Trade Me: Still quacking

Recommendation

Ever worried about something that didn't end up as bad as you thought? The sharemarket does that a lot of the time. Even companies that do a decent impression of a dead duck often manage to continue quacking longer than anyone expected.

Consider Fairfax Media, Trade Me's one-time owner. While oodles of value has evaporated from Fairfax's legacy media business, its Trade Me investment ended up a great success. Bought from its founders for NZ$700m in 2006, Trade Me now has a market capitalisation of NZ$1,700m.

Fairfax also built property listings business Domain from nothing; next week Domain will list on the ASX with a market capitalisation of around $2bn. Fairfax may have lost a few feathers over the past decade, but Trade Me and Domain mean it's still paddling along.

Key Points

-

Expect some share loss

-

Classifieds business still strong

-

Market has overreacted

Over the past year, Trade Me investors have also been worried. So much so that they've forced the share price down 24% since Trade Me: Result 2016. Is all this anxiety justified?

Problem one: Structural

The market has two main concerns. The first is the ‘structural' threat from competition, mainly in its ‘General Items' division. At the time of Trade Me: Result 2017, management noted that ‘bigger global competitors are more present than at any point in Trade Me's history'.

Facebook's new ‘Marketplace' is probably already taking share from General Items (see Trade Me and Facebook square off). Gross merchandise sales (GMS) for used goods – the value of the stuff you don't want – declined by 2% in the second half of 2017, which management said ‘may' be due to Facebook. At today's annual general meeting, Trade Me announced GMS for used goods was down 1% in the first four months of 2018.

Trade Me's General Items business also competes with Amazon in the US, Alibaba in China and eBay in Australia. But with Amazon launching in Australia at some point soon, it will be easier for Kiwis to buy a much larger range of goods and have them shipped across the Tasman.

Truth be told, we are concerned about these structural threats. It would be naïve to think that Facebook and Amazon won't take more market share from Trade Me's General Items business over time.

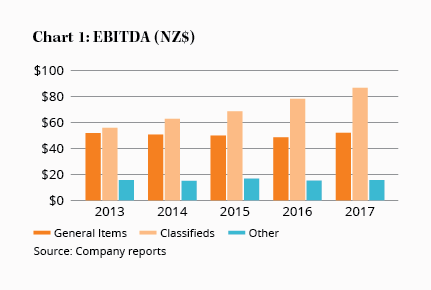

That's mainly because Trade Me's General Items business is very profitable (see Chart 1). It generated $52m of earnings before interest, tax, depreciation and amortisation (EBITDA) in 2017, around 33% of the company's total.

But General Items has always been a less attractive business than Classifieds, which is growing much faster. Earnings from General Items has been flat for years now, reflecting the business's maturity. For these reasons General Items has only ever accounted for about 25% of our valuation historically.

Based on the share price fall, the market is now implying that General Items is worth only around 15% of Trade Me's valuation. Another way of viewing it is that the market is assuming divisional earnings could fall 40%.

That's a lot of worry baked into the share price.

Problem two: Cyclical

The market's second concern is mainly to do with ‘cyclical' issues in the Classifieds business. At the time of Trade Me: Result 2017, management said that property listings were down in the first seven weeks of 2018. At today's annual meeting, management confirmed the real estate market had indeed slowed.

But Trade Me is a diversified business – and one where management can pull a lot of different levers. For example, while property listings were down, Trade Me Property's revenue rose 2% between July and October 2018. Premium ad revenue must be helping to offset lower volumes.

Elsewhere in Classifieds, the story was better. At today's meeting, management said that Motors and Jobs revenue were respectively up 17% and 20% for the first four months of 2018. In total, Classifieds revenues were up 7%. Yes it's a little slower than the 11% revenue growth produced in 2017 but Trade Me – like all advertising businesses – will experience swings and roundabouts.

As management forecast at the 2017 result, expense growth was higher than revenue growth as the company took on staff to defend its position. EBITDA growth for the first four months of 2018 was 5%.

All in all, it could have been worse. Net profit is likely to be flattish to slightly up this year. Overall Trade Me's Classifieds business – accounting for more than two-thirds of our valuation – continues to perform pretty well.

Be prepared

Nevertheless, it appears the General Items business might be under more threat than we originally anticipated. Prepare yourself for divisional earnings to decline as Facebook Marketplace continues encroaching and Amazon launches in Australia. Trade Me is already fortifying itself against these threats but they will take some years to play out.

With some deterioration expected in the General Items division over time, we're lowering our valuation slightly – and therefore our price guide. But on a price-earnings ratio of 18, this high-quality stock looks pretty good value. There's a decent case for topping up at this point if you're below our maximum suggested 6% portfolio weighting.

Slowing growth and competitive threats tend to make investors wary, but in this case we think the market has overreacted – much as it did in 2015. Trade Me is by no means a dead duck – rather it's a rare bird. BUY.

Note: The Intelligent Investor Equity Growth and Equity Income portfolios own shares in Trade Me. You can find out about investing directly in Intelligent Investor and InvestSMART portfolios by clicking here.

Disclosure: The author owns shares in Trade Me and Fairfax Media.

Recommendation