Veda's dark side

Recommendation

Every move you make, every step you take, I'll be watching you.

So said Sting in 1983 (somewhat creepily, it must be said). But did you know there's a company that watches every move you make and every step you take? Or it does when you apply for credit, anyway.

The company is Veda Group. With records on more than 16m Australians over the age of 18, it probably has a file on you. If you've ever applied for a mortgage, credit card or personal loan, it certainly will.

Key Points

Stable, near monopoly business

Growth from comprehensive credit reporting

Private equity ownership niggles

Reminiscent of Big Brother this might be, but it's all perfectly legal. Veda has been allowed to collect, analyse and distribute information about you and your creditworthiness for almost 50 years. If you're a man or woman of a certain age – and if you remember Sting's song, you probably are – then you might know Veda as the old credit reference bureau.

More than 12,000 banks and other institutions use Veda's database and analytical tools to verify your identity and decide whether to extend you credit. Veda also operates the national tenancy database (ntd.net.au) and carhistory.com.au, which provide information on prospective tenants and used cars respectively.

Are you worthy?

Australians are somewhat unusual in that few of us take much interest in our creditworthiness (unless and until there's a problem of course). By contrast, in the US it's reasonably common for people to know their FICO score, a number that represents your creditworthiness at a point in time. Veda introduced the VedaScore in 2013, which it hopes will become the default creditworthiness score locally.

So that's the consumer side of the business. Together Veda's consumer credit bureau and the various products individuals can purchase contribute 46% of revenue. But Veda also operates a commercial credit bureau, accounting for 42% of revenue, which provides similar credit information and data on businesses.

| You can obtain your VedaScore for free at www.getcreditscore.com.au (assuming you're willing to provide certain information for marketing purposes). It's also a legislative requirement that Veda must provide you with a free copy of your credit file if you ask (see www.mycreditfile.com.au), or you can pay extra if you want Veda's bells and whistles. We recommend you check your credit file with Veda regularly to ensure you detect identity theft. |

The remaining 12% of revenue comes from Veda's credit bureau operations in New Zealand, and investments in credit bureaus in Singapore, Malaysia, Cambodia and the United Arab Emirates.

Veda Group is a wonderful business. As the largest and longest-operating credit bureau in Australia, it has the most comprehensive database. Users not only draw information but supply it with new data as well. This creates a 'network effect', increasing the database's usefulness for everyone.

Near monopoly

Veda Group's consumer credit bureau isn't a monopoly in Australia but it's close, with an 85% market share. The industry tends to operate as an oligopoly around the world and Australia is no exception. Competitors locally include the US-based Dun & Bradstreet and Experian, based in Dublin, Ireland, although they've tended to focus on niches within the same 'data analytics' industry (as it's known).

Experian commenced operations in Australia in 2011, with six major financial institutions – including the big four banks – holding a 4% stake in its local business. These shareholdings might sound warning bells for Veda but they're probably designed to ensure it doesn't get too big for its boots.

Veda's comprehensive consumer database means Experian is unlikely to displace it easily. Not only are Veda's systems embedded within its customer's own systems, the company has acted pre-emptively to lock in customers to longer-term contracts that reward loyalty.

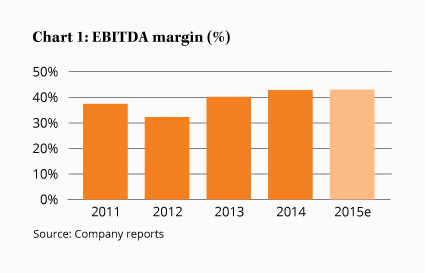

As you might expect in an oligopolistic market structure, Veda makes excellent margins. Chart 1 show earnings before interest and tax, depreciation and amortisation (EBITDA) margins over the past five years.

Premium price

Veda's strong market position and high margins mean it deserves a premium price. But the price is just a little too 'premium' for us at the moment, with the stock trading on a 2015 prospective price-earnings ratio of 26 and an EV/EBITDA multiple of 16. Table 1 shows some valuation statistics.

Further growth is expected so those multiples should fall in 2016 and beyond. Growth should come from Australia's new comprehensive credit reporting regime, which began in early 2014 but will take time to ramp up. It replaces 'negative' credit reporting, under which only applications for credit and defaults were collected.

| Share price ($) | 2.40 |

| Earnings per share ($) | 0.093 |

| Price-earnings ratio (x) | 25.8 |

| Market capitalisation ($m) | 2,022 |

| Net debt ($m) | 253 |

| Enterprise value ($m) | 2,275 |

| 2015e EBITDA ($m) | 144 |

| 2015e EV/EBITDA (x) | 15.8 |

| 2016e Free cash flow (norm.) ($m) | 71 |

| 2016e Free cash flow yield (%) | 3.5% |

Comprehensive credit reporting is the system that operates in most other countries. It allows credit bureaus like Veda to collect more information than before, including data on repayment histories and credit card limits. If you're not making your repayments on time, Veda probably knows about it.

Veda expects the additional data from comprehensive credit reporting will drive market growth in future. But it shouldn't be the company's only source of upside. The consumer reporting division can be pushed harder and it's also investing in digital marketing. Altogether, there should be significant opportunities for Veda to manipulate its data for profit, perhaps with the help of bolt-on acquisitions.

Aside from the valuation, we have some other niggles. Perhaps counter-intuitively, the company's much-lauded unbroken 20-year revenue growth record is cause for concern. Not coincidently, 2015 marks Australia's 24th year without a recession. An economic downturn would almost certainly see credit applications decline. The company highlighted its 'resilience across economic cycles' in the prospectus but without a real recession that claim is dubious.

Private equity ownership

Then there's the company's former private equity ownership. Veda Advantage was bought by Pacific Equity Partners in 2007 and relisted as Veda Group in late 2013, with PEP selling its last remaining stake in February this year. Veda's an impressive business, but private equity floats have a certain reputation. Skeletons have a habit of tumbling from the closet shortly after private equity has wedged the door shut.

Perhaps one's already poking out. Companies under private equity control employ so much debt that they often make losses whilst unlisted. This explains why Veda, an otherwise highly profitable business, has accumulated losses on its balance sheet. The company also has tax losses that saw it pay just $3m of tax on its $94m of pre-tax profit in 2014.

The tax losses should exhaust by 2017, at which point the company will start paying franked dividends (expect around 6 cents a share unfranked this financial year). The downside is that, until then, the company's cash flow statement is effectively overstating Veda's sustainable free cash flow. Normalising for tax, we estimate Veda is trading on a sustainable free cash flow yield of about 3.5% (see Table 1). Even for a high quality business, it's not sufficiently attractive.

A lower share price might provide adequate compensation. At around $2.00, Veda would be trading on a 2016 prospective EV/EBITDA multiple of 12 times. Market wobbles or worries about Veda's growth might see it get there.

Veda Group's a great business, although perhaps not in quite the same league as REA Group (for example). We'd love to recommend the stock one day, and think there's a good chance an opportunity will arise.

In the meantime Veda, every move you make, every step you take, we'll be watching you. Make sure you watch the company too and, if you own the stock, HOLD.

Recommendation