here.

Given the strength of Bunnings' business – as well as its consistent outperformance – we're sticking with the same 'low' and 'high' multiples as before. If it were a separately listed company, Bunnings would almost certainly justify a market capitalisation around $15bn – the mid-point of our two valuations.

While Coles and Bunnings together account for more than three-quarters of our Wesfarmers valuation, there's a smaller division that deserves comment. Conditions in the Resources division have turned truly ugly, with management recently confirming it would report a loss in 2016. That's quite a turnaround from 2012, when Resources generated EBIT of $439m.

So what's going on? And why on earth have we increased our low valuation compared with 25 Feb 15?

Coal weakening

The first question can be answered easily enough. Coal prices have continued weakening and Wesfarmers' hedging policy means the benefits of the lower Australian dollar won't be evident this financial year.

To answer the second question, consider the two coal assets contained within the Resources division – a 40% stake in the Bengalla mine and 100% of the Curragh mine. The Begalla mine produces mainly thermal coal, which is used for electricity production. Our long-term negative view on coal has been dead right – see Coal: A dark future ahead? – and our negative views on thermal coal in particular are strongly held.

But New Hope Corporation – supposedly the value-seeker of the coal industry – has just paid Rio Tinto $865m for a 40% stake in the Bengalla mine. That implies the entire mine is worth $2.2bn and that Wesfarmers' own 40% stake is worth $865m too. Well, it might imply that except that everyone thinks New Hope paid a crazy price.

Curragh is considered the superior asset of the two mines, mainly because it produces premium-priced metallurgical coal for steel-making. Not so long ago Wesfarmers management valued the Curragh mine in excess of $5bn and it's hard to imagine it being worth much less than $2bn today.

Nevertheless, conditions for coal are challenging and likely to remain that way. So we're going to plump for a valuation for the entire Resources division of $1bn at the low end and $2.5bn at the high end.

Buyer beware?

Of course, challenging conditions tend to attract value-oriented companies like Wesfarmers. Might Wesfarmers actually end up buying assets for its Resources division?

Don't rule it out. Coal mines are out of favour, as are energy assets. Indeed, in June Wesfarmers quietly took a 14% stake in the unlisted Quadrant Energy, a company that supplies about 40% of Western Australia's gas. Further investments or even a significant acquisition in the energy sector would not surprise.

That's why Michael Chaney joining the board as chairman is undoubtedly positive. Chaney, Richard Goyder's predecessor, deserves his reputation as the architect of Wesfarmers' success. Managing director from 1992 to 2005, Chaney built Bunnings in Western Australia, acquired the Curragh mine for just $200m in 2000, then took Bunnings national with the acquisition of BBC Hardware in 2001.

Wesfarmers will almost certainly make another major acquisition at some stage. Richard Goyder recently announced a management restructure that 'will free me and others up to look at opportunities'. While acquisitions always carry risk, we're much more comfortable knowing that Chaney will have the final say.

Wesfarmers' acquisition record has been generally good, save for the fact it paid for Coles Group with too much debt. With Goyder and Chaney now dancing a duet, there's less chance of shareholders taking a tumble.

We've made minor adjustments to the other divisions in our sum-of-the-parts valuation but most are similar to last time. Adding it all up, the valuation per share isn't significantly different from that of 25 Feb 15.

That means the value equation is significantly better. With Wesfarmers' share price down 5% since Wesfarmers: 1Q sales from 22 Oct 15 (Hold – $40.87), we're getting closer to an upgrade. Further bad news in the grocery or resources sectors could get us there but for now the stock remains a HOLD.

Recommendation