Twilight of a banking era

For other articles in this series, see:

1. The building blocks of banking

2. Regulation shapes bank returns

3. Home truths for the big banks

Key Points

-

Growth prospects fading

-

Dividend growth seems unlikely

-

Maintain portfolio limits

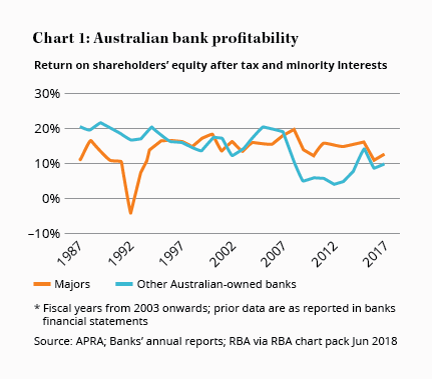

Since the recession of the early 1990s, the major banks have produced a stellar record. Commonwealth Bank's lending volumes have grown around 10% annually for the past 25 years. Its peers have had a similar experience. That growth was combined with exceptional profitability, paving the way for strong earnings growth and rising dividends. It's been a golden age for Australia's major banks, and they've been the envy of international peers. However, such conditions rarely last indefinitely. And so it is with the Big 4 who are set for a tougher future (see chart 1).

That's due to a number of factors. So far in this series, we've touched on threats from regulation, not least from higher capital requirements, and increased competition, from regional and overseas banks as well as ‘fintechs'. All this has pushed the major banks' return on equity down to its lowest level in 25 years.

Growth is also fading across all the main areas of operation: retail banking; business banking and wealth management. In this final article of the series, we'll look at the prospects for these areas (hint: it's not very inspiring).

Housing blues

As we explained in Home truths for the big banks, home loans have been the major driver of the big four banks' sensational run of profit growth over the past couple of decades. As a result, they've become the largest and most profitable portion of their lending portfolios, and any slowdown in this area will have an outsized impact.

Regulators have sought to limit some aspects of mortgage lending due to concerns about the hot property market and the possible consequences of a collapse. More recently, regulatory scrutiny has turned to banks' assessment of loan applicants' income and expenses. Lending conditions now seem to be tightening, and with that, loan volumes are likely to decline.

House prices have moderated as a result – particularly in the largest markets of Sydney, Melbourne, and Brisbane, which have experienced declines in recent months. The combination of high consumer debt and expensive property markets suggest we're unlikely to see much growth in home lending anytime soon.

Revenue from this area has had some support from margins which, somewhat counterintuitively, have increased since regulators started imposing restrictions, particularly in the most affected segments of investor and interest-only mortgages.

Margin adjustments, however, are a one-off impact. And in any case, the longer-term trajectory is likely lower, as banks compete for share in a slowing, and increasingly competitive, mortgage market. The increased capital requirements for home loans adds further pressure.

Mixed business

The outlook for business lending is perhaps a little better – or at least more mixed. The major banks lend to businesses large and small and demand between the various segments can differ considerably.

At the big end of town, the big four have largely been working to increase the profitability of their institutional lending books, which has typically lagged that of the wider groups in recent years, while also involving greater risks. That's generally led to a reduced appetite for corporate loans, in favour of fees from providing a range of services to these clients.

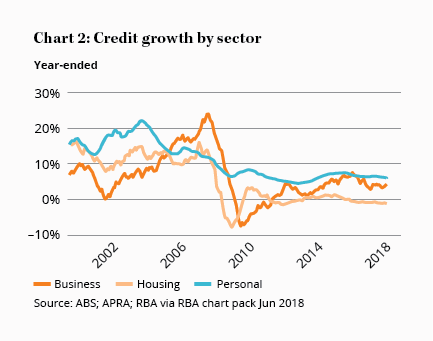

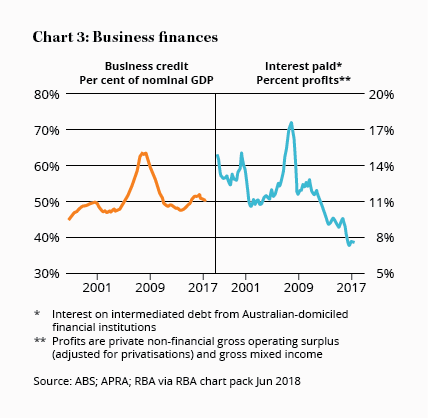

And that's hardly coming off a high base. Business lending growth has been volatile in recent years, and below that of housing loans, despite record low interest rates (see chart 3). Where major banks have shown reduced willingness, foreign banks and non-bank lenders have been taking market share.

A more promising growth area is small business lending, based on recent interim results and management comments. Many of these loans are backed by residential property, so the risk profile can be related to housing, and it's also a relatively small contributor of profits compared to home loans.

Shrinking wealth

Wealth management operations won't bridge the gap, as disposals in this area continue. These divisions incorporate a range of businesses from financial planning to insurance, and growth and profitability have been mixed – hence the disposals.

As an alternative, the major banks are now looking for partnerships, where they can earn a margin and retain customers by selling wealth products provided by third parties. Reduced exposure to the producs themselves will reduce earnings in the short term, but should free up capital and management time to focus on more profitable areas. Overall, we view it as a positive development.

Westpac is bucking the trend. The bank gets about 10% of its earnings from wealth management – more than its peers – and obviously feels it's too much to give away. Its operations in this area also make similar returns to the rest of the group, so it makes some sense to keep them.

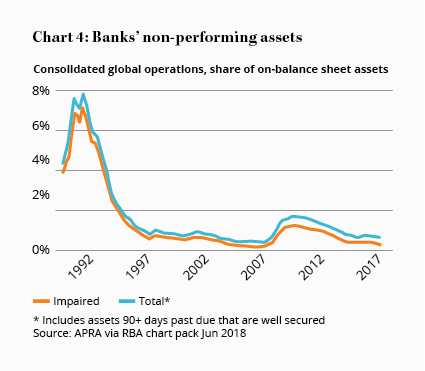

Counting costs

One final potential source of growth is by reducing costs. Perhaps the most obvious potential source is lower impairments – but unfortunately these have already fallen to historic lows across all categories (see chart 4). They can't go below zero (at least not sustainably) so any falls are likely to be small, while increases could be more significant. Overall, we'd conservatively expect average impairments ‘across the cycle' to be materially higher, perhaps around three times their current level.

Prospects are better for reducing operating costs. Technology can help with this, although continued investment will be necessary to achieve any improvements and, as with impairments, there are limits – you can only cut any individual cost once. While cost savings are always welcome, holding onto them is hard in a competitive market place, and ultimately you need top-line growth to drive long-term earnings growth.

Dividend watch

As a result of this weak outlook, we expect little, if any, growth in dividends in the next few years. Indeed they could even be cut, particularly if margins decline or bad debts rise.

We see NAB's dividend as the most precarious, as it persists with a large investment program whilst having the highest payout ratio (at 81%). ANZ's is probably the safest, having already been cut and with the lowest payout ratio among the major banks (at around 67%).

Despite this uncertainty over the sustainability of their dividends, we could see capital being returned in other ways over the next few years. The Big 4 are on track to meet the regulator's requirements of a CET1 level of 10.5% by 2020. Capital above this level could be handed back to shareholders by way of special dividends or buy-backs. The disposal of wealth operations (and potentially other assets) would increase that prospect.

Stick to limits

The major banks remain strong businesses and worthy of a place in many investors' portfolios – but their future will look quite different to the past, and investor caution is warranted. As a result, we expect a considerable margin of safety before recommending them and, despite recent falls, we're not quite there yet.

Above all, we recommend that you keep your exposure to the sector below 20%, and closer to 10% for more conservative investors or those with other significant property exposure.

For other articles in this series, see:

1. The building blocks of banking

2. Regulation shapes bank returns

3. Home truths for the big banks

Our Intelligent Investor Equity Income Portfolio is now available as a listed fund. Holdings in the Fund will mirror our current Equity Income Portfolio, has the same low costs, but you can buy it on the ASX. You can save yourself the broking commission by applying during the initial offer.