Village Roadshow's reporting season flop

Recommendation

According to the final slide in Village Roadshow's 2016 annual result presentation, ‘people will always want to go out!'. So confident is the company in this claim that management even added an exclamation mark.

To be fair, management's probably right. Ever since the motion picture camera was invented in the 1890's people have attended cinemas for their entertainment. Even before motion pictures – going back to ancient Greece and before – theatres drew people together with plays and other shows.

Key Points

-

Film distribution under pressure

-

Higher ticket and food prices boosting cinemas

-

Theme park stable

The biggest problem for Village, though, isn't whether people will still want to go out but what they're doing when they're at home.

Content Distribution

Five years ago, Village's biggest profit generator wasn't its theme parks or cinema exhibition business but its film distribution business. How times have changed. Despite Village still being among the top three distribution businesses in Australia, this division's operating profit has since halved to $21m.

The problem is that the overall size of the market is shrinking: with the increasing popularity of video-on-demand (VOD) platforms such as Netflix or Stan, fewer people are buying DVDs. As a result, the home entertainment market (DVDs and television) shrank by around 4% in 2015 after contracting by around 6% the previous year. Although the digital download market increased by 7%, this was off a much lower base and is yet to offset the change.

Nevertheless, Village is confident that things will improve in 2017. The company has completed a restructuring of this division, including closing its New Zealand branch, and this should lead to lower costs.

However, as always, the key will be the success of the titles it distributes and this is something that can't be accurately predicted. So far there is reason for optimism after the success of the DC Comics/Warner Brothers' Suicide Squad and Bad Moms: both took turns at the top of the box office in August.

Even so, with more people using VOD services to watch content and fewer watching DVDs, the distribution chain has undergone a fundamental shift. Village will be hoping that the digital dollars coming in catch up with the analog dollars going out, but it might be waiting a while.

Using an earnings before interest and tax (or EBIT) multiple of six times, we value the distribution business at around $220m in our base case, which assumes slightly lower revenue but also lower costs (see Table 1). Although the multiple remains the same, our bull case assumes revenue growth and lower costs whilst the bear case has revenue falling and costs increasing.

Cinema Exhibition

Despite 2016 boasting six of the all-time 50 highest grossing movies in Australia, total admissions to the company's cinemas increased by only 1% on the prior year. Compared to 2011, admissions have increased a more reasonable 4% but as Village has increased its screens by 6% since then, fewer people are visiting each individual Village cinema.

This trend isn't limited to Village but is consistent across all cinemas in Australia. According to Screen Australia statistics, whilst the percentage of Australians that go to the cinema has remained stable in recent years, the frequency of visits has dropped. The average person visited the cinema 6.8 times in 2014 compared to 7.8 times in 2004 and 10.7 times in 1994. Considering the increased cost of going to the movies, as well as expanding entertainment options both inside and outside of the home, it isn't unreasonable to expect that this trend has continued into 2016.

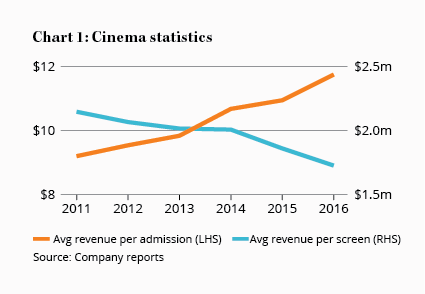

Despite this, Village has been able to generate year-on-year revenue growth of almost 6% per year since 2009 thanks to higher ticket prices (helped by enhanced viewing options such as Gold Class and Vmax) and more expensive food and beverages (see chart 1). In the cinema business, total admissions are a key profit driver as a cinema will typically use ticket sales to cover operating costs whilst food and drink sales drive profit.

Assuming Hollywood keeps producing movies that people want to see, the key question is: how much more can Village raise prices without pushing people away? This is especially true with technology making it easier to watch movies outside of cinemas, and studios considering shortening the exclusivity period exploited by cinemas before movies become available via other means such as pay-TV or Netflix.

In valuing the cinema business, our base case assumes a modest increase in the average revenue per admission but that total admissions remain around 25m per year. Using an EBIT multiple of eight times leads to a value of around $520m. Our bear case assumes a slight fall in both admissions and revenue, whilst the bull case assumes higher admissions and higher revenue.

Theme Parks

Compared to the challenging film market, the company's theme park division is relatively stable; in fact, operating profit barely budged from the year before.

The company blamed the lack of growth on a new subscription-based membership program for its Gold Coast properties including Warner Bros. Movie World and Wet'n'Wild. Under this model, revenue is recognised pro-rata across the 12-month membership period and so, with the subscription model being introduced in the second half of 2016, a large amount of revenue was deferred to 2017.

There always seems to be some reason why this division under-delivers, but it makes a change to hear complaints about something other than the weather (although this was still mentioned).

| Valuation ($m) | Bear | Base | Bull |

| Cinema exhibition | 390 | 521 | 634 |

| Theme parks | 357 | 489 | 632 |

| Distribution | 96 | 219 | 346 |

| Marketing solutions | 70 | 100 | 130 |

| Total operations | 913 | 1,329 | 1,743 |

| VREG | 160 | 160 | 160 |

| Corp costs | -300 | -300 | -300 |

| Net debt | -535 | -535 | -535 |

| Enterprise value | 238 | 655 | 1,068 |

| Per share | 1.48 | 4.06 | 6.63 |

Even so, there are at least a few clear areas where the theme park division should be able to grow: the company has signed an agreement to bring the Topgolf concept (a golf driving range that also acts as a party venue) to Australia, as well as new attractions and extended trading hours at its Sydney Wet'n'Wild property which should help boost attendance. The company is also aiming to expand in China, with properties set to open in mid-2017 which Village will manage.

Lack of disclosure around the Chinese venture makes it difficult to value. We'll stick with our estimate of $120m, which gives us about $490m for the theme park business in our base case when added to the properties on the Gold Coast, in Sydney and Las Vegas. For its theme park properties in Australia and Nevada, we estimated total guests, the average revenue each guest generates, total expenses and depreciation charges to calculate normalised operating profit figures under our three cases. We then used an EBIT multiple of eight to estimate the value in each case.

Other businesses

The company's new marketing solutions business, which operates consumer rewards and loyalty programs, continues to show potential, with operating profit of $7m in 2016 following the acquisition of UK sales company Opia. This division continues to sign up new clients and should grow faster than the other divisions in the years ahead. In our valuation we have used an EBIT multiple of 10 times.

The final part of the Village puzzle, film production, comes from its 47% ownership of Village Roadshow Entertainment Group (or VREG). The entire carrying value of the equity portion of this investment was written down to zero on Village's balance sheet, which justifies our previous decision to assume the value of Village's ordinary share investment is zero. This leaves only the preferred shares, which we value at around $160m.

Valuation

In sum, Village Roadshow operates in a risky and fast-changing environment. There's a wide range of potential outcomes, as you can see from our 'bear, base and bull' valuations in Table 1. Even that range could prove too narrow and we wouldn't be astonished to see better or worse outcomes than our bull and bear estimates. With this in mind, we have increased Village's business risk to medium-high.

What of its valuation? We'd want to see the stock at or below our base case valuation to recommend it as a Buy and we'd likely suggest selling it anywhere above our bull case valuation. As a result, we're lowering our Buy price to $3.50 (from $4) and our Sell price to $6 (from $7). HOLD.

Recommendation