Virtus, Monash and the $30,000 babies

Recommendation

For an increasing number of couples, doing what comes naturally requires assisted reproductive technology (ART). In fact, at current levels, almost one child in every classroom – 3.3% of Australian children – is born as a result of ART.

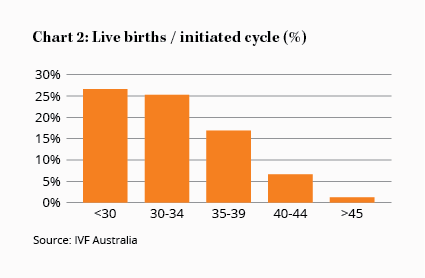

In vitro fertilisation (IVF) is the most common ART procedure and also one of the most expensive. A standard IVF cycle costs around $9,000 and women typically require three or more cycles to become pregnant. Even then, a clinical pregnancy isn't the same as a baby in your arms: only 80% of IVF pregnancies result in a live birth, and that rate falls to roughly 50% for women over 40.

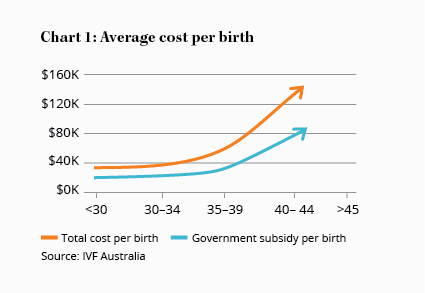

The total cost per live birth is around $35,000 for women under 35. For women over 40 – who account for 1 in 4 patients – it can easily surpass $100,000.

Key Points

Government funding significant risk

Not an immediate threat

Our view on Primary's impact is unchanged

Thankfully, though, Australia has one of the most supportive public funding policies for ART in the world. Between Medicare, the Pharmaceutical Benefits Scheme, and the Extended Medicare Safety Net (EMSN), a bit over half of the cost per cycle is covered by the Government.

What's more, Australia has no restrictions on marital status, maternal age, the presence of existing children or health issues such as obesity. Women receiving treatment are entitled to an unlimited number of cycles.

Policy and rates

Given the significant expense, Government support makes a big difference to ART activity. Australian and Singaporean mothers reclaim as much as 60% of the cost per cycle from public funding. Consequently, ART penetration is high, with roughly 1,700 and 1,200 fresh cycles per million people per year performed in Australia and Singapore, respectively.

In contrast, Irish mothers receive only 20% in tax deductions, while in the USA the patient foots the bill entirely. In these countries, IVF is used much more sparingly: just 750 cycles per million are performed in Ireland and just 500 per million in the USA.

Should Australia remove its funding for ART, it's easy to imagine revenue at providers like Virtus Health and Monash IVF falling by a quarter or more. And Government funding has actually been declining in recent years: In January 2010, the Government introduced a cap to the EMSN, which effectively doubled a patient's out-of-pocket expense to around $2,500 per cycle, and more than $4,000 if they opt for add-on services like genetic screening or advanced embryo selection.

Should Australia remove its funding for ART, it's easy to imagine revenue at providers like Virtus Health and Monash IVF falling by a quarter or more. And Government funding has actually been declining in recent years: In January 2010, the Government introduced a cap to the EMSN, which effectively doubled a patient's out-of-pocket expense to around $2,500 per cycle, and more than $4,000 if they opt for add-on services like genetic screening or advanced embryo selection.

In the 12 months following the EMSN changes, the number of cycles performed fell 13% – a far cry from the 10% annual growth rate enjoyed in the preceding five years.

And the Government continues to tinker with Medicare funding. In January 2015, the EMSN threshold was raised from $1,248 to $2,000, meaning patients will need to incur higher out-of-pocket expenses before they are eligible for the additional Medicare benefit. The proportion of cycle costs covered by Medicare and the EMSN has fallen from around 75% in 2009 to 55% today.

What's more the EMSN threshold is only indexed to inflation. ART pricing has increased at 4-5% a year over the last few years; if that rate continues, it will mean out-of-pocket expenses will grow over time, which could slow growth in cycle volumes.

We consider a change to Medicare funding to be the biggest risk facing Virtus and Monash; however, a major shift in policy any time soon seems unlikely.

Rational policy

To varying degrees, all of the major political parties currently support funding for ART. In fact, despite the recent decline, there are several good reasons to actually increase funding. For one thing, lower out-of-pocket expenses mean couples are under less pressure to conceive during the first cycle. This, in turn, has encouraged Australian doctors to overwhelmingly opt for single embryo transfers, which is safer for both the mother and developing child. Only 2% of Australian cycles result in multiple births, compared to 30% in the USA and 18% in the UK, where funding is less generous.

Additionally, a child's future economic contribution in taxes, insurance and productivity will, in most cases, far exceed the cost of their birth. In 2006, UK researchers concluded that a newborn's long-term financial benefit to society was more than 10 times the cost of IVF. In any case, with the population aging and the number of Australians over 65 expected to rise by 2.6m by 2035, having a few more youngsters around to shoulder the pension burden won't go astray.

Additionally, a child's future economic contribution in taxes, insurance and productivity will, in most cases, far exceed the cost of their birth. In 2006, UK researchers concluded that a newborn's long-term financial benefit to society was more than 10 times the cost of IVF. In any case, with the population aging and the number of Australians over 65 expected to rise by 2.6m by 2035, having a few more youngsters around to shoulder the pension burden won't go astray.

Unfortunately, despite ART expenditure accounting for less than 0.5% of the healthcare budget, if there's one thing we know the Government isn't particularly good at, it's thinking long term. We can't rule out a drastic change to policy, especially as $30,000 babies probably make an easy target for budget cutters.

Nonetheless, for many, IVF isn't considered discretionary spending – even a drastic change to Medicare funding won't make a dent in human psychology. The desire to have children runs deeply. And, as the average maternal age continues to rise, so too will the prevalence of infertility and demand for IVF. Cycle numbers took a hit in 2010, but it proved a short-term blip and they now exceed their peak before the EMSN changes.

Share price slide

Virtus and Monash's share prices have continued to decline since Virtus announced it is losing market share to IVF bulk-billing upstart Primary Health Care (see Virtus warns on growth from 2 Jun 15 (Buy – $6.11)).

Primary's entry to the market is disruptive, but its low-cost offering won't be for everyone. A 'fresh' IVF cycle is particularly invasive and stressful. To cut down on costs, budget IVF providers use a local, rather than general, anaesthetic, and use less hormones and drugs to stimulate egg production. Instead of collecting 10 eggs, the doctor may only retrieve, say, three. It's unlikely all those eggs will be fertilised and survive, so only one may be available for implantation. If that embryo fails, you start from scratch.

This is in contrast to the full-service offering by Virtus, Monash and Genea, where more eggs are collected on the first round. With genetic screening and more embryos to choose from, the fertility specialist has the luxury of implanting the best of the best, which affects pregnancy rates.

What's more, any superfluous healthy embryos can then be frozen and saved for later use if this cycle isn't successful – instead of dishing out $9,000 again for a fresh cycle, you may be able to opt for a 'frozen' cycle, which only costs $3,200.

While budget IVF offerings are quite a bit cheaper up-front, if the cycle isn't successful, it can actually be more expensive in the long run with an added layer of stress from having to change doctors at each visit (compared to a full-service clinic, where your support team remains constant).

Our view remains unchanged: Virtus and Monash face pricing pressure, margin declines and a loss of market share, but they also have high returns on capital, economies of scale, solid brands and plenty of free cash flow. The risks are real, but there's still plenty to like.

Virtus's share price has fallen 7% since Doubling down on Virtus and Monash IVF from 3 June 15 (Buy – $5.69) and the stock now has a price-earnings ratio below 14 and free cash flow yield of 7.1%. Monash's stock has declined 9% since 3 June 15 (Buy – $1.45) and trades on a similarly undemanding price-earnings ratio of 14.

Virtus is the stronger player both operationally and financially, so our preference is for a heavier weighting towards Virtus. BUY

Note: Our model Income, Growth and Premium portfolios own shares in Virtus Health and Monash IVF.

Disclosure: The author owns shares in Virtus Health.

Recommendation