Trade Me builds for a bright future

Recommendation

Internet stocks have been on a tear over the past couple of years, although the love hasn't been shared around equally. Classified advertising businesses have been leading the way, with the likes of REA Group up 150% since the beginning of 2013, Seek up 135% and Carsales up 30%.

More general online retailing businesses have found the going tougher, however, with US-listed eBay, for example, up just 2% over the same period. With earnings expected to rise at 10% a year for the next few years, though, the iconic online auctioneer still has much to recommend it.

The trouble is, of course, that these stocks now trade on hair-raising multiples – of 40, 32, and 26 for the local group and about 24 for eBay – making new investments difficult. But what if you could buy a portfolio of them for a multiple of just 17?

- Fast-growing classifieds business has overtaken slow-growing general items

- Expenses rising to cater for increasing mobile business

- Investment should enhance already very strong competitive position

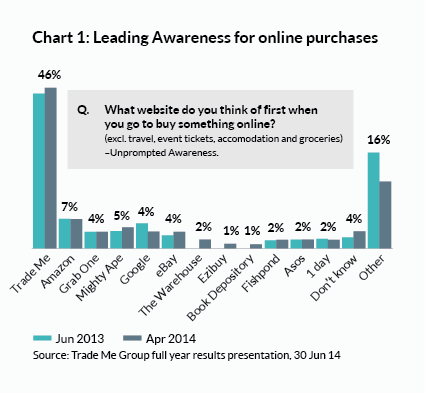

You can do just that – well almost – by investing in New Zealand's Trade Me. As well as a cheaper price, Trade Me offers advantages by combining these businesses, giving it huge brand awareness (see Chart 1), stronger network effects and increased economies of scale.

Running out of space

The downside is that it's based in New Zealand. Not that there's anything wrong with New Zealand; it's just that it is, in population terms, relatively small – and certain parts of Trade Me's business show signs of running out of space.

The company is split between General Items (the eBay-like business) and Classifieds (the REA Group, Carsales and Seek-like businesses), with the former contributing 34% of revenue in 2014 and the latter 50% (the loose 16% is 'other' which we'll come to later). And while revenues in the Classifieds business are still rising by over 20% a year (23% in the year to June 2014), they've ground to a halt in General Items (falling 1% in the year to June 2014).

The simple fact is that Trade Me already has 3.4m active members in a country of 4.5m, and they've only got so much junk to auction. Like eBay, Trade Me is trying to expand its retailing of new goods (as opposed to the auction of old goods), but it's not as good a business.

Lacking the network effects of a true market place, it's exposed to the full force of online competition. If a small retailer can get people to their site using Google, then they won't have any need for Trade Me. And while Trade Me is hugely dominant in New Zealand-sourced merchandise, it will increasingly need to compete with eBay and other big online retailers all over the world.

So, for the time being, revenue growth in General Items has stalled, and it's likely that any significant growth will be at lower margins. But we shouldn't be too down on this business: it still displays many of the characteristics that make online businesses so attractive. Most particularly, it generates operating margins of over 70% and uses very little capital, meaning that almost all its earnings come through as free cash flow.

Dominant classifieds

The Classifieds business also has these advantages, but is growing revenues much more quickly and is therefore increasingly influencing the performance of the overall group. Within this category, the cars business is hugely dominant (about 20 times the audience of the number two: Auto Trader) and the property business is very dominant (about three times the audience of the number two: realestate.co.nz, which is run by the NZ estate agent industry).

These businesses have similar looking futures to their Australian counterparts, Carsales and REA Group (but without the international businesses): although they're nearing the limit in terms of number of listings, there is considerable potential to increase prices.

The first challenge in Property is to move the industry over from subscription-based fees to per listing fees, and Trade Me tried to make this switch last November. The idea is that while a subscription is a service provided to estate agents, per listing fees are a value-added product provided to the sellers themselves. Given their interest in the results of good advertising, sellers will be prepared to pay much more than the agents.

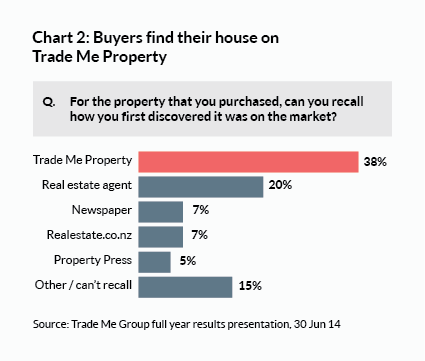

But the trouble with Trade Me shining a light on the value of its listings – as far as the real estate agents are concerned – is that it also shines a light on the value the agents provide. In an independent survey in June 2014, almost twice as many buyers said they first came across the property they bought through Trade Me (38%) as through a real estate agent (20%), with only 7% saying they saw it on the No 2 property portal, realestate.co.nz (see Chart 2). So if NZ$349 gets your property onto Trade Me, with various premium features for another NZ$20–299, what's the agent providing for their cut, which can run into many thousands.

Backdown

Real estate agents were not happy with the price changes and some even took the step of refusing to list properties on Trade Me, despite the negative impact on their clients (whose best interests they are obliged to serve). The actions of some agents has been referred to the NZ Commerce Commission and we're still waiting to hear what it thinks of the situation. Trade Me, however, got increasingly fretful as its leadership position slipped from four times as many visitors as realestate.co.nz to three times, and in July it backed down and offered agents subscriptions again.

It was a smart move because Trade Me's market leadership is everything to it. In the past year it has made a series of improvements to its site and it will no doubt make more, which will put it in a stronger position when it next tries to make the pricing switch – particularly if in the meantime some estate agents get a slap on the wrist from the NZ Commerce Commission.

In Jobs classifieds, Trade Me is relatively weak, with the formidable Seek claiming a small lead in market share, although Trade Me has been closing the gap recently. We view jobs classifieds as a less attractive business than property because people have their own way of doing things – networking through sites like LinkedIn for example. Jobs, however, represent only about a fifth of overall Classifieds revenue (with Motors contributing 48% and Property 31%).

Rounding out Trade Me's portfolio of businesses is its 'Other' segment, which contributes about 16% of revenues but only 12% of profits due to its lower operating margin of 51%. The money mostly comes from selling advertising on Trade Me's websites, but there's also a couple of travel websites (Travelbug and Holiday Homes), an insurance comparison site (LifeDirect) and an online dating site (the somewhat unromantically named 'Find Someone'). Also included here is Pay Now, which enables sellers in Trade Me's main businesses to be paid by credit card and earns a fee for its pleasure. It has been touted by some as New Zealand's PayPal, but we wouldn't be getting too excited; it lacks the network effects, at least on the scale of PayPal.

Increasing costs

The other major concern for investors is Trade Me's rapidly increasing costs, which rose 19% to NZ$51m in the year to June. Promotional expenses saw the largest jump – more than doubling to NZ$7m – but the biggest expense is wages, which rose 16% to NZ$25m.

| Year to 30 Jun ($m) | 2014 | 2013 | /– (%) |

|---|---|---|---|

| Staff costs | 24.6 | 21.2 | 16 |

| Web infrastructure | 3.2 | 3.0 | 5 |

| Promotion | 7.4 | 2.8 | 168 |

| Other | 16.2 | 13.7 | 19 |

| Total | 51.4 | 40.7 | 26 |

The increase is partly due to underinvestment in the past, but it also reflects spending on new delivery channels, with 61% of all visits now coming via a mobile device and 52% of all visits coming from apps. Android is growing particularly strongly with sessions almost doubling over the past 12 months. This channel proliferation has a positive side to it, though, because it increases barriers to entry.

All up, in the year to June, revenue grew by 10%, while earnings before interest and tax rose only 1.5% as the margin slipped from 70% to 65%. Earnings per share were 20 NZ cents and free cash flow per share was 24 NZ cents (boosted by a lower tax rate due to higher supplementary dividends paid to non-resident shareholders). Dividends of 16 NZ cents were paid for the year, with supplementary payments to overseas shareholders to account for the imputation credit for New Zealand tax.

Sum of the parts

Due to the higher costs, little earnings growth is expected for the current year, but we'd expect it to trend back towards about 10% a year after that. Probably the best way to think about valuing the company, though, is as a sum of its parts, apportioning the 2014 earnings per share of 20 NZ cents between the businesses and giving them each their own price-earnings multiples.

For General Items, we'll opt for a multiple of 17 on the basis that while growth has gone absent without leave, almost all the earnings are cash. Assuming a conservative flow through of earnings to free cash of 90% would imply a free cash flow yield of just over 5%. Over time we'd also expect to see growth in line with the economy at least. Applying that to the 7.9 NZ cents of earnings for this division gives a value of NZ$1.34.

For Classifieds we'll go for 25, which is a considerable discount to the ratings of 40, 32 and 26 for REA Group, Seek and Carsales, but that's appropriate since we'd regard the ratings of at least the first two as somewhat optimistic. Applying that to the 9.8 NZ cents of earnings from this division gives us a value of NZ$2.45.

| Year to 30 Jun | 2014 | 2013 | /– (%) |

|---|---|---|---|

| Revenue (NZ$m) | 180 | 164 | 10 |

| EBIT (NZ$m) | 116 | 115 | 1 |

| Net profit (NZ$m) | 80 | 79 | 2 |

| EPS (NZ cents) | 20.2 | 19.8 | 2 |

| PER | 17.3 | 17.7 | n/a |

| DPS (NZ cents) | 16.0 | 15.8 | 1 |

| Div. Yld (%) | 4.6 | 4.5 | n/a |

| Franking (%) | 0 | 0 | n/a |

| Final div. | 8.4 NZ cents, fully imputed, ex date 10 Sep | ||

Finally, for 'Other' we'll use 17. Although it's a lower-quality business than General Items, it arguably has better short-term growth prospects and has a degree of what they call 'optionality' (that is, a small chance of striking lucky with something). Applying that to 2.3 NZ cents of earnings gives NZ$0.39.

Currency risk

Putting it all together we end up with a conservative valuation of NZ$4.18 – or about $3.76 in Aussie dollars. Overall, that would imply a PER of about 21 for the stock, or a free cash flow yield of 4.3% (assuming a 90% free cash conversion), which looks attractive for a company that combines several gems with some OK businesses – yet the current price of $3.15 is well below even that.

Bear in mind that Trade Me is squarely exposed to the NZ dollar, so Australian investors will need to accept that currency risk. Over the past few years Australian investors have done better than NZ investors as the NZ dollar has strengthened, but it could have gone the other way. We don't tend to make currency predictions, least of all about the NZ dollar, except to say that there will be swings and roundabouts and the longer you own the stock the less of an issue the currency should become.

That said, we rate the company a Buy up to $3.60, with a Sell target of $5.40. BUY.

Disclosure: The author, James Carlisle, owns shares in Trade Me.

Recommendation