US Steel recovery not factored into forecasts

Although US steel pricing remains weak, recent industry comments suggest that inventory levels will decline in coming months

We are increasingly positive on US steel stocks - BUY Nucor (NUE US) and US Steel (X US). Although US steel pricing remains weak, recent industry comments suggest that inventory levels will decline in coming months and we note the offset/margin benefit from the substantial decline in energy and iron ore costs over the past 3 months.

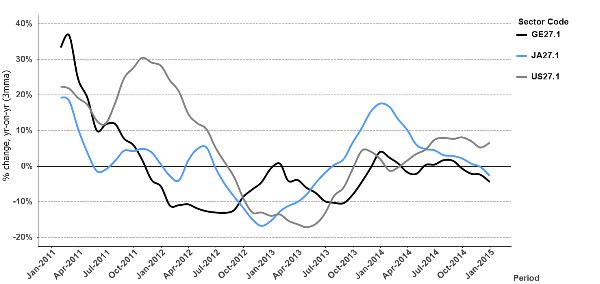

This chart shows current QMG observations across 3 major steel producing countries which highlight the recovery already underway across the US sector - which does not appear to be factored into either consensus forecasts or share prices. ArcelorMittal (MT NA) and ThyssenKrupp (TKA GY) are both 9% year-to-date vs -4.8% for X and -1.6% for NUE - at odds with our data which suggests stronger US backdrop and higher likelihood of consensus upgrades.

Insight by Matthew Unsworth, Managing Director, QMG. Intelligent Investor has partnered with Livewire Markets to deliver you more market insights from industry insiders.

This content is provided by Livewire Markets Pty Ltd and does not represent the views of Intelligent Investor Publishing Pty Ltd. Content sourced from Livewire Markets is provided solely on the basis that individuals viewing the content use it only for personal, non-commercial purposes.