Wesfarmers and the canny Scott - Part 2

Recommendation

Here's one thing you can count on at Wesfarmers: future acquisitions won't be in retail. As we saw in Part 1, Wesfarmers' two best businesses – Bunnings and Coles – are retailers. And together they account for almost three-quarters of the company's value.

But Rob Scott isn't a retailer. He was most recently the managing director of Wesfarmers' ‘Industrials' division. And he's been hinting that Industrials is likely to be where the acquisition action will happen.

Before getting to the fun bit – speculating on potential takeover targets – we need to conclude our review of Wesfarmers' valuation. And that brings us back to retailing, at least for the time being.

Key Points

-

Remaining assets generally high quality

-

Hidden upside/potential

-

Large non-retail acquisition likely

Department stores

While the company's remaining retailers aren't small, they are dwarfed by Coles and Bunnings. But it's a measure of Wesfarmers' size that its Department Store division would – were it listed on the ASX – be valued by the market at perhaps $6bn.

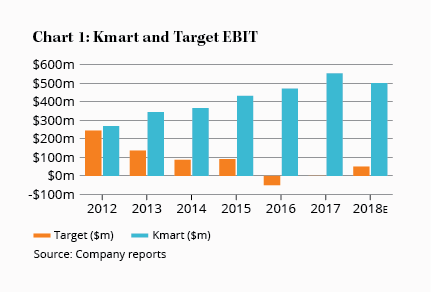

The division contains two assets – or possibly three, if you count the highly capable divisional managing director Guy Russo. Russo was responsible for Kmart's stunning reinvention, and the results are plain to see in Chart 1. Earnings doubled between 2012 and 2017, although margins looked a little high and will come down this financial year.

Rob Scott compares Kmart to Irish retailer Primark, which combines a focused but exciting range of clothing and homewares at ultra-low prices. Kmart's success has contributed to woes at other discount department stores, including Woolworths' Big W but also stablemate Target.

As Kmart has thrived Target has struggled (Chart 1, again). Turning around a struggling mid-market department store is neither fast nor easy, but Russo is doing the right things. Having eliminated unprofitable ranges and events, he's refocusing the product range on quality fast fashion at prices lower than Zara and Myer. It's a crowded segment but early signs are positive – and Target should return to profitability in 2018.

Unfortunately the consolidation of Kmart and Target into one ‘Department Stores' division means Wesfarmers is no longer breaking out each chain's profitability separately. But, as the sum-of-the-parts table in Part 1 shows, more than 80% of the division's valuation is attributable to Kmart, with a nominal valuation for Target.

Longer term there's some risk that Amazon makes inroads to Kmart's and Target's market but with almost $10bn of sales between the two chains, we're comfortable with a valuation of $5.8bn.

Officeworks

Office supplies retailer Officeworks is another quality asset but – at a valuation of ‘only' $2bn – perhaps a little small for the Wesfarmers portfolio. It's arguably under threat from Amazon, which helps explains why the proposed initial public offering last year was a non-starter.

However, Officeworks is well-placed to adapt and even thrive. Its brand, store network and strong online offer – 17% of sales are online – helped earnings grow 69% between 2012 and 2017. While Officeworks won't make much difference to the Wesfarmers behemoth, it's a better business than many think.

Industrials revolution?

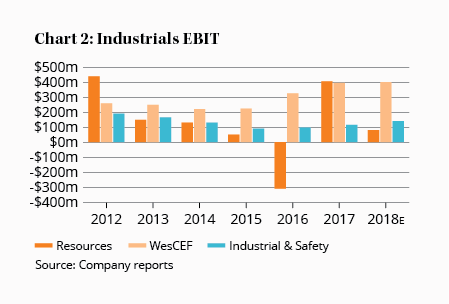

Perhaps the least well-known of Wesfarmers' divisions is ‘Industrials', something of a misnomer that contains assorted assets worth more than $7bn. The sub-divisions are Resources, Wesfarmers Chemicals, Energy & Fertilisers (WesCEF), and Industrial & Safety.

The Industrials division is a bit like a confectionary showbag at the Royal Easter Show. It contains a few sweet treats but also some other things you'd rather it didn't.

Chart 2 shows the variable performance of the sub-divisions over the past six years. But don't write off the Industrials division completely as it might contain hidden assets, or at least ones that could be worth more combined with other businesses.

The Industrials division will become true to label after Wesfarmers disposes of its remaining resource assets. The company has said its coal mines aren't compatible with retailing, and Curragh has already been sold. The $700m price was lower than expected but coal assets are like the Cadbury Clinkers in a showbag. They're nobody's favourite, least of all now.

Wesfarmers' last remaining coal asset is a 40% stake in the Bengalla thermal coal mine. New Hope Corporation purchased a 40% stake in Bengalla in 2015 for $865m so we're hopeful of a price in that vicinity. After Bengalla is sold Wesfarmers will no longer have a ‘Resources' division, and the proceeds will help repay debt.

WesCEF

WesCEF is a significantly diversified business in its own right. WesCEF owns CSBP which is not only a major supplier of fertiliser to Western Australia's agricultural sector, but a supplier of ammonia, ammonium nitrate and sodium cyanide for the resource and industrial sectors.

WesCEF also contains Kleenheat, a supplier of Liquified Petroleum Gas and a retailer of gas and electricity in Western Australia and the Northern Territory. WesCEF's underlying diversification has helped reduce earnings volatility, while returns on capital have been surprisingly good (28% in the first half of 2018).

Not so at Industrial & Safety, which generated a return on capital of just 8% in the first half. This division has been hit by the resources downturn in recent years, but the Blackwoods industrial distribution business has also been beset by structural issues. The 2014 acquisition of the Workwear Group – which owns the King Gee and Hard Yakka brands – also looks like a dud.

The turnaround of Industrial & Safety is still a work in progress and there's potential upside over time. But, just as Target became a victim of Kmart's success, so Blackwoods has suffered as Bunnings has become the dominant destination for tools and hardware. Industrial & Safety is, however, the smallest of Wesfarmers' divisions, and whether it achieves $100m or $200m of operating earnings is almost immaterial.

Getting down with the upside

The last line in our sum-of-the-parts is, we admit, a little unorthodox. We've allowed $3bn for ‘management upside' in our base case for the value we expect the new management team to create. It's necessarily difficult to quantify future value creation but Rob Scott's words and actions since becoming managing director suggest there's potential upside.

We've already covered (and quantified) how we think the demerger of Coles might release value. But Scott's focus on ‘data and digital initiatives' could be almost as significant. The airlines already know the value of loyalty schemes and they can be worth a great deal, but Coles' FlyBuys loyalty program – with 8.1m members – looks like an underappreciated asset.

Wesfarmers intends to retain a stake in FlyBuys, with the demerged Coles to hold the remainder. While FlyBuys' earnings are currently immaterial, there's an opportunity to make its points more valuable, as Qantas has done. What's more, databases – especially those rich with customer data like FlyBuys – are valuable. Scott's aim will be to use FlyBuys data to sell its 20m weekly customers more stuff.

Scott's shopping list

In the meantime, the $3.2bn of net debt that Wesfarmers currently carries is dwindling rapidly. The sale of Bengalla and transfer of debt into Coles will mean that Wesfarmers should have negligible net debt by the end of the calendar year. It's a big, flashing signal that acquisitions are on the agenda.

Acquisitions don't always create value, it's true. Wesfarmers has had its share of duds, including Homebase, the Workwear Group and Coregas. But there have been few absolute disasters because Wesfarmers' process is robust. That Michael Chaney – arguably Wesfarmers' most capable former managing director – will be overseeing things as chairman is reassuring.

|

Here's a list of the most obvious ASX-listed Wesfarmers' takeover targets, but left-field (and opportunistic) targets are just as likely.

|

So what might be on Wesfarmers' shopping list?

The most recent rumour was Fletcher Building, as its Tradelink and Placemakers divisions would slot in nicely alongside Bunnings. That Fletcher Building looks potentially cheap made it a noteworthy candidate. But Wesfarmers has since confirmed it doesn't own shares in Fletcher Building, although presumably that doesn't rule it out entirely.

There are plenty of other decent-sized candidates. Fertiliser and explosives companies like Incitec Pivot or Orica are obvious choices, while crop protection company Nufarm is also a possibility.

Distribution and wholesaling is also one of Wesfarmers' strengths, but reasonably priced and decent-sized targets are hard to find. Reece has long been on Wesfarmers' shopping list but the Wilson family's controlling stake prevents the company from reaching the checkout.

Left-field targets are also possible. In early 2007, few imagined that Wesfarmers would acquire Coles Group for $19bn – a higher market capitalisation than Wesfarmers' own at the time. Hospital operator Healthscope is another rumoured target but we struggle to see value, or how it would fit within Wesfarmers' portfolio.

Heading overseas?

International targets can't be ruled out either but the board will be wary after Homebase. One thing's for sure: Wesfarmers will need a large acquisition to move the needle. And anything the size of Orica or Incitec Pivot – with enterprise values of $9bn and $8bn respectively – will require an equity raising.

Wesfarmers is an acquisitive company and, while that tag comes with risk, shareholders pay management to identify and create value. Sometimes they get it right, and sometimes they don't. But the process matters, and Wesfarmers' opportunistic and disciplined approach counts for a lot.

Even without acquisitions, Wesfarmers is underpriced. To realise double-digit returns over the long term, however, we are counting on Wesfarmers to buy well. We judge that the odds of that are good.

Below $42, Wesfarmers remains a wonderful business at a reasonable price. Do not underestimate how much a company like this can contribute to your long-term returns. BUY.

Intelligent Investor is loading up the van and going on tour in April and May, with events on the NSW central and north coast, the QLD mid-north coast and in Perth, Adelaide, Melbourne, Sydney and Canberra. If you'd like to hear us talk about building a portfolio to weather any storm, book your spot here.

Note: The Intelligent Investor Growth and Equity Income portfolios own shares in Wesfarmers. You can find out about investing directly in Intelligent Investor and InvestSMART portfolios by clicking here.

Disclosure: The author owns shares in Wesfarmers.

Recommendation