Virtus Health's genetic goldmine

Recommendation

Not since the stork theory of delivery was abandoned has assisted reproduction been advancing so rapidly. And Virtus Health's most promising growth engine is at the forefront – the provision of genetic screening, diagnostic and pathology tests. We'll get to the advances in a moment, but, first, we need to put them in context.

No matter how fancy its name, in vitro fertilisation (IVF) is still a primitive procedure, little changed since the first 'test tube baby', Louise Brown, was born in 1978.

You start by bombarding the ovaries with hormone levels far higher than would ever occur naturally – hyperstimulation, as it's known. A host of other drugs are used to suppress ovulation because, instead, 5–20 eggs are sucked out at warp speed using what amounts to a long needle and a small vacuum cleaner. Next, the eggs are placed into a petri dish that, no matter how state-of-the-art, is still far more hostile than a womb.

Key Points

Genetic tests are becoming widespread

Cost of tests declining rapidly

Improves success rates and margins

The father's semen is washed and individual sperm cells made to fight for their life in a 'swim up' competition, with the fastest and most agile chosen for fertilisation.

In some cases, enough eggs are then fertilised to fill a mini-bus with children. However, most of the embryos are frozen; Only the healthiest one is selected for transfer back into the uterus – where, under perfect conditions, you might expect it to develop into a baby about half the time.

With this in mind, the 'miracle' isn't so much that infertility was overcome as the fact that people pay Virtus upwards of $10,000 to go through the ordeal – and more than a few times, in most cases. Hope is a powerful motivator.

In your genes

That's the standard procedure. At full-service clinics, you can opt for a special add-on: preimplantation genetic diagnosis (PGD), which involves removing one or two cells from a developing embryo for testing before it's transferred to the uterus, typically at the 8-cell stage around three days in. The testing is done to check for genetic abnormalities and to ensure the embryo has a normal set of chromosomes.

The benefits are clear. PGD can be used to screen for a fleet of heritable diseases, such as cystic fibrosis, Down's Syndrome and Tay-Sachs disease. It can even look for genes that predispose an individual to breast cancer. Given 10 visually identical embryos, PGD can pinpoint which one has the best chance of survival once implanted, which improves pregnancy success rates.

Pathology expansion

While the benefits of PGD are significant, the procedure doesn't come cheap. Virtus charges $1,640 for a preliminary PGD evaluation and then $700 per embryo, which typically adds $2,500-5,000 to the cost of an IVF cycle (taking the average spend per customer up to $13,800). What's more, Medicare doesn't provide a rebate for PGD; it's an entirely out-of-pocket expense.

Still, revenue from diagnostics, which includes blood and semen testing in addition to PGD, increased 15% in the year to 30 June – an impressive result given the total number of cycles performed in Australia rose just 1%.

Virtus conducts more than half a million endocrinology, andrology and genetic tests each year. Diagnostics now accounts for around 9% of revenue, with that figure almost certain to increase over time.

The company has been slowly adding to its assortment of tests, including standard pathology testing like Vitamin D and chlamydia. Virtus also recently purchased a pathology lab in Sydney to expand its range of specialised diagnostics, including haematology, microbiology, serology and immunology.

'Importantly, this acquisition is central to our strategy to continue to grow our diagnostics offering. With a comprehensive pathology service in-house and a designated diagnostics division, we will enhance our capacity to introduce new genetics based testing capabilities – such as Next Generation Sequencing – to both internal and external referrers,' said chief executive Sue Channon.

Benefits of growth

Unlike most areas of medicine, pathology is capital rather than people intensive. Tests typically rely on expensive equipment and this means there's a benefit to having them perform as many tests as possible. Each additional test completed using the equipment lowers the average cost per test and improves margins. Virtus has a strong incentive to grow the division, increase the number of tests available and outsource its offering to third parties.

PGD and pathology testing has other benefits too: it allows Virtus to increase the revenue it generates per cycle, improves success rates (which are a big focus of marketing) and can give Virtus a slight short-term competitive advantage, at least so far as new tests and techniques are concerned. And there are plenty of new tests on the horizon.

There are already prenatal tests for more than 800 genetic disorders, with more added to the arsenal each year. Advances in genome sequencing, analysis and the discovery of genes that correlate with early and late stage implantation failure has put PGD centre stage in IVF research.

Moore's Law

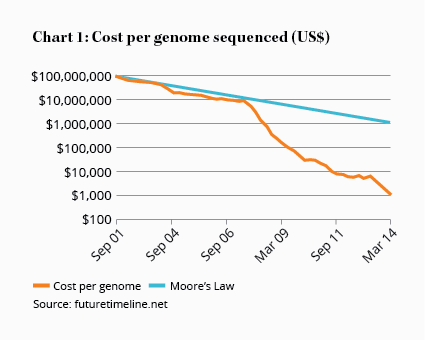

Of particular note, the cost of genetic sequencing is falling rapidly: in just five years, the cost of whole genome sequencing has fallen more than 95%. Costs are falling so quickly, the famed Moore's Law of computing power looks lethargic in comparison (see chart 1).

Beyond genetics, equipment and technology used in IVF is also becoming more efficient, with improvements in robotics, incubators, microfluids, embryo storage and automated processing.

What does this mean for investors? As success rates and efficiency improve, it seems inevitable that IVF will follow the cost curve of most technology-intensive processes – it's going to get cheaper.

What does this mean for investors? As success rates and efficiency improve, it seems inevitable that IVF will follow the cost curve of most technology-intensive processes – it's going to get cheaper.

While Virtus has been raising the price of its services for several years now, we don't expect this trend to continue for much longer, especially now that budget 'low intervention' IVF providers are becoming more common (see Virtus, Monash and the $30,000 babies).

Revenue, however, isn't predestined to fall. As IVF and PGD become cheaper, it will also spur demand. Volume growth in cycles has ground to a standstill for a couple of years now, but that's not to say there isn't plenty of pent-up demand at the right price.

The Fertility Society of Australia estimates that one in six couples of reproductive age suffer from infertility, yet only around 50% seek medical advice. Of these, only around half get the specialist treatment they need, mainly on account of the extremely high cost of assisted reproduction and limited coverage by Medicare. There's still a huge untapped market for IVF out there, with room to at least double the number of cycles performed each year over the long term.

We saw the effect that reduced prices have in the final quarter of 2015, where the industry-wide number of cycles performed in NSW increased 6% – well above the national average of 1.4% – due to the introduction of bulk-billed IVF by Primary Health Care.

Left behind

PGD and advancing technology hold enormous promise. With pregnancy success rates only around 30%, there's still plenty of scope to improve screening, PGD, embryo development and freezing techniques.

In late 2014, Virtus was the first IVF provider in Australia to provide karyomapping, a faster, cheaper form of testing for a specific subset of genetic disorders. This is encouraging, as is Virtus's recent lab acquisition and management's clear desire to improve the company's diagnostics capability.

Nonetheless, Virtus still only invests meagre amounts of money back into research – just $3.5m, or 1.5% of revenue in 2015, compared to around 10% for Genea.

The company has stellar returns on capital, economies of scale, a pristine balance sheet and plenty of free cash flow. Virtus has the financial firepower to really make a mark on IVF research. We suspect it's held back in recent years as a way to temporarily boost net profit in the time surrounding its public listing.

The company can underinvest in research without any repercussions for many years, but at some point Virtus will need to lift its research game or face being left behind by the industry it dominates.

With the share price up 7% since Virtus: Result 2015 from 25 Aug 15 (Buy – $4.84), the stock has an undemanding price-earnings ratio of 13. BUY.

Disclosure: The author owns shares in Virtus Health

Recommendation